Ripple Valuation is Directly Linked to XRP Price: Global Investment Bank

In a report, global investment bank Houlihan Lokey linked the valuation of blockchain technology firm Ripple directly to the XRP price.

Notably, the February 2024 report, titled “Digital Assets: How Can Valuation Differ From Traditional Assets?”, recently re-emerged in the XRP community after researcher SMQKE called attention to its findings.

Valuing Blockchain Firms Contrasts with Traditional Methods

The report discussed how valuing blockchain companies like Ripple contrasts with traditional methods and concluded that most of Ripple’s true valuation lies in its XRP holdings rather than corporate equity.

The bank highlighted that in blockchain projects, investors often hold both equity and token warrants since tokens tend to capture most of the project’s value. It then used Ripple as its primary example of how this structure works.

Houlihan Lokey Ties Ripple Valuation to XRP Price

For context, Ripple built its payment network on the blockchain technology of the XRP Ledger (XRPL). Since XRP serves as the gas token of the network, Houlihan Lokey suggested that this makes the token the primary source of economic value in Ripple’s ecosystem. At the time of the report, XRP traded around $0.60 per token.

Houlihan Lokey estimated that Ripple held about $1 billion in cash and securities and roughly 46 billion XRP tokens, assuming no liabilities. Notably, though they had no affiliations with Ripple, markets like Linqto and EquityZen traded Ripple’s shares, and the company had revealed a share buyback program in January 2024.

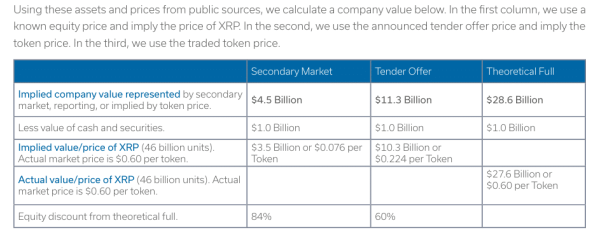

Using its valuation model, the report presented three different scenarios. In the first, secondary-market pricing valued Ripple at $4.5 billion, which implied an XRP price of $0.076 and an 84% equity discount.

Houlihan Lokey Ties Ripple Valuation to XRP Price

The second, based on Ripple’s tender offer, valued the company at $11.3 billion, equal to an implied XRP price of $0.224 and a 60% discount. The third, which used XRP’s actual market price of $0.60, placed Ripple’s full theoretical value at $28.6 billion, considering its XRP holdings.

Houlihan Lokey noted that this wide range shows how much token prices can affect equity valuations. The firm also called attention to new accounting standards, specifically FASB ASU 2023-08, that require companies to report crypto assets at fair market value.

If Ripple applied that rule, it would need to record its XRP holdings at their market price, pushing its balance sheet closer to the $28.6 billion theoretical valuation rather than the $4.5 billion to $11.3 billion figures reflected in private equity trades.

Possible Ripple Valuation Today Using Same Methodology

Interestingly, using the same method today creates a much higher estimate. Specifically, Ripple currently holds about 40 billion XRP, with 5 billion spendable and 35 billion in escrow.

With XRP trading at $2.30, those tokens are worth about $92 billion. Adding $1 billion in cash and securities brings Ripple’s updated theoretical valuation to around $93 billion, more than three times the level Houlihan Lokey estimated in early 2024.

Meanwhile, at the Ripple Swell 2025 conference, the company revealed a $500 million investment that raised its private valuation to $40 billion.

Notably, CEO Brad Garlinghouse said earlier in the year that an IPO remains possible but is not a focus right now. However, Ripple President Monica Long has recently confirmed that the company has no plans for an IPO anytime soon and has set no timeline for it.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Wrapped SOL

Wrapped SOL  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  WhiteBIT Coin

WhiteBIT Coin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Ethena USDe

Ethena USDe  WETH

WETH  Zcash

Zcash  Hedera

Hedera  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Avalanche

Avalanche  Monero

Monero  Shiba Inu

Shiba Inu  Uniswap

Uniswap  Toncoin

Toncoin  Polkadot

Polkadot  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  Dai

Dai  Mantle

Mantle  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  Canton

Canton  sUSDS

sUSDS  USDT0

USDT0  Bittensor

Bittensor  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Aave

Aave  PayPal USD

PayPal USD  Bitget Token

Bitget Token  USD1

USD1  OKB

OKB  Currency One USD

Currency One USD  Pump.fun

Pump.fun  Pepe

Pepe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Aptos

Aptos  Aster

Aster  Tether Gold

Tether Gold  Binance-Peg WETH

Binance-Peg WETH  Ondo

Ondo  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Falcon USD

Falcon USD  Pi Network

Pi Network  POL (ex-MATIC)

POL (ex-MATIC)  USDtb

USDtb  Worldcoin

Worldcoin  KuCoin

KuCoin  HTX DAO

HTX DAO  Filecoin

Filecoin  Official Trump

Official Trump  Arbitrum

Arbitrum  Algorand

Algorand  Rocket Pool ETH

Rocket Pool ETH  Binance Staked SOL

Binance Staked SOL  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Gate

Gate  PAX Gold

PAX Gold  Kinetiq Staked HYPE

Kinetiq Staked HYPE  BFUSD

BFUSD  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Sky

Sky  Wrapped BNB

Wrapped BNB  syrupUSDT

syrupUSDT  Function FBTC

Function FBTC  Render

Render  Lombard Staked BTC

Lombard Staked BTC  Story

Story  syrupUSDC

syrupUSDC  Liquid Staked ETH

Liquid Staked ETH  Sei

Sei  Jupiter

Jupiter  Aerodrome Finance

Aerodrome Finance  Renzo Restaked ETH

Renzo Restaked ETH  NEXO

NEXO  Global Dollar

Global Dollar  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  Ripple USD

Ripple USD  Circle USYC

Circle USYC  Pudgy Penguins

Pudgy Penguins  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Immutable

Immutable  Virtuals Protocol

Virtuals Protocol  Dash

Dash  PancakeSwap

PancakeSwap  Mantle Staked Ether

Mantle Staked Ether  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  clBTC

clBTC  Celestia

Celestia  Optimism

Optimism  Rain

Rain  OUSG

OUSG  Jupiter Staked SOL

Jupiter Staked SOL  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Injective

Injective  Stacks

Stacks  Lido DAO

Lido DAO  Starknet

Starknet  StakeWise Staked ETH

StakeWise Staked ETH  Curve DAO

Curve DAO  The Graph

The Graph  Ondo US Dollar Yield

Ondo US Dollar Yield  cgETH Hashkey Cloud

cgETH Hashkey Cloud  SOON

SOON  Tezos

Tezos  DoubleZero

DoubleZero  SPX6900

SPX6900  tBTC

tBTC  Marinade Staked SOL

Marinade Staked SOL  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Beldex

Beldex  Pyth Network

Pyth Network  IOTA

IOTA  Kaia

Kaia  FLOKI

FLOKI  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  USDai

USDai  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Sonic

Sonic  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Stader ETHx

Stader ETHx  GTETH

GTETH  Ethereum Name Service

Ethereum Name Service  Decred

Decred  Plasma

Plasma  Usual USD

Usual USD  Ether.fi

Ether.fi  The Sandbox

The Sandbox  Trust Wallet

Trust Wallet  Maple Finance

Maple Finance  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  Bitcoin SV

Bitcoin SV  Conflux

Conflux  TrueUSD

TrueUSD  dogwifhat

dogwifhat  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  AB

AB  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  GALA

GALA  BitTorrent

BitTorrent  Pendle

Pendle  Swell Ethereum

Swell Ethereum  Theta Network

Theta Network  JasmyCoin

JasmyCoin  ether.fi Staked ETH

ether.fi Staked ETH  sBTC

sBTC  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Flow

Flow  Binance-Peg Dogecoin

Binance-Peg Dogecoin  MYX Finance

MYX Finance  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Helium

Helium  GHO

GHO  Decentraland

Decentraland  Sun Token

Sun Token  ARK

ARK  Raydium

Raydium  USDD

USDD  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  AINFT

AINFT  ZKsync

ZKsync  Wrapped HYPE

Wrapped HYPE