How Stream Finance’s Collapse Exposed DeFi’s Looping Yield Bubble

Stream Finance, a yield-optimization focused DeFi project that issued a synthetic dollar token called xUSD, told users on Nov. 4 that an “external fund manager” had lost about $93 million in assets tied to the project.

Staked Stream USD (xUSD) 7-day price chart. SourceL CoinGecko

Within a day, xUSD lost over 85% of its value, collapsing from $1.26 to as low as $0.16 by press time. Withdrawals from the platform were frozen, and a dense web of interconnected yield vaults began to unwind, raising questions about how much of DeFi’s apparent growth was built on what are known as circular lending loops.

The disclosure also came shortly after reports surfaced that established DeFi protocol Balancer had been exploited for over $100 million, further shaking confidence in the sector.

As the dust settles, reports continue to surface that indicate the scale of the fallout across DeFi.

What Is Stream Finance?

Stream Finance describes itself as a “tokenized market neutral fund.” The project’s main slogan, “The SuperApp DeFi Deserves,” remains prominently placed on its website at press time, alongside a promise to simplify earning yield on-chain.

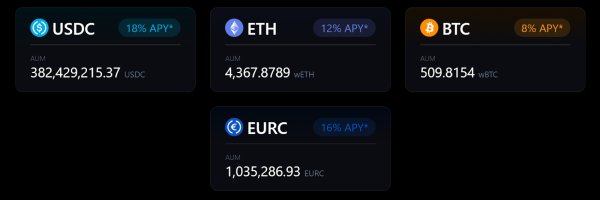

But the way Stream worked was largely a black box. Users would deposit supported assets — USDC, ETH, BTC, or EURC — into vaults that promised double-digit APYs. The Stream Finance team would then reallocate those funds into other protocols in various opaque and not fully disclosed strategies in order to deliver the high returns to depositors. Per Stream’s platform, these strategies included “lending arbitrages, to incentive farming, to dynamically hedged HFT, to market making.”

In return for deposited assets, Stream Finance issued corresponding yield-bearing tokens, such as xUSD for USDC deposits, which total over $382 million on the platform at press time, with APY at 18%, per Stream’s official platform.

Stream Finance supported assets for deposit. Source: Stream Finance

For comparison, at the time of writing, DeFi’s largest lending protocol, Aave, currently offers 4.8% APY on USDC deposits, while Compound offers just over 3%.

While the value proposition of Stream Finance — much higher yield on stablecoin deposits — was clear, the “yield-optimizing” corner of DeFi is also explicitly high-risk. As the platform itself noted, risks include “Execution failure, smart contract risk, custody risk.”

To provide the higher-than-usual yield, players like Stream build on-chain positions that include self-looped lending markets, risk curators, and automated strategies— all without disclosure to users lending or depositing their assets — which makes understanding the full scope of risk complex, if not impossible.

How Things Started: Recursive Minting

Even before Stream revealed its losses and xUSD collapsed, some in the crypto community had already noticed something was off. After crypto’s biggest liquidation event ever on Oct. 10, which wiped out around $20 billion from the market, Stream Finance and a few others were suspiciously acting as if nothing had happened.

That raised eyebrows among on-chain analysts who began increasingly flagging a pattern where Stream Finance was lending and borrowing its own assets, recycling borrowed tokens into partner vaults, and minting new yield tokens on top, effectively creating circular liquidity and inflating total value locked.

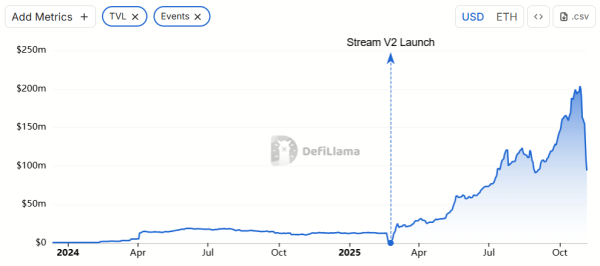

And for some time, that tactic worked, as looped liquidity pushed Stream Finance’s self-reported total value locked (TVL) above $200 million. However, many now question this tactic, saying tracking sites likely double-counted bridged tokens, artificially inflating TVL.

Stream Finance TVL. Source: DefiLlama

As warning signs popped up, DefiLlama updated its metrics, wiping millions off Stream Finance’s TVL page. After news broke of Stream’s collapse, DefiLlama’s pseudonymous founder, 0xngmi, posted on X that they might start asking protocols with funds on centralized exchanges to share data, because “currently all protocols with funds on CEXs are a black box in terms of verification.”

DeFi yield aggregator Yearn’s lead, known on X as Schlag, posted yesterday evening that “none of what happened came out of nowhere,” adding that “as with any good bubble/blow up, it has been slowly brewing and was simply a matter of time till it burst.” Schlag also added that Stream Finance is “far from the only ones out there with bodies to hide.”

On Oct. 28, just a few days before Stream reported its $93 million hole, Schlag had sounded the alarm on X in a detailed article, reporting that Stream Finance and Elixir, a DeFi protocol focused on liquidity provisioning, were using hidden markets on lending protocol Morpho.

Per Schlag’s report, Elixir was supplying USDC via Morpho’s private vault, in which Stream Finance was the only borrower, using its own xUSD as collateral. “It is hard to know for sure how much actual collateral is backing this full system, but it seems likely to be sub $0.10 per $1,” Schlag concluded at the time.

Schlag also explained how Stream and Elixir executed a so-called looping mechanism, “recursively minting each other’s tokens in order to inflate their own TVL and create a ponzu the likes of which we haven’t seen for awhile in crypto.” As Yearn’s lead explained, Stream Finance’s xUSD wallet received millions in USDC, cycled the funds through multiple addresses, swapped into USDT, minted Elixir’s own synthetic dollar token, deUSD, and then used the borrowed assets to mint more xUSD.

“[…] using the same $1.9m USDC they minted about 14.5m xUSD […],” Schlag wrote.

On Nov. 3, Elixir responded to concerns about xUSD that were increasingly circulating on social media, saying that it had “full redemption rights at $1 with Stream” and claimed to be “the only creditor with these 1-1 rights.”

The Fallout

The breaking point came that same day, on Nov. 3, when Balancer V2, one of the biggest automated market makers, was hacked for $128 million. The exploit sparked confusion about potential contagion, and liquidity providers rushed to exit any pools that looked connected, triggering a classic bank run on Stream Finance, as users rushed to withdraw their funds.

On Nov. 4, Stream unveiled the $93 million loss, but offered few details, except that it had hired U.S. law firm Perkins Coie LLP to investigate the incident. The project then notified users that it had suspended both withdrawals and deposits.

By then, xUSD’s value had already crashed far below $1, and the web of vault integrations began to break down. When the collapse finally hit, the scope of those hidden loops became at least somewhat visible.

Several major DeFi protocols, including Morpho, Euler, Silo, and Gearbox, were found to have accepted Stream Finance’s xUSD as collateral, despite evidently being aware of the asset’s recursive minting structure. This interconnected setup allowed xUSD-backed positions to spread across multiple lending markets, amplifying risk throughout the ecosystem.

As the scheme unraveled, reports surfaced that risk curators and vault managers such as Beefy, Silo, and Valarmore had reallocated user funds into xUSD without transparent disclosure, leaving depositors unknowingly exposed to Stream’s token.

“Too many entities, no oversight,” JohnnyTime, founder of web3 security firm Ginger Security, wrote in an X thread on Nov. 4.

Speaking with The Defiant, Driss Benamour, co-founder and CEO of YO Labs, the firm behind multi-chain yield optimizer YO, called the strategy behind xUSD a “degen practice in DeFi,” clarifying that “YO vaults had no exposure to xUSD and no meaningful exposure to yUSD.”

Silo Labs, the firm behind the Silo protocol, said in a press release shared with The Defiant on Nov. 5 that the Silo DAO is also preparing to take legal action, but against the Stream team, as the incident “has left lenders unable to access funds or redeem xUSD and xBTC.”

In the release, Silo Labs said that Silo DAO will work closely with its legal counsel to prepare and coordinate the case to seek “maximum possible repayment, distributed pro rata to all affected lenders.”

Stream’s Response

Before Stream Finance revealed the major losses, the platform’s founder, known by the pseudonym 0xlaw, tried to reassure users, saying in a now-deleted Oct. 29 post on X that Stream maintains a more than “$10 million insurance fund,” and that all positions outside the main wallet are “fully liquid immediately.” The founder also promised a transparency report on Stream’s strategies.

Although 0xlaw initially agreed to an interview with The Defiant on Oct. 28, they didn’t respond to follow-up questions about the transparency report or the details of the announced insurance fund.

After the meltdown, Stream Finance’s founder wrote in an X post that has since been made private that they’re “not the external fund manager” responsible for the multi-million loss, claiming that “zero strategies i was running suffered any drawdowns. we are pursuing aggressive legal against the asset manager responsible. i had zero knowledge of this due to various reasons until briefly before it was made public.”

But with roughly $285 million in debts intertwined across risk curators, vaults, as well as lending markets, and multiple yield tokens collapsing 30%-99% as of Nov. 5, the fallout has exposed just how fragile DeFi’s stacked-yield economy had become and how badly its so-called risk curators failed.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Figure Heloc

Figure Heloc  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  WhiteBIT Coin

WhiteBIT Coin  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Zcash

Zcash  Wrapped eETH

Wrapped eETH  LEO Token

LEO Token  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  WETH

WETH  Hedera

Hedera  Avalanche

Avalanche  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Dai

Dai  Cronos

Cronos  Polkadot

Polkadot  MemeCore

MemeCore  Mantle

Mantle  Bittensor

Bittensor  Internet Computer

Internet Computer  sUSDS

sUSDS  USDT0

USDT0  Uniswap

Uniswap  World Liberty Financial

World Liberty Financial  Aave

Aave  USD1

USD1  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bitget Token

Bitget Token  PayPal USD

PayPal USD  NEAR Protocol

NEAR Protocol  Currency One USD

Currency One USD  OKB

OKB  Ethena

Ethena  Pepe

Pepe  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic  Falcon USD

Falcon USD  Tether Gold

Tether Gold  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Aster

Aster  Binance-Peg WETH

Binance-Peg WETH  Wrapped SOL

Wrapped SOL  Aptos

Aptos  Ondo

Ondo  USDtb

USDtb  Pi Network

Pi Network  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Worldcoin

Worldcoin  KuCoin

KuCoin  Official Trump

Official Trump  Rocket Pool ETH

Rocket Pool ETH  Arbitrum

Arbitrum  Dash

Dash  Binance Staked SOL

Binance Staked SOL  Algorand

Algorand  Gate

Gate  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Pump.fun

Pump.fun  PAX Gold

PAX Gold  BFUSD

BFUSD  syrupUSDT

syrupUSDT  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  StakeWise Staked ETH

StakeWise Staked ETH  Wrapped BNB

Wrapped BNB  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Function FBTC

Function FBTC  Lombard Staked BTC

Lombard Staked BTC  syrupUSDC

syrupUSDC  Sky

Sky  Liquid Staked ETH

Liquid Staked ETH  Filecoin

Filecoin  Jupiter

Jupiter  Story

Story  NEXO

NEXO  Global Dollar

Global Dollar  Solv Protocol BTC

Solv Protocol BTC  Ripple USD

Ripple USD  Renzo Restaked ETH

Renzo Restaked ETH  Render

Render  Sei

Sei  Circle USYC

Circle USYC  Bonk

Bonk  Pudgy Penguins

Pudgy Penguins  Mantle Staked Ether

Mantle Staked Ether  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Virtuals Protocol

Virtuals Protocol  Immutable

Immutable  OUSG

OUSG  Aerodrome Finance

Aerodrome Finance  clBTC

clBTC  PancakeSwap

PancakeSwap  Jupiter Staked SOL

Jupiter Staked SOL  Ondo US Dollar Yield

Ondo US Dollar Yield  Optimism

Optimism  Celestia

Celestia  Lido DAO

Lido DAO  Tezos

Tezos  Decred

Decred  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Beldex

Beldex  Stacks

Stacks  Injective

Injective  tBTC

tBTC  DeAgentAI

DeAgentAI  Curve DAO

Curve DAO  SPX6900

SPX6900  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  USDai

USDai  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  The Graph

The Graph  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Marinade Staked SOL

Marinade Staked SOL  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  FLOKI

FLOKI  DoubleZero

DoubleZero  Usual USD

Usual USD  ZKsync

ZKsync  Kaia

Kaia  IOTA

IOTA  Cognify

Cognify  GTETH

GTETH  Stader ETHx

Stader ETHx  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  Pyth Network

Pyth Network  Trust Wallet

Trust Wallet  Plasma

Plasma  TrueUSD

TrueUSD  Ether.fi

Ether.fi  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Stables Labs USDX

Stables Labs USDX  Starknet

Starknet  Ethereum Name Service

Ethereum Name Service  Sonic

Sonic  Maple Finance

Maple Finance  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  AB

AB  Bitcoin SV

Bitcoin SV  Conflux

Conflux  ether.fi Staked ETH

ether.fi Staked ETH  sBTC

sBTC  Helium

Helium  Swell Ethereum

Swell Ethereum  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Pendle

Pendle  The Sandbox

The Sandbox  GHO

GHO  ARK

ARK  USDD

USDD  JasmyCoin

JasmyCoin  BitTorrent

BitTorrent  Sun Token

Sun Token  dogwifhat

dogwifhat  Theta Network

Theta Network  Binance-Peg Dogecoin

Binance-Peg Dogecoin  GALA

GALA  Decentraland

Decentraland  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  AINFT

AINFT  Flow

Flow  Wrapped HYPE

Wrapped HYPE  Concordium

Concordium  MYX Finance

MYX Finance  Arbitrum Bridged Wrapped eETH (Arbitrum)

Arbitrum Bridged Wrapped eETH (Arbitrum)