The 65-Month Clock Is Ticking: Why Bitcoin May Drop 20% While Silver Shines

As risk assets enter a sensitive phase, many analysts are closely monitoring the 65 Month Liquidity Cycle. This model is believed to have accurately forecasted market peaks and troughs for over two decades.

Are we approaching a new tightening phase where Bitcoin faces 20% downward pressure, while Silver emerges as an alternative haven?

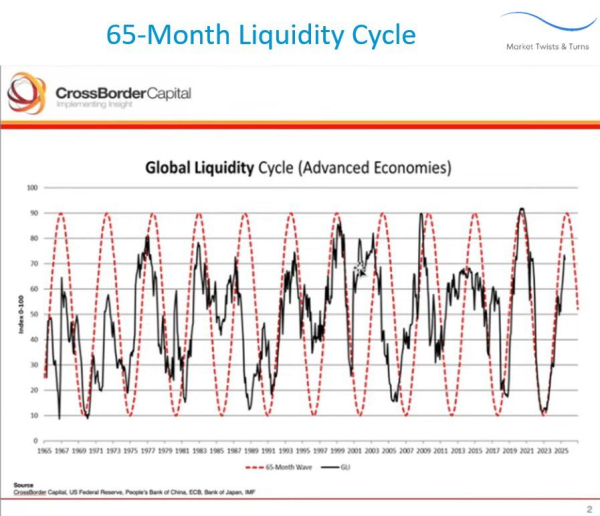

65 Month Liquidity Cycle: Global Liquidity Map Enters Final Stage

In the latest chart from CrossBorder Capital, the black line represents the Global Liquidity Index (GLI). It is currently rising sharply, approaching the red peak area. Its movement resembles the late phases of the 2016-2021 cycle. This strongly suggests we are entering the vibrant late upswing phase of the liquidity cycle. During this period, asset valuations are soaring well beyond their intrinsic worth.

65 Month Liquidity Cycle. Source: X

This is an average 5.5-year cycle, first identified through Fourier analysis in 1999. Each cycle follows a familiar pattern: capital is injected strongly in the early phase, peaks when monetary policy is extremely loose, and then reverses as credit and liquidity tighten.

Based on the slopes of previous cycles, the next liquidity peak is expected to appear in Q1 or Q2 2026, roughly between March and June, just a few months away. This suggests we are nearing an “overheat” phase, when capital flow slows and adjustment risks rise.

If this assumption holds, risk assets—from tech stocks to crypto—will soon enter a “re-pricing” period. This is when smart money begins to reduce exposure to highly leveraged positions, potentially leading to a 15-20% correction in Bitcoin before the new cycle bottom forms.

Although the chart and overall analysis are compelling, as one analyst on X points out, the cycle timing on the chart is often off by several years. This means we cannot know for certain whether the market has peaked, will accelerate, remain flat, or do nothing.

“I like the chart and the overall analysis, but the timing of the cycle is on average off by years in this chart. So, you don’t know whether it has peaked, whether it will accelerate, or do nothing, based on the chart. It is a coinflip,” the analyst noted.

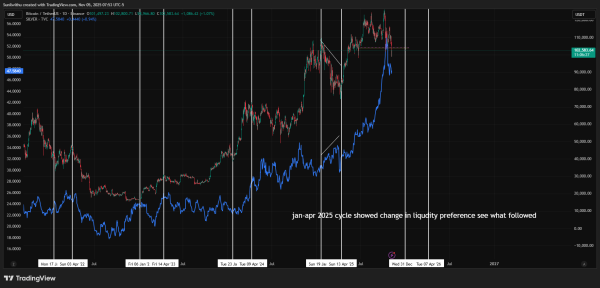

Bitcoin Drops, Silver Rises: Safe Money Rotation Signals

An interesting trend in 2025 is the divergence between Bitcoin (BTC) and Silver. According to charts from 2021 to 2025, Bitcoin has fallen roughly 15-20%, from $109,000 to $82,000. At the same time, Silver rose 13%, from $29 to $33. This reflects a clear shift in capital flows. As global liquidity tightens, investors gradually exit high-risk assets, such as cryptocurrencies, and rotate toward “collateral-backed” assets, including precious metals.

Bitcoin vs Silver divergence. Source: X

This divergence suggests that Bitcoin serves as a risk-on indicator, benefiting directly from liquidity expansion. At the same time, Silver exhibits dual characteristics of a commodity and a safe-haven asset, making it more attractive when inflation remains high but economic growth slows.

Based on stagflation signals and historical trends of the liquidity cycle, many experts predict Silver may outperform Bitcoin during January-April 2026. However, year-end 2025 rallies in both assets suggest that this shift will not occur abruptly but will be moderated by market sentiment and macro events.

“As we move into January-April 2026, we may see this trend accelerate. Bitcoin may only recover moderately, while Silver rises sharply, deepening the rotation toward tangible collateral assets,” the analyst noted.

2026: A Pivot Year for the Cycle – Bitcoin Rebounds or Silver Continues to Lead?

Although a 20% drop in Bitcoin sounds bearish, it does not necessarily mark the end of the bullish cycle. In most late liquidity cycle phases, the market typically experiences a sharp correction before entering the final upswing, known as the “liquidity echo rally.” If this scenario repeats, Bitcoin may undergo a technical dip before rebounding strongly in the second half of 2026.

Meanwhile, Silver, benefiting from industrial demand and hedging flows, may sustain short-term gains. However, when global liquidity expands again in 2027, speculative capital may shift away from precious metals toward cryptocurrencies and equities in search of higher returns.

In summary, the 65 Month Liquidity Cycle is entering a critical phase. Bitcoin is likely to experience a temporary correction, while Silver continues to play the market’s “steady hand.” For long-term investors, this may not be a signal to exit, but rather an opportunity to reposition portfolios ahead of the next liquidity wave in 2026-2027.

The post The 65-Month Clock Is Ticking: Why Bitcoin May Drop 20% While Silver Shines appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  WhiteBIT Coin

WhiteBIT Coin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Ethena USDe

Ethena USDe  Zcash

Zcash  WETH

WETH  Hedera

Hedera  Litecoin

Litecoin  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  Monero

Monero  Shiba Inu

Shiba Inu  Uniswap

Uniswap  Polkadot

Polkadot  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  Dai

Dai  World Liberty Financial

World Liberty Financial  Mantle

Mantle  MemeCore

MemeCore  Canton

Canton  sUSDS

sUSDS  USDT0

USDT0  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Aave

Aave  PayPal USD

PayPal USD  Bitget Token

Bitget Token  USD1

USD1  OKB

OKB  Pepe

Pepe  Currency One USD

Currency One USD  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Aptos

Aptos  Aster

Aster  Tether Gold

Tether Gold  Binance-Peg WETH

Binance-Peg WETH  Ondo

Ondo  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Falcon USD

Falcon USD  Wrapped SOL

Wrapped SOL  Pi Network

Pi Network  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  USDtb

USDtb  KuCoin

KuCoin  Filecoin

Filecoin  HTX DAO

HTX DAO  Official Trump

Official Trump  Arbitrum

Arbitrum  Algorand

Algorand  Rocket Pool ETH

Rocket Pool ETH  Pump.fun

Pump.fun  Binance Staked SOL

Binance Staked SOL  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Gate

Gate  PAX Gold

PAX Gold  Kinetiq Staked HYPE

Kinetiq Staked HYPE  StakeWise Staked ETH

StakeWise Staked ETH  BFUSD

BFUSD  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Sky

Sky  Wrapped BNB

Wrapped BNB  Render

Render  syrupUSDT

syrupUSDT  Function FBTC

Function FBTC  Story

Story  Lombard Staked BTC

Lombard Staked BTC  Quant

Quant  syrupUSDC

syrupUSDC  Liquid Staked ETH

Liquid Staked ETH  Sei

Sei  Jupiter

Jupiter  Aerodrome Finance

Aerodrome Finance  NEXO

NEXO  Renzo Restaked ETH

Renzo Restaked ETH  Bonk

Bonk  Global Dollar

Global Dollar  Solv Protocol BTC

Solv Protocol BTC  Ripple USD

Ripple USD  Pudgy Penguins

Pudgy Penguins  Circle USYC

Circle USYC  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Dash

Dash  Immutable

Immutable  Virtuals Protocol

Virtuals Protocol  PancakeSwap

PancakeSwap  Mantle Staked Ether

Mantle Staked Ether  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Celestia

Celestia  clBTC

clBTC  Optimism

Optimism  Starknet

Starknet  Rain

Rain  OUSG

OUSG  Injective

Injective  Jupiter Staked SOL

Jupiter Staked SOL  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Lido DAO

Lido DAO  Stacks

Stacks  Curve DAO

Curve DAO  The Graph

The Graph  Ondo US Dollar Yield

Ondo US Dollar Yield  SOON

SOON  Tezos

Tezos  cgETH Hashkey Cloud

cgETH Hashkey Cloud  SPX6900

SPX6900  DoubleZero

DoubleZero  tBTC

tBTC  Marinade Staked SOL

Marinade Staked SOL  Beldex

Beldex  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Pyth Network

Pyth Network  FLOKI

FLOKI  IOTA

IOTA  Kaia

Kaia  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  USDai

USDai  Decred

Decred  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Sonic

Sonic  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Plasma

Plasma  Ethereum Name Service

Ethereum Name Service  Stader ETHx

Stader ETHx  Ether.fi

Ether.fi  GTETH

GTETH  Usual USD

Usual USD  Trust Wallet

Trust Wallet  The Sandbox

The Sandbox  Conflux

Conflux  Bitcoin SV

Bitcoin SV  Maple Finance

Maple Finance  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  TrueUSD

TrueUSD  dogwifhat

dogwifhat  GALA

GALA  JasmyCoin

JasmyCoin  AB

AB  Pendle

Pendle  Theta Network

Theta Network  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  BitTorrent

BitTorrent  Swell Ethereum

Swell Ethereum  ether.fi Staked ETH

ether.fi Staked ETH  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  sBTC

sBTC  Flow

Flow  Binance-Peg Dogecoin

Binance-Peg Dogecoin  MYX Finance

MYX Finance  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Helium

Helium  Decentraland

Decentraland  GHO

GHO  Sun Token

Sun Token  Raydium

Raydium  ARK

ARK  USDD

USDD  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  ZKsync

ZKsync  Wrapped HYPE

Wrapped HYPE