Three Macro Signals Just Flipped, Putting November and December on the Spot

Three key macro signals just turned, and investors may be underestimating what that means for the next leg of both traditional and crypto markets.

Inflation is steady but not falling, liquidity appears frozen but only temporarily, and the business cycle’s weakest point may already be behind us. December, as analysts warn, could be “very interesting.”

Inflation Holds Steady as Policy Pressure Eases

Real-time inflation data from Truflation, a blockchain-based gauge, indicates that prices are rising at an annual rate of 2.5%, which is near the Federal Reserve’s 2% target. That compares to 2.3% from official BLS data, suggesting inflation has stabilized, not resurged.

2.51% Truflation pic.twitter.com/44v9pej1Se

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) November 9, 2025

Director of Global Macro at Fidelity, Jurrien Timmer, notes that this mild trajectory gives the Fed “more room” to move toward a 3.1% terminal rate. This could open the door to a December rate cut.

A real-time inflation series called Truflation (a daily blockchain-based market measure of inflation) is rising at only a 2.5% annual rate, which is closer to the Fed’s long-term inflation target of 2.0%. So that seems promising and suggests that perhaps the Fed does have more… pic.twitter.com/quv0gyyxqX

— Jurrien Timmer (@TimmerFidelity) November 7, 2025

However, consumer data continues to show uneven pressure, particularly in the grocery and insurance sectors. This highlights the gap between aggregate inflation and real-world pain.

For markets, stable inflation means less policy tightening, but not yet the kind of deep easing risk assets crave.

Liquidity Looks Dead, But Only for Now

According to HTX’s latest macro report, the US government shutdown has pulled over $200 billion in liquidity from the financial system.

The Treasury General Account (TGA) ballooned from roughly $800 billion to over $1 trillion. This effectively froze government spending and tightened funding across banks and money markets.

That, more than sentiment or risk aversion, explains why liquidity “looks dead,” as Milk Road put it. The moment Congress resolves the shutdown, that $1 trillion floodgate reopens, potentially unleashing a surge in both fiscal and market liquidity.

“Once the shutdown ends, spending should resume — and liquidity should expand,” Milk Road’s analysts wrote. “That should be bullish.”

The Business Cycle Turns Beneath the Surface

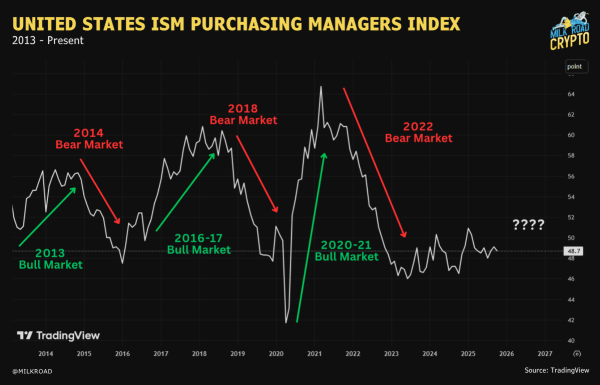

While the ISM Manufacturing Index remains below 50, still in contraction territory, New Orders climbed from 48.9 to 49.4. It’s a small uptick, yet historically, this indicator turns higher before broader growth recovers.

United States ISM Manufacturing PMI. Source: Trading Economics

Three macro signals just flipped.

Inflation is drifting higher on Truflation, just enough to keep policy steady.

Liquidity looks dead, but only because the shutdown has frozen over a $1T dollars of government spending. That returns once the shutdown ends.

And the ISM is still… pic.twitter.com/rPZHcVbJFN

— Milk Road (@MilkRoad) November 9, 2025

Any ISM Purchasing Managers Index (PMI) value below 50 represents contraction for the sector. This result feeds a narrative of economic weakness that impacts sentiment toward riskier assets.

ISM PMI at 48.7 shows manufacturing contraction in October 2025. Source: Milk Road via X

This difference between current and future orders creates some uncertainty about the economic outlook. These three signals deliver a nuanced market setting:

- Inflation remains stable, creating room for policy adjustments.

- Manufacturing is weak, but forward-looking areas are improving.

- Liquidity remains frozen but is likely to be released.

Once the government resolves its shutdown, the market may see quick and notable shifts.

The post Three Macro Signals Just Flipped, Putting November and December on the Spot appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  WhiteBIT Coin

WhiteBIT Coin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Zcash

Zcash  Stellar

Stellar  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Hedera

Hedera  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  WETH

WETH  Monero

Monero  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Polkadot

Polkadot  Canton Network

Canton Network  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  Dai

Dai  Uniswap

Uniswap  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  Mantle

Mantle  sUSDS

sUSDS  NEAR Protocol

NEAR Protocol  USDT0

USDT0  Bittensor

Bittensor  Internet Computer

Internet Computer  Aave

Aave  Bitget Token

Bitget Token  USD1

USD1  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  OKB

OKB  Pepe

Pepe  Currency One USD

Currency One USD  Ethereum Classic

Ethereum Classic  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  Aptos

Aptos  Ondo

Ondo  Aster

Aster  Binance-Peg WETH

Binance-Peg WETH  Tether Gold

Tether Gold  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Solana

Solana  Falcon USD

Falcon USD  Pi Network

Pi Network  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  USDtb

USDtb  Official Trump

Official Trump  Filecoin

Filecoin  KuCoin

KuCoin  HTX DAO

HTX DAO  Algorand

Algorand  Arbitrum

Arbitrum  Pump.fun

Pump.fun  Rocket Pool ETH

Rocket Pool ETH  Binance Staked SOL

Binance Staked SOL  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Gate

Gate  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Render

Render  PAX Gold

PAX Gold  StakeWise Staked ETH

StakeWise Staked ETH  BFUSD

BFUSD  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Wrapped BNB

Wrapped BNB  Sky

Sky  syrupUSDT

syrupUSDT  Lombard Staked BTC

Lombard Staked BTC  Function FBTC

Function FBTC  Quant

Quant  Liquid Staked ETH

Liquid Staked ETH  syrupUSDC

syrupUSDC  Story

Story  Sei

Sei  Jupiter

Jupiter  NEXO

NEXO  Bonk

Bonk  Renzo Restaked ETH

Renzo Restaked ETH  Global Dollar

Global Dollar  Solv Protocol BTC

Solv Protocol BTC  Ripple USD

Ripple USD  Pudgy Penguins

Pudgy Penguins  Dash

Dash  Circle USYC

Circle USYC  Aerodrome Finance

Aerodrome Finance  Virtuals Protocol

Virtuals Protocol  Starknet

Starknet  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Immutable

Immutable  Mantle Staked Ether

Mantle Staked Ether  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  PancakeSwap

PancakeSwap  Celestia

Celestia  Optimism

Optimism  clBTC

clBTC  Injective

Injective  Jupiter Staked SOL

Jupiter Staked SOL  OUSG

OUSG  Stacks

Stacks  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Lido DAO

Lido DAO  The Graph

The Graph  Curve DAO

Curve DAO  Ondo US Dollar Yield

Ondo US Dollar Yield  Tezos

Tezos  SPX6900

SPX6900  DoubleZero

DoubleZero  cgETH Hashkey Cloud

cgETH Hashkey Cloud  tBTC

tBTC  Marinade Staked SOL

Marinade Staked SOL  Pyth Network

Pyth Network  FLOKI

FLOKI  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  IOTA

IOTA  Beldex

Beldex  Kaia

Kaia  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  USDai

USDai  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Plasma

Plasma  SOON

SOON  Sonic

Sonic  Ether.fi

Ether.fi  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Decred

Decred  Maple Finance

Maple Finance  Stader ETHx

Stader ETHx  Ethereum Name Service

Ethereum Name Service  The Sandbox

The Sandbox  GTETH

GTETH  Usual USD

Usual USD  Trust Wallet

Trust Wallet  Conflux

Conflux  Bitcoin SV

Bitcoin SV  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  TrueUSD

TrueUSD  dogwifhat

dogwifhat  GALA

GALA  JasmyCoin

JasmyCoin  Theta Network

Theta Network  MYX Finance

MYX Finance  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Pendle

Pendle  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  AB

AB  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  BitTorrent

BitTorrent  Swell Ethereum

Swell Ethereum  sBTC

sBTC  Flow

Flow  Binance-Peg Dogecoin

Binance-Peg Dogecoin  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Helium

Helium  ether.fi Staked ETH

ether.fi Staked ETH  Decentraland

Decentraland  GHO

GHO  ARK

ARK  ZKsync

ZKsync  Sun Token

Sun Token  Raydium

Raydium  Wrapped HYPE

Wrapped HYPE  USDD

USDD  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  AINFT

AINFT