Is Ethereum (ETH) About to Rally? Breakdown Points to Bullish Setup

Ethereum (ETH) has faced a sharp pullback in recent days, dropping 14% over the past week. Despite this decline, analysts suggest the recent breakdown may not indicate weakness but could instead lead to the next major upward move. The asset is trading around $3,390 at press time, after gaining 2% in the past 24 hours.

Some technical analysts continue to point toward long-term chart structures and liquidation setups that support the possibility of a bullish continuation.

Pattern Suggests Breakdown Could Precede Breakout

Trader Tardigrade shared a multi-cycle view of Ethereum’s price action on the 3-day chart. The setup shows that ETH has previously entered strong uptrends following breakdowns from support levels. These breakdowns were followed by sideways ranges and later led to major breakouts.

In the latest move, ETH appears to be repeating this structure. Suggesting that the recent price weakness may serve as the starting point for the next upward trend, Tardigrade said,

$ETH/3-day

A breakdown is essential for a massive surge 🔥#Ethereum pic.twitter.com/jMexdye4bg— Trader Tardigrade (@TATrader_Alan) November 6, 2025

Based on this pattern, ETH may be building a base before continuation.

Long-Term Structure Remains in Place

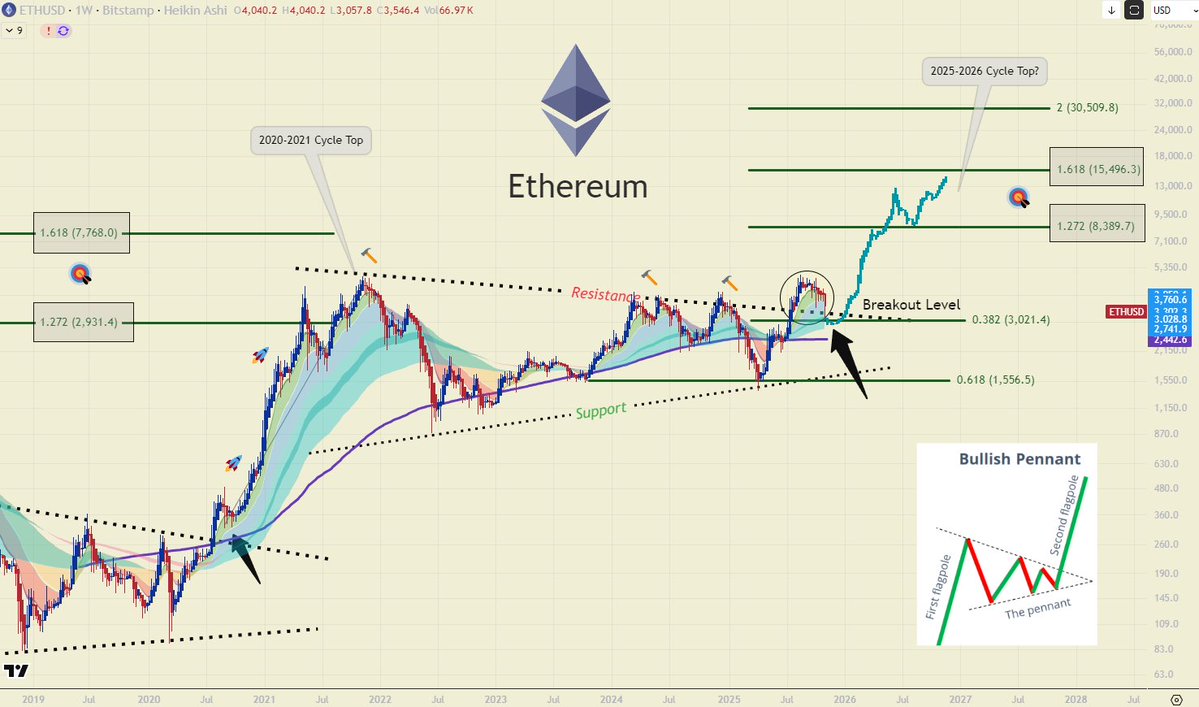

BACH, another market analyst, pointed to a long-term bullish pennant formation still intact on the weekly chart. Ethereum recently reclaimed the $3,000 breakout level, which aligns with the 0.382 Fibonacci retracement of the previous cycle. This area is being monitored as support.

You may also like:

- NewYorkCoin Skyrockets on Social Feeds as Zohran Mamdani’s Win Triggers a Political Crypto Frenzy

- Ethereum Sellers Dominate, But $5K Year-End Target Holds Firm

- Here’s Why Bitcoin’s (BTC) Crash Is a Sentiment Flush, Not a Structural Breakdown

Future price targets based on Fibonacci projections include $7,700, $15,500, and $30,500, with a potential macro top between 2025 and 2026. BACH commented that, “Crypto sentiment [is] completely washed out and in Extreme Fear,” referring to current market conditions that have historically occurred near bottom ranges.

Short-Term Levels and Leverage Signals

Analyst Lennaert Snyder noted that ETH should hold the $3,300 level to maintain higher lows. He added that reclaiming $3,530 would be important.

“If we lose $3,300 with conviction I’m shorting the continuation to probably new lows,” he said.

Liquidation data shows a buildup of short positions between $3,500 and $3,800. If the price moves higher, forced liquidations could push it up quickly. “MAX PAIN IS UP FOR $ETH,” said CryptoGoos, referring to this risk for short traders.

Despite the recent recovery, ETH has struggled to reclaim the $3,600–$3,700 zone. Analyst Ted said the bounce was mostly driven by closed short positions.

“Until Ethereum reclaims the $3,600–$3,700 zone with strong inflows, the chances are it’ll go lower,” he noted.

As CryptoPotato reported, the Taker Buy-Sell Ratio on Binance remains below 1.0, showing more sell pressure than buy volume. This aligns with the broader view that selling has increased, even as buyers are cautiously watching for a reversal.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Figure Heloc

Figure Heloc  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  WhiteBIT Coin

WhiteBIT Coin  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Zcash

Zcash  LEO Token

LEO Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  WETH

WETH  Hedera

Hedera  Avalanche

Avalanche  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Ethena Staked USDe

Ethena Staked USDe  Dai

Dai  Cronos

Cronos  Polkadot

Polkadot  MemeCore

MemeCore  Mantle

Mantle  Bittensor

Bittensor  sUSDS

sUSDS  Internet Computer

Internet Computer  USDT0

USDT0  Uniswap

Uniswap  World Liberty Financial

World Liberty Financial  Aave

Aave  USD1

USD1  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bitget Token

Bitget Token  PayPal USD

PayPal USD  NEAR Protocol

NEAR Protocol  Currency One USD

Currency One USD  OKB

OKB  Pepe

Pepe  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic  Falcon USD

Falcon USD  Tether Gold

Tether Gold  Aster

Aster  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Binance-Peg WETH

Binance-Peg WETH  Aptos

Aptos  Wrapped SOL

Wrapped SOL  Ondo

Ondo  USDtb

USDtb  Pi Network

Pi Network  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Worldcoin

Worldcoin  KuCoin

KuCoin  Official Trump

Official Trump  Rocket Pool ETH

Rocket Pool ETH  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Algorand

Algorand  Dash

Dash  Gate

Gate  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Filecoin

Filecoin  PAX Gold

PAX Gold  BFUSD

BFUSD  Pump.fun

Pump.fun  syrupUSDT

syrupUSDT  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Wrapped BNB

Wrapped BNB  StakeWise Staked ETH

StakeWise Staked ETH  Function FBTC

Function FBTC  Lombard Staked BTC

Lombard Staked BTC  syrupUSDC

syrupUSDC  Sky

Sky  Liquid Staked ETH

Liquid Staked ETH  Jupiter

Jupiter  Story

Story  NEXO

NEXO  Global Dollar

Global Dollar  Ripple USD

Ripple USD  Solv Protocol BTC

Solv Protocol BTC  Renzo Restaked ETH

Renzo Restaked ETH  Render

Render  Sei

Sei  Circle USYC

Circle USYC  Bonk

Bonk  Pudgy Penguins

Pudgy Penguins  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Mantle Staked Ether

Mantle Staked Ether  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  DeAgentAI

DeAgentAI  Immutable

Immutable  Virtuals Protocol

Virtuals Protocol  OUSG

OUSG  Aerodrome Finance

Aerodrome Finance  clBTC

clBTC  PancakeSwap

PancakeSwap  Jupiter Staked SOL

Jupiter Staked SOL  Optimism

Optimism  Ondo US Dollar Yield

Ondo US Dollar Yield  Celestia

Celestia  Lido DAO

Lido DAO  Tezos

Tezos  Stacks

Stacks  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Beldex

Beldex  Decred

Decred  Injective

Injective  tBTC

tBTC  Curve DAO

Curve DAO  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  The Graph

The Graph  SPX6900

SPX6900  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  USDai

USDai  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Marinade Staked SOL

Marinade Staked SOL  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  FLOKI

FLOKI  DoubleZero

DoubleZero  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Usual USD

Usual USD  Kaia

Kaia  Pyth Network

Pyth Network  IOTA

IOTA  Cognify

Cognify  Stader ETHx

Stader ETHx  GTETH

GTETH  Trust Wallet

Trust Wallet  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  ZKsync

ZKsync  Stables Labs USDX

Stables Labs USDX  TrueUSD

TrueUSD  Plasma

Plasma  Ether.fi

Ether.fi  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Ethereum Name Service

Ethereum Name Service  Starknet

Starknet  Sonic

Sonic  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  AB

AB  Conflux

Conflux  Maple Finance

Maple Finance  Bitcoin SV

Bitcoin SV  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Helium

Helium  SOON

SOON  sBTC

sBTC  ether.fi Staked ETH

ether.fi Staked ETH  The Sandbox

The Sandbox  Pendle

Pendle  JasmyCoin

JasmyCoin  Swell Ethereum

Swell Ethereum  GHO

GHO  BitTorrent

BitTorrent  dogwifhat

dogwifhat  ARK

ARK  USDD

USDD  Sun Token

Sun Token  Theta Network

Theta Network  Binance-Peg Dogecoin

Binance-Peg Dogecoin  GALA

GALA  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Decentraland

Decentraland  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  MYX Finance

MYX Finance  AINFT

AINFT  Flow

Flow  Wrapped HYPE

Wrapped HYPE