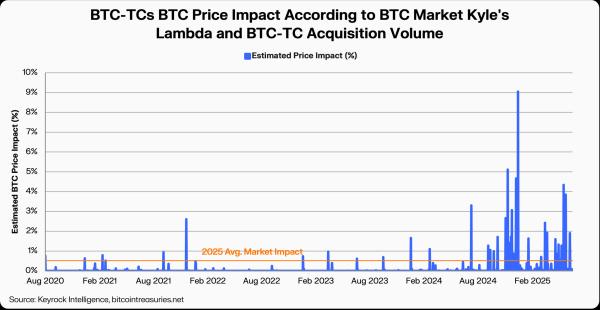

Data highlights Bitcoin holders have negligible impact on Bitcoin market price

A new research by crypto investment firm, Keyrock, has shown that Bitcoin treasury companies account for just 0.59% of daily BTC price movements. The Brussels-based firm released the market report on July 10.

The report shows that the Bitcoin Treasuries company has minimal influence on price action despite holding a combined 847,000 BTC, approximately 4% of the total Bitcoin supply. Keyrock report relied on data from both public and private companies that disclose Bitcoin holdings in financial reports or regulatory filings.

Per the report, the largest corporate holder, Strategy, alone controls over 1% of the total BTC supply. Interestingly, in the second quarter of 2024, corporate holdings grew by over 159,000 BTC, marking the highest quarterly increase so far.

However, the report shows this had little to no effect on Bitcoin’s short-term market movements and no strong correlation between treasury buying and BTC price trends. It noted that most companies behave as long-term holders and do not move coins frequently.

Bitcoin Treasury Firms Impact on Price (Source: Keyrock)

Thus, Bitcoin, which is held in corporate treasuries, does not influence trading behavior or market momentum. Price action remains dominated by spot markets, exchange-traded products, derivatives, and retail activity. Treasury growth, while symbolic, has not translated into volatility or upward price pressure.

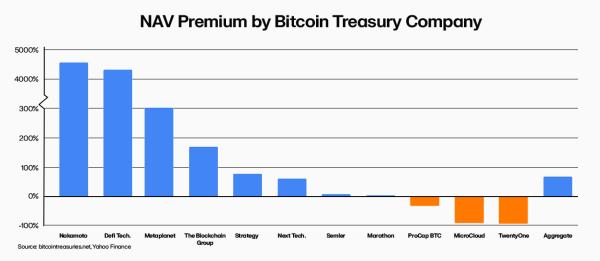

Bitcoin-heavy stocks trade at significant premiums

Meanwhile, the new report shows that public companies holding large Bitcoin reserves often trade at a premium to their actual BTC value. MicroStrategy currently leads with a 91.3% premium over the market value of its holdings.. That means investors pay $191 for every $100 of Bitcoin exposure through its stock.

Other treasury firms also show similar premiums, ranging from 20% to 60%, depending on market cycles and investor demand. These premiums reflect how equities with Bitcoin exposure are priced above the value of the coins they hold.

Bitcoin Treasury Firms Premium (source: Keyrock)

The report tracked multiple companies with disclosed BTC holdings and found consistent overvaluation in share price compared to underlying assets. This trend was present even when Bitcoin was flat or declining.

The firm noted that these premiums move independently of Bitcoin’s price. They often respond faster to market sentiment, news, or speculation. Premiums narrowed sharply during drawdowns but widened again during price surges.

This gap between share price and BTC value highlights a cost difference for investors using public equities to gain Bitcoin exposure. While treasury holdings appear passive, the pricing of their stocks is not. As of July 2025, MicroStrategy remains the most overvalued relative to its Bitcoin. The report did not name all the companies reviewed, but confirmed that this pattern is widespread.

Most Treasury Bitcoin cannot be used as Collateral

Interestingly, the report also highlighted why Bitcoin held by treasury companies might not have much impact on the price action, noting that it is because most of the BTC remains inactive. The report confirms that most holdings are stored offline and not used as collateral or in financial products.

Companies holding BTC rarely use their reserves for lending, yield generation strategies, or derivatives. Their internal rules and custody structures limit their operational use of the assets, which means that while treasury firms hold large volumes, they are not used for leverage or liquidity.

Keyrock notes that only a small percentage of treasury assets are moved or deployed after acquisition. Most remain static, even during market volatility. This approach keeps holdings secure but also limits strategic flexibility. Treasury companies do not benefit from yield or lending returns, even as other platforms generate revenue from active BTC use.

However, the report noted that unless these firms adapt, they may lose ground to institutions with more dynamic strategies, as treasury growth without use cases is not the best way to maximize resources.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Stellar

Stellar  LEO Token

LEO Token  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Zcash

Zcash  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Dai

Dai  USDT0

USDT0  Cronos

Cronos  Polkadot

Polkadot  Mantle

Mantle  Bittensor

Bittensor  MemeCore

MemeCore  sUSDS

sUSDS  Uniswap

Uniswap  Aave

Aave  World Liberty Financial

World Liberty Financial  USD1

USD1  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  Bitget Token

Bitget Token  OKB

OKB  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Binance-Peg WETH

Binance-Peg WETH  Falcon USD

Falcon USD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Tether Gold

Tether Gold  Wrapped SOL

Wrapped SOL  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  Aster

Aster  USDtb

USDtb  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Worldcoin

Worldcoin  Dash

Dash  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Official Trump

Official Trump  Gate

Gate  Algorand

Algorand  Pump.fun

Pump.fun  syrupUSDT

syrupUSDT  PAX Gold

PAX Gold  StakeWise Staked ETH

StakeWise Staked ETH  BFUSD

BFUSD  Kinetiq Staked HYPE

Kinetiq Staked HYPE  syrupUSDC

syrupUSDC  Lombard Staked BTC

Lombard Staked BTC  Function FBTC

Function FBTC  Liquid Staked ETH

Liquid Staked ETH  Wrapped BNB

Wrapped BNB  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Story

Story  Sky

Sky  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH