Is This the Start of Ethereum’s November Crash?

The Federal Reserve just delivered its second consecutive interest rate cut, lowering the benchmark rate to a 3.75–4% range. On paper, looser monetary policy should fuel risk assets like crypto. But the market’s reaction told a different story. Ethereum (ETH) price fell over 5%, signaling traders aren’t convinced this cut is a clear bullish signal. Let’s break down why.

Ethereum Price Prediction: What the Fed’s Move Really Means

The Fed’s rate cut was expected, but Chair Jerome Powell’s comments dampened enthusiasm. His refusal to commit to another cut in December introduced uncertainty. Investors had priced in aggressive easing, so the cautious tone felt like a cold shower.

The end of quantitative tightening (QT) on December 1 was also a major announcement. It means the Fed will stop shrinking its balance sheet, effectively injecting more liquidity into the system. Normally, that’s bullish for crypto, but the backdrop of weak employment data and sticky inflation complicates things.

So while the policy shift favors risk assets in the long run, short-term volatility is back—especially as markets reassess how “dovish” the Fed really is.

Ethereum Price Prediction: Bears Regain Control

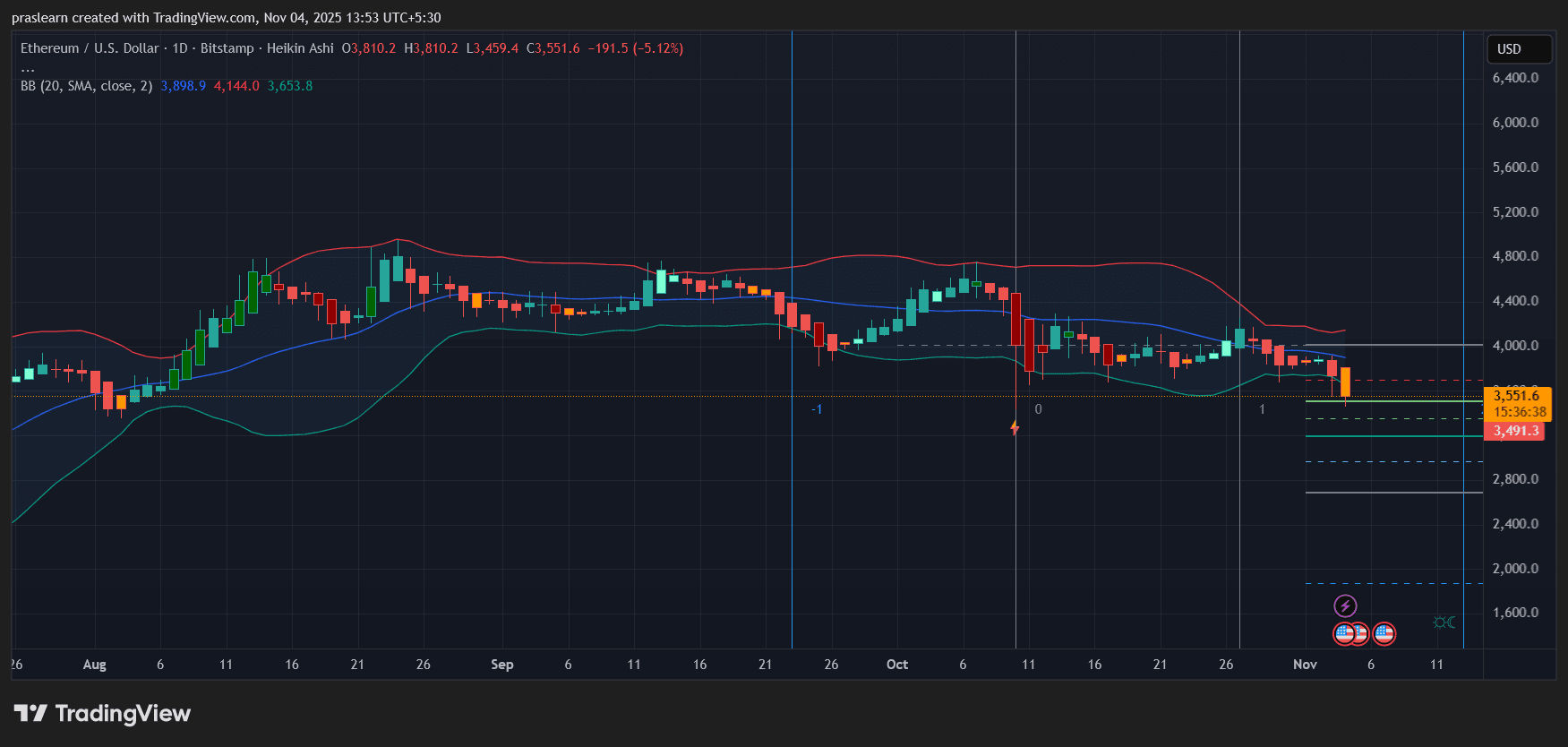

ETH/USD Daily Chart: TradingView

Ethereum price daily chart shows a decisive rejection near the mid-Bollinger Band (around $3,900), followed by a sharp breakdown toward $3,550. The Heikin Ashi candles turned solid red, confirming renewed bearish momentum.

The Bollinger Bands (BB) are widening—classic sign of volatility expansion—and ETH just closed below the 20-day simple moving average (SMA). This breakdown puts immediate support at the lower Bollinger band near $3,650, which has now been breached intraday. If the slide continues, the next downside targets sit near $3,490 and $3,250.

The chart also hints at a failed recovery attempt in late October, where ETH price couldn’t reclaim $4,000 resistance. That rejection reinforced a lower-high structure, suggesting sellers remain in control.

In short: the $3,500 zone is a key battleground. Lose that level convincingly, and ETH risks accelerating toward $3,000.

Macro Meets Market: Liquidity vs. Sentiment

Crypto market thrives on liquidity, and the end of QT should theoretically add fuel. But traders are wary because Powell’s tone wasn’t outright dovish. Add in labor-market weakness and inflation still above 3%, and you get uncertainty—something markets hate.

The lack of fresh economic data (due to the ongoing government data freeze) only adds to that uncertainty. Investors don’t know how deep the slowdown runs, so they’re hedging instead of rotating fully into risk assets. For Ethereum, this hesitation translates into cautious positioning and low conviction rallies.

Still, there’s a twist. If inflation data cools again before the December meeting, traders could quickly flip bullish on the next rate move. That’s the wild card to watch.

What Comes Next for Ethereum Price?

Here’s the thing: Ethereum’s longer-term structure remains intact as long as it holds above $3,200. That’s where the major trendline support from the July rally still aligns. A bounce from that level could trigger a short-covering rally back toward $3,800.

But for a sustained bullish reversal, ETH price needs two things:

- A clear signal from the Fed that further cuts are on the table.

- A decisive daily close above the mid-band (~$3,900) to reestablish bullish control.

If neither happens, $ETH could continue grinding lower through November, testing $3,250–$3,000 before buyers return.

Ethereum’s current drop isn’t just about charts—it’s about confidence. Traders wanted a clear dovish path; Powell gave them uncertainty. That combination typically leads to short-term weakness but sets up a potential rebound once clarity returns.

So while the near-term outlook looks bearish, medium-term traders should watch the $3,200–$3,000 region closely. If $Ethereum stabilizes there while the Fed signals another cut, a powerful rebound toward $4,000 could follow.

Until then, caution wins. The Fed may have cut rates, but the market isn’t celebrating just yet.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Wrapped SOL

Wrapped SOL  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Stellar

Stellar  LEO Token

LEO Token  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Litecoin

Litecoin  Zcash

Zcash  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Dai

Dai  Cronos

Cronos  USDT0

USDT0  Polkadot

Polkadot  MemeCore

MemeCore  Mantle

Mantle  Bittensor

Bittensor  sUSDS

sUSDS  Uniswap

Uniswap  World Liberty Financial

World Liberty Financial  Aave

Aave  USD1

USD1  Internet Computer

Internet Computer  Bitget Token

Bitget Token  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  OKB

OKB  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Falcon USD

Falcon USD  Binance-Peg WETH

Binance-Peg WETH  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Tether Gold

Tether Gold  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  USDtb

USDtb  Aster

Aster  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Worldcoin

Worldcoin  Dash

Dash  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Algorand

Algorand  Gate

Gate  Pump.fun

Pump.fun  syrupUSDT

syrupUSDT  Kinetiq Staked HYPE

Kinetiq Staked HYPE  BFUSD

BFUSD  StakeWise Staked ETH

StakeWise Staked ETH  PAX Gold

PAX Gold  syrupUSDC

syrupUSDC  Liquid Staked ETH

Liquid Staked ETH  Lombard Staked BTC

Lombard Staked BTC  VeChain

VeChain  Wrapped BNB

Wrapped BNB  Cosmos Hub

Cosmos Hub  Function FBTC

Function FBTC  Sky

Sky  Story

Story  Jupiter

Jupiter  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Renzo Restaked ETH

Renzo Restaked ETH  NEXO

NEXO  Solv Protocol BTC

Solv Protocol BTC  Ripple USD

Ripple USD  Filecoin

Filecoin  Render

Render  Global Dollar

Global Dollar  Sei

Sei  Pudgy Penguins

Pudgy Penguins  Virtuals Protocol

Virtuals Protocol  Bonk

Bonk  Mantle Staked Ether

Mantle Staked Ether  Immutable

Immutable  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Circle USYC

Circle USYC  clBTC

clBTC  OUSG

OUSG  Jupiter Staked SOL

Jupiter Staked SOL  PancakeSwap

PancakeSwap  Aerodrome Finance

Aerodrome Finance  Decred

Decred  Ondo US Dollar Yield

Ondo US Dollar Yield  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Stables Labs USDX

Stables Labs USDX  Optimism

Optimism  Lido DAO

Lido DAO  Stacks

Stacks  Celestia

Celestia  Injective

Injective  Marinade Staked SOL

Marinade Staked SOL  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  tBTC

tBTC  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Curve DAO

Curve DAO  Beldex

Beldex  The Graph

The Graph  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  USDai

USDai  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  FLOKI

FLOKI  SPX6900

SPX6900  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Tezos

Tezos  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  DoubleZero

DoubleZero  Usual USD

Usual USD  Stader ETHx

Stader ETHx  GTETH

GTETH  Pyth Network

Pyth Network  IOTA

IOTA  Kaia

Kaia  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  TrueUSD

TrueUSD  Trust Wallet

Trust Wallet  Ether.fi

Ether.fi  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Cognify

Cognify  Starknet

Starknet  Plasma

Plasma  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  AB

AB  Swell Ethereum

Swell Ethereum  Conflux

Conflux  Sonic

Sonic  sBTC

sBTC  Pendle

Pendle  The Sandbox

The Sandbox  Humanity

Humanity  Bitcoin SV

Bitcoin SV  BitTorrent

BitTorrent  ether.fi Staked ETH

ether.fi Staked ETH  Ethereum Name Service

Ethereum Name Service  GHO

GHO  ARK

ARK  Helium

Helium  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Maple Finance

Maple Finance  USDD

USDD  Theta Network

Theta Network  JasmyCoin

JasmyCoin  GALA

GALA  Sun Token

Sun Token  dogwifhat

dogwifhat  Wrapped HYPE

Wrapped HYPE  Satoshi Stablecoin

Satoshi Stablecoin  AINFT

AINFT  Arbitrum Bridged Wrapped eETH (Arbitrum)

Arbitrum Bridged Wrapped eETH (Arbitrum)  Decentraland

Decentraland  Flow

Flow  ZKsync

ZKsync  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)