Bitcoin Eyes $147,000—but One More Pullback May Come First

Bitcoin (BTC) has traded mostly sideways this week, hovering near $121,300 after a mild 1% weekly rise. On the surface, the Bitcoin price move seems uneventful, but a closer look at key chart structures and investor behavior suggests that the next big breakout might need one more correction before it happens.

Some crucial indicators — both on the chart and on-chain — now point to a deeper pullback forming underneath the surface, even as a new long-term target takes shape.

Chart Patterns Hint at a Cooling Phase Before the Next Leg Up

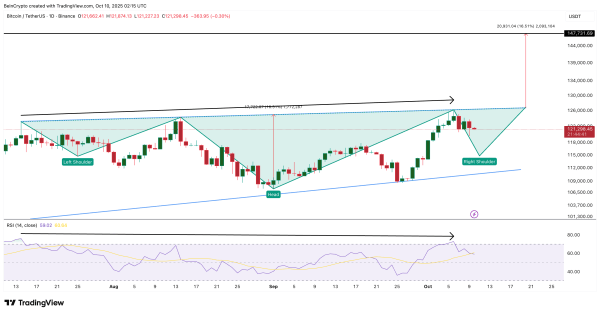

Bitcoin’s current setup is shaping into a classic reversal structure that has historically preceded major rallies. The inverse head & shoulders pattern, still developing, shows the early signs of symmetry between its left and right halves — suggesting the market may be in the process of building a foundation for the next advance.

Bitcoin Price Pattern: TradingView

However, short-term traders are watching a developing slope pattern that’s rising slightly (forming a rising wedge-like structure), showing potential exhaustion near the top and more immediate bearishness.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

At the same time, the Relative Strength Index (RSI), which measures market momentum, has started to diverge from price. Between July and early October, Bitcoin’s price made higher highs, while the RSI made lower highs — a bearish divergence that often signals fading buying strength.

This combination — a maturing chart pattern and a bearish wedge-like formation paired with weakening momentum — suggests that the Bitcoin price might first test lower levels to fully form its right side before attempting a breakout.

Whales and Long-Term Holders Add to the Selling Pressure

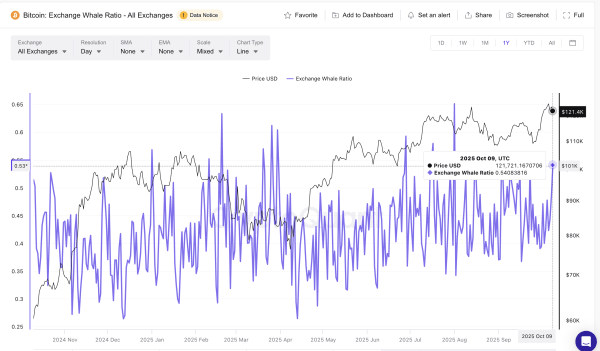

On-chain data backs the technical setup. The Exchange Whale Ratio, which measures the share of exchange inflows from the largest 10 addresses, has surged to 0.54 — its highest level since August 1. That signals increased whale deposits to exchanges, usually tied to short-term selling or portfolio rebalancing.

Bitcoin Whale Moves: CryptoQuant

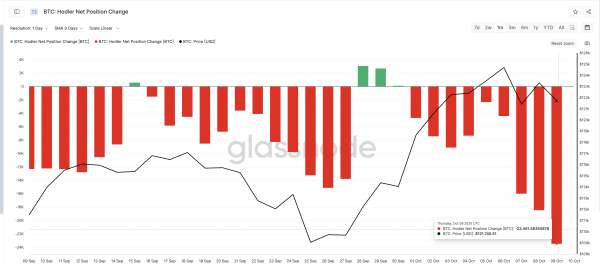

Meanwhile, long-term investors have turned net sellers. The Hodler Net Position Change, which tracks monthly accumulation or distribution, dropped sharply from +3,082 BTC on September 28 to –23,461 BTC on October 9. This swing of over 26,000 BTC shows clear profit-taking by veteran holders.

Bitcoin HODLers Selling: Glassnode

The combination of whale inflows and long-term selling suggests that big players expect near-term volatility before confidence returns — fitting the picture of a developing pattern rather than a completed one.

Key Bitcoin Price Levels to Watch

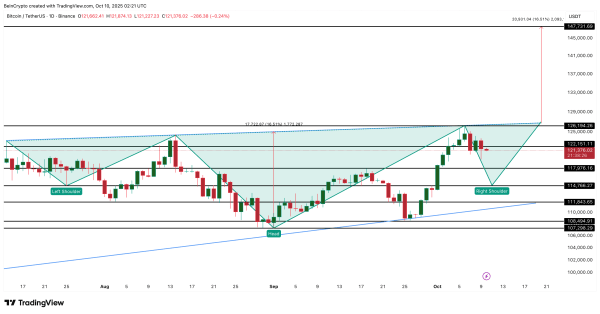

Bitcoin’s broader structure still targets around $147,700, based on the projection from its current setup. For that move to play out, the market must first stabilize and break cleanly above $126,100 (all-time high), close to the neckline level of the ongoing inverse head and shoulders pattern.

Until then, short-term support lies between $117,900, $114,700, and $111,800. Holding those zones keeps the structure intact. A fall below $107,200 would invalidate the bullish projection, while reclaiming $126,100 could trigger a move toward $147,700 — marking the start of Bitcoin’s next leg higher.

Bitcoin Price Analysis: TradingView

For now, the message is simple: a pullback might come before the push. The structure remains bullish, but patience will likely define who catches the next breakout. Just to reiterate, the Bitcoin price structure, based on this pattern, will continue to lean bullish unless BTC falls under $107,200.

The post Bitcoin Eyes $147,000—but One More Pullback May Come First appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Stellar

Stellar  LEO Token

LEO Token  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Zcash

Zcash  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Dai

Dai  USDT0

USDT0  Cronos

Cronos  Polkadot

Polkadot  Mantle

Mantle  Bittensor

Bittensor  MemeCore

MemeCore  sUSDS

sUSDS  Uniswap

Uniswap  Aave

Aave  World Liberty Financial

World Liberty Financial  USD1

USD1  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  Bitget Token

Bitget Token  OKB

OKB  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Binance-Peg WETH

Binance-Peg WETH  Falcon USD

Falcon USD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Tether Gold

Tether Gold  Wrapped SOL

Wrapped SOL  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  Aster

Aster  USDtb

USDtb  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Worldcoin

Worldcoin  Dash

Dash  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Official Trump

Official Trump  Gate

Gate  Algorand

Algorand  Pump.fun

Pump.fun  syrupUSDT

syrupUSDT  PAX Gold

PAX Gold  StakeWise Staked ETH

StakeWise Staked ETH  BFUSD

BFUSD  Kinetiq Staked HYPE

Kinetiq Staked HYPE  syrupUSDC

syrupUSDC  Lombard Staked BTC

Lombard Staked BTC  Function FBTC

Function FBTC  Liquid Staked ETH

Liquid Staked ETH  Wrapped BNB

Wrapped BNB  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Story

Story  Sky

Sky  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH  Quant

Quant  NEXO

NEXO  Solv Protocol BTC

Solv Protocol BTC  Filecoin

Filecoin  Ripple USD

Ripple USD  Render

Render  Global Dollar

Global Dollar  Sei

Sei  Pudgy Penguins

Pudgy Penguins  Bonk

Bonk  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Immutable

Immutable  clBTC

clBTC  Circle USYC

Circle USYC  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  OUSG

OUSG  Jupiter Staked SOL

Jupiter Staked SOL  PancakeSwap

PancakeSwap  Aerodrome Finance

Aerodrome Finance  Ondo US Dollar Yield

Ondo US Dollar Yield  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Stables Labs USDX

Stables Labs USDX  Optimism

Optimism  Celestia

Celestia  Decred

Decred  Lido DAO

Lido DAO  Stacks

Stacks  Marinade Staked SOL

Marinade Staked SOL  Injective

Injective  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  tBTC

tBTC  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Beldex

Beldex  Curve DAO

Curve DAO  The Graph

The Graph  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  SPX6900

SPX6900  USDai

USDai  FLOKI

FLOKI  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Tezos

Tezos  Usual USD

Usual USD  Stader ETHx

Stader ETHx  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  GTETH

GTETH  DoubleZero

DoubleZero  Pyth Network

Pyth Network  Kaia

Kaia  IOTA

IOTA  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  TrueUSD

TrueUSD  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Plasma

Plasma  Cognify

Cognify  Trust Wallet

Trust Wallet  Starknet

Starknet  Ether.fi

Ether.fi  Swell Ethereum

Swell Ethereum  AB

AB  sBTC

sBTC  Conflux

Conflux  Sonic

Sonic  Pendle

Pendle  Bitcoin SV

Bitcoin SV  Humanity

Humanity  The Sandbox

The Sandbox  BitTorrent

BitTorrent  ether.fi Staked ETH

ether.fi Staked ETH  Ethereum Name Service

Ethereum Name Service  Maple Finance

Maple Finance  GHO

GHO  Binance-Peg Dogecoin

Binance-Peg Dogecoin  ARK

ARK  USDD

USDD  dogwifhat

dogwifhat  Theta Network

Theta Network  Helium

Helium  Sun Token

Sun Token  JasmyCoin

JasmyCoin  GALA

GALA  Wrapped HYPE

Wrapped HYPE  Satoshi Stablecoin

Satoshi Stablecoin  Arbitrum Bridged Wrapped eETH (Arbitrum)

Arbitrum Bridged Wrapped eETH (Arbitrum)  AINFT

AINFT  Decentraland

Decentraland  ZKsync

ZKsync  Flow

Flow  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund