Ethereum Price Forecast: ETH investors resume buying amid strong ETF inflows and low exchange reserves

Ethereum price today: $2,570

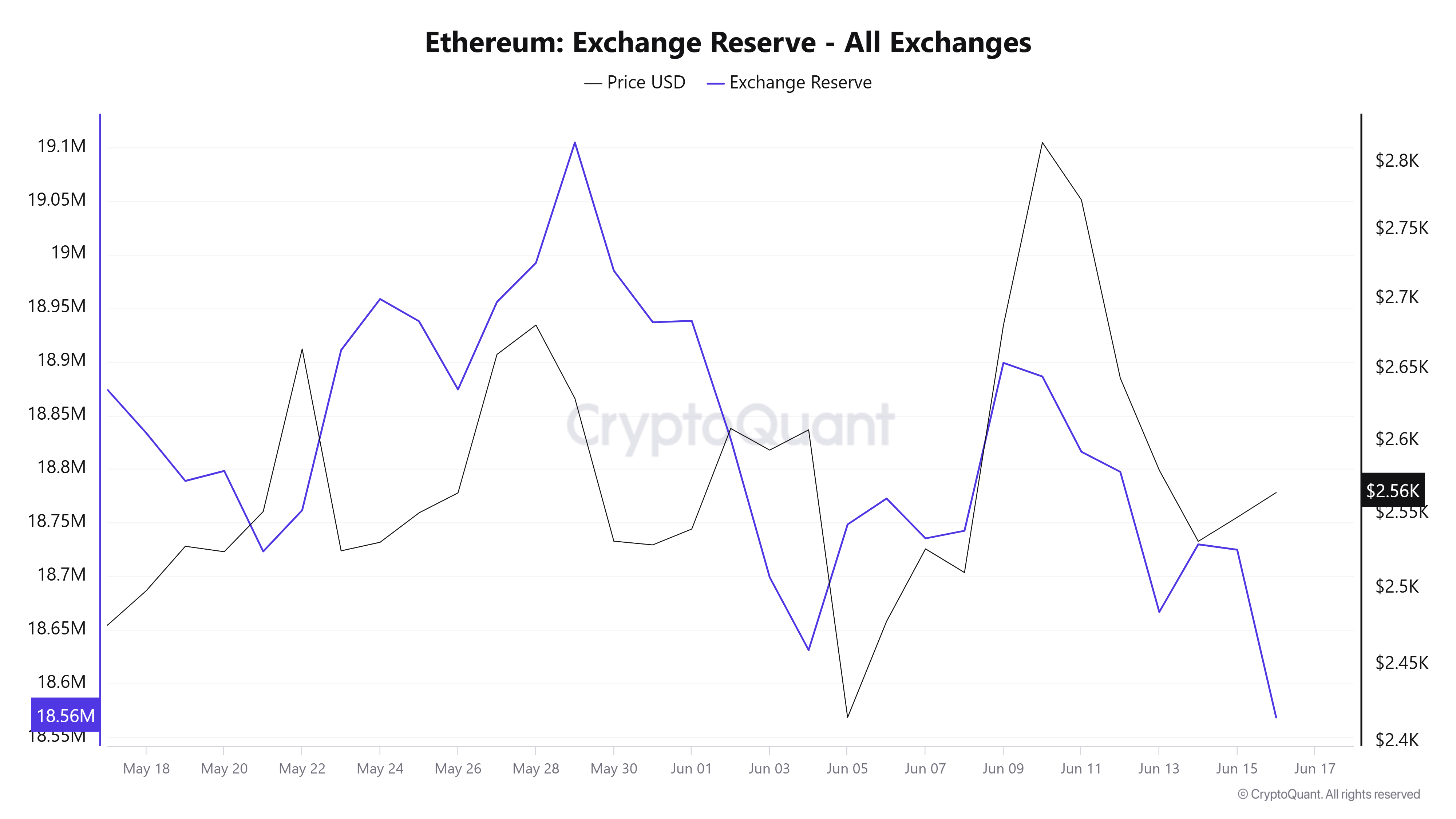

- Ethereum exchange reserves have flipped toward accumulation, reaching an all-time low of 18.57 million ETH.

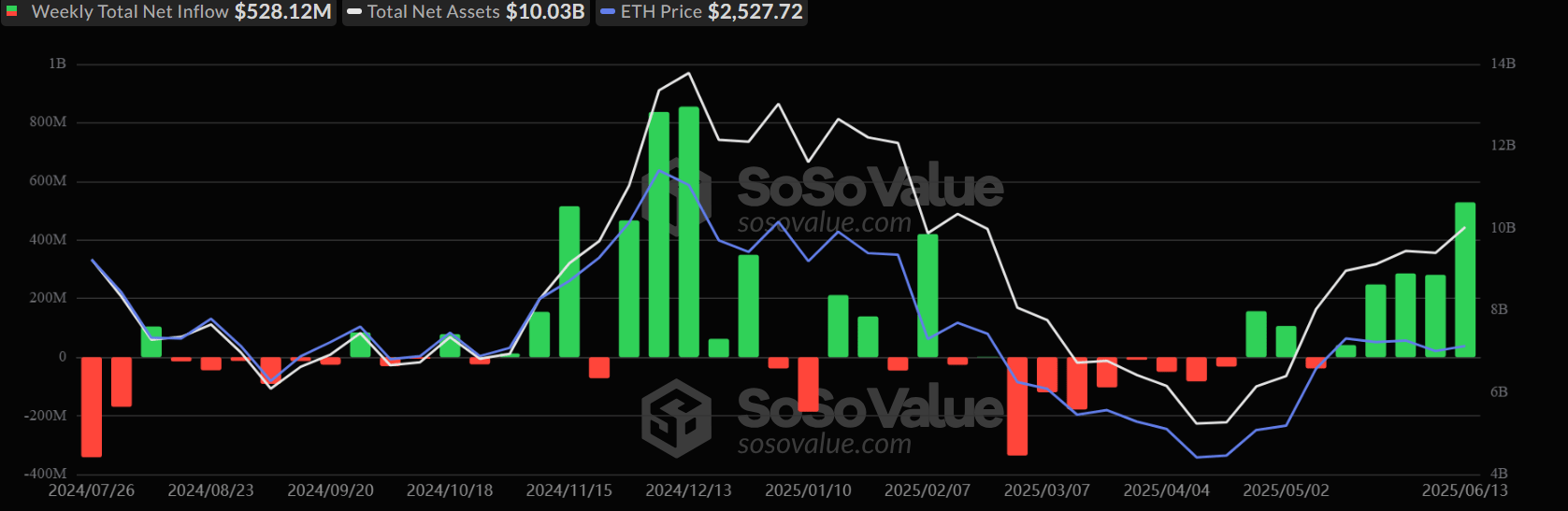

- Ethereum ETFs posted $583 million in weekly net inflows, their strongest performance since December.

- MEXC’s Tracy Jin gives a cautious ETH price growth prediction despite positive developments surrounding the Ethereum ecosystem.

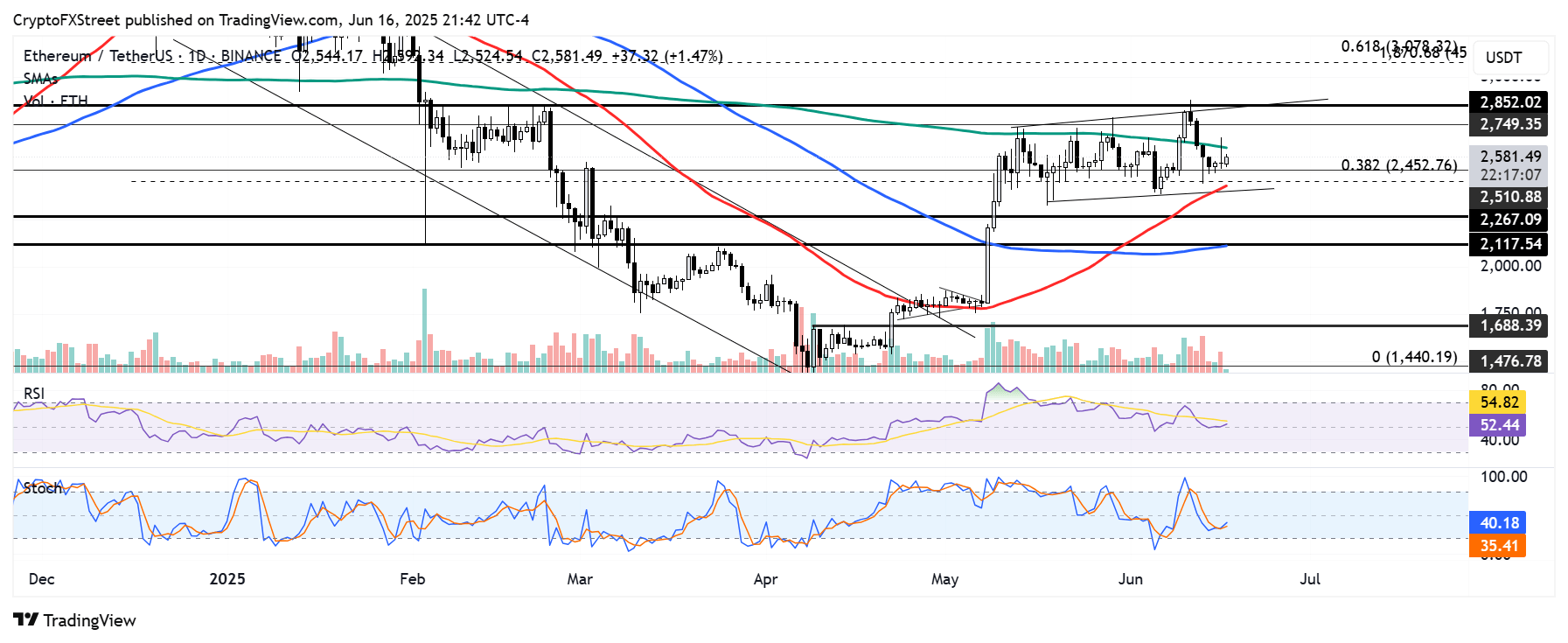

- ETH faces rejection at the 200-day SMA after holding the $2,500 support through the weekend.

Ethereum (ETH) briefly crossed above $2,600 on Monday following a switch to accumulation in the top altcoin’s exchange reserve and $583 million in inflows into ETH investment products last week.

Ethereum exchange reserves hit all-time low amid $583 million ETF inflows

Ethereum resumed bullish action on Monday after its exchange reserve flipped back to a downtrend, declining from 18.72 million ETH on Saturday to an all-time low of 18.57 million ETH over the past 24 hours. As the total value of exchange reserves drops, it indicates rising buying pressure.

ETH Exchange Reserve. Source: CryptoQuant

During the period, ETH’s total value staked also grew by 80K ETH, signifying a stronger bullish sentiment among investors, according to data from Beaconcha.in.

The shift toward accumulation in ETH follows a strong week of institutional buying pressure, which pushed net inflows in global Ethereum products to $583 million last week, according to CoinShares data.

The buying pressure was spearheaded by $528.12 million inflows into US spot ETH exchange-traded funds (ETFs), their highest weekly performance since December 2024. The products recorded a 19-day run of net inflows before breaking the streak on Friday, with mild outflows of $2.18 million following the escalation of tensions in the Middle East.

US spot ETH ETF Flows. Source: SoSoValue

“Ethereum’s recovery is being supported by the ‘digital oil’ narrative and ecosystem fundamentals, like the Pectra upgrade and increased stablecoin activity, with almost 50% of all stablecoins on the Ethereum network,” said Tracy Jin, COO of crypto exchange MEXC.

“It’s also good to see that the rules around staking and new stablecoin-related ETFs are coming into effect, which is helping to boost investor confidence,” she added.

Despite the positive developments surrounding ETH recently, Jin maintained a cautious end-of-year price prediction for ETH.

“ETH could be between $2,800 and $3,600 by the end of the year, with the possibility of going even higher if ETF staking and network developments speed up,” Jin said.

Ethereum Price Forecast: ETH sees rejection at 200-day SMA

Ethereum experienced $134.04 million in futures liquidations, with long and short liquidations totaling $70.55 million and $63.49 million, respectively, over the past 24 hours, per Coinglass data.

ETH held support near $2,500 through the weekend and tested the 200-day Simple Moving Average (SMA) as dynamic resistance before experiencing a rejection. The top altcoin could test the $2,850 key resistance if it flips the 200-day SMA support. A rejection at $2,850 will imply a double-top formation.

ETH/USDT daily chart

On the downside, if the $2,500 support fails, ETH needs to hold the lower boundary of a key channel, strengthened by the 50-day SMA, to prevent a decline to the $2,260 to $2,110 support range.

The Relative Strength Index (RSI) is above its neutral level and could test its moving average line, while the Stochastic Oscillator (Stoch) is below its neutral level. A successful crossover above in both indicators will strengthen the bullish momentum.

Related news

- Ethereum Price Forecast: ETH’s new valuation framework tags it ‘digital oil,’ highlights an $8,000 bull case

- Ethereum Price Forecast: ETH maintains downtrend despite SharpLink’s $463 million purchase

- Crypto Today: Bitcoin, Ethereum, XRP rebound along with surge in open interest, trading volumes

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Stellar

Stellar  LEO Token

LEO Token  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Zcash

Zcash  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Dai

Dai  USDT0

USDT0  Cronos

Cronos  Polkadot

Polkadot  Mantle

Mantle  Bittensor

Bittensor  MemeCore

MemeCore  sUSDS

sUSDS  Uniswap

Uniswap  Aave

Aave  World Liberty Financial

World Liberty Financial  USD1

USD1  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  Bitget Token

Bitget Token  OKB

OKB  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Binance-Peg WETH

Binance-Peg WETH  Falcon USD

Falcon USD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Tether Gold

Tether Gold  Wrapped SOL

Wrapped SOL  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  Aster

Aster  USDtb

USDtb  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Worldcoin

Worldcoin  Dash

Dash  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Official Trump

Official Trump  Gate

Gate  Algorand

Algorand  Pump.fun

Pump.fun  syrupUSDT

syrupUSDT  PAX Gold

PAX Gold  StakeWise Staked ETH

StakeWise Staked ETH  BFUSD

BFUSD  Kinetiq Staked HYPE

Kinetiq Staked HYPE  syrupUSDC

syrupUSDC  Lombard Staked BTC

Lombard Staked BTC  Function FBTC

Function FBTC  Liquid Staked ETH

Liquid Staked ETH  Wrapped BNB

Wrapped BNB  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Story

Story  Sky

Sky  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH