Ethereum’s Early August Surge Meets Reality Check as Bears Eye Dip Below $4,000

Ethereum’s rally in early August drove the largest altcoin to a cycle peak of $4,793 by August 14, marking one of its strongest performances of the year.

However, the sharp rise also triggered a wave of profit-taking, which has since put significant pressure on the asset and caused it to lose much of its recent gains. With selloffs intensifying in the derivatives market, ETH now faces the risk of a breakdown below the $4,000 price mark.

ETH Faces Heavy Sell Pressure

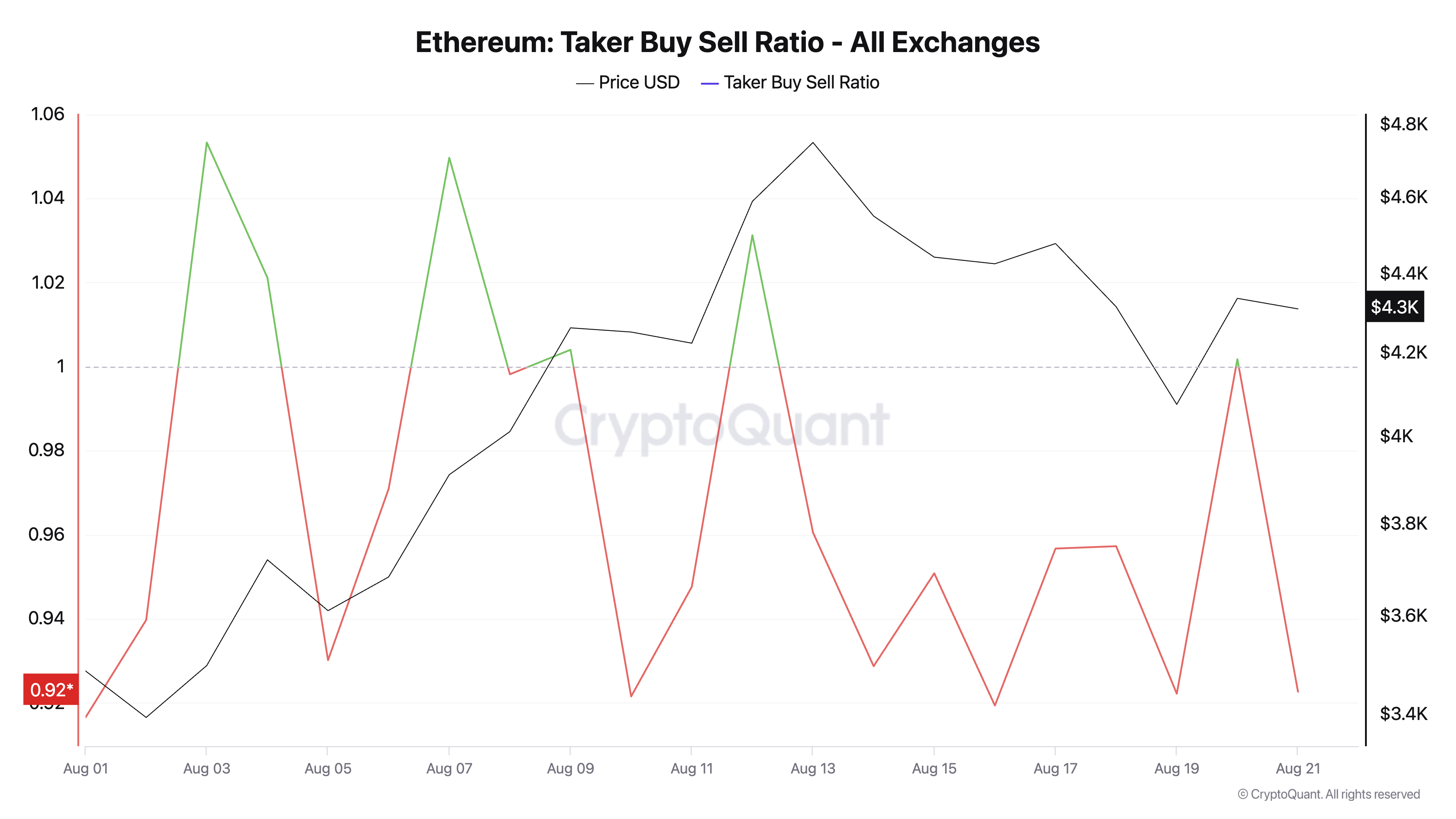

ETH’s price has been weighed down by the bearish tilt in sentiment among its derivatives traders. This is reflected by its taker-buy/sell ratio, which has mostly remained under one since the beginning of August.

At press time, this stands at 0.92 per CryptoQuant, indicating that sell orders dominate buy orders across the ETH futures market.

ETH Taker Buy Sell Ratio. Source: CryptoQuant

The taker buy-sell ratio measures the balance between buy and sell orders in an asset’s futures market. A ratio above one indicates stronger buying pressure, showing traders are actively chasing price gains. On the other hand, a value below one reflects dominant selling pressure, often linked to profit-taking or bearish sentiment.

Since August began, ETH’s taker buy/sell ratio has stayed mostly below one, confirming persistent sell-offs among futures traders.

For context, the coin’s performance had been largely muted for much of the year, so when an uptrend finally began in July and extended into early August, many traders seized the opportunity to lock in profits.

This mounting sell-side pressure confirms the weakening bullish sentiment and could worsen ETH’s price fall if it continues.

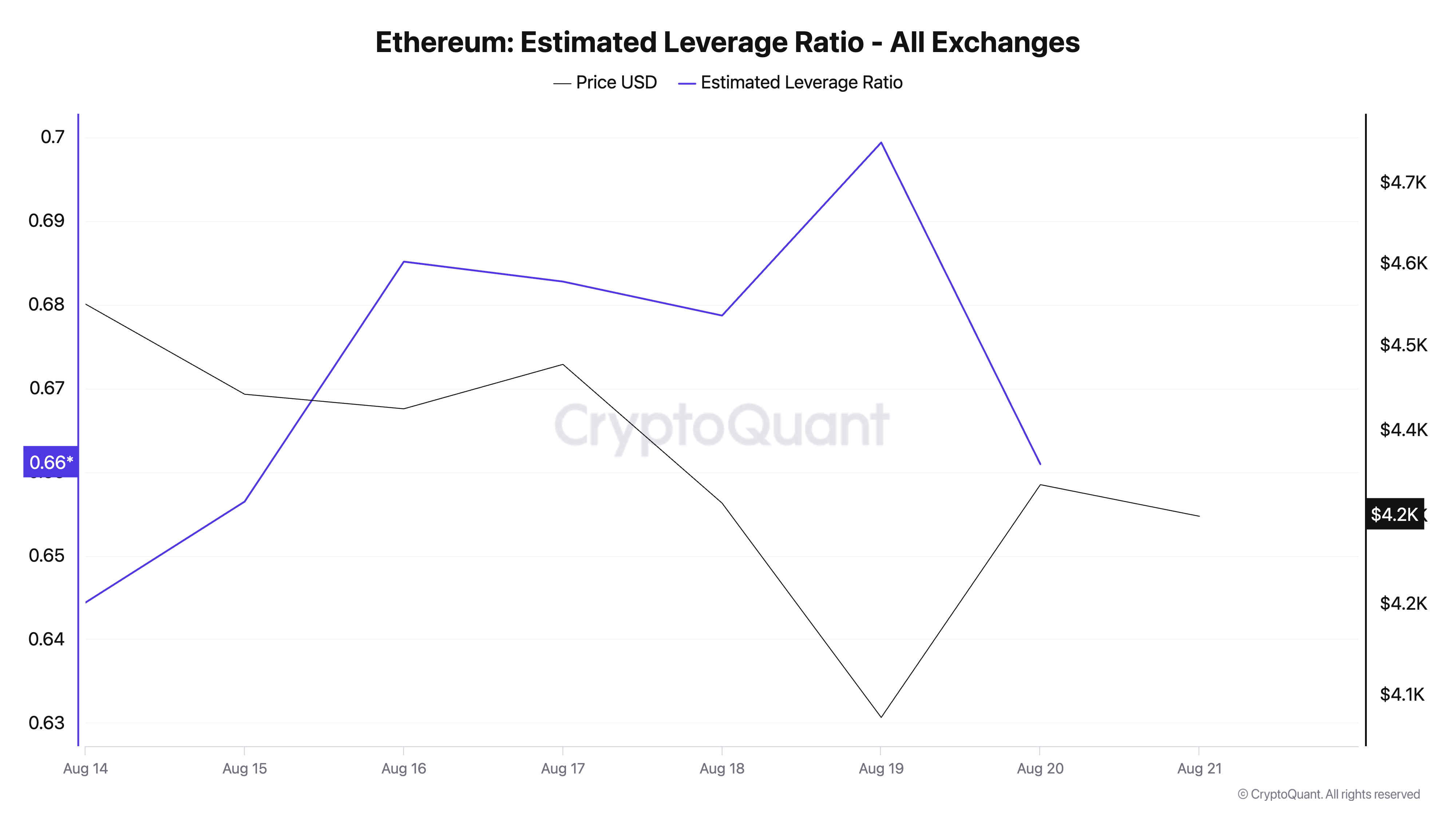

Traders Ditch High-Risk Bets Amid Price Pressure

The recent decline in ETH’s Estimated Leverage Ratio (ELR) also confirms the low confidence among coin holders. According to CryptoQuant, ETH’s ELR currently sits at 0.66 — its lowest value in the past five days.

ETH Estimated Leverage. Source: CryptoQuant

An asset’s ELR measures the average leverage its traders use to execute trades on a cryptocurrency exchange. It is calculated by dividing the asset’s open interest by the exchange’s reserve for that currency.

When an asset’s ELR falls, it indicates a reduced risk appetite among traders. This trend signals that ETH investors have grown increasingly cautious this week and are now avoiding high-leverage positions that could worsen potential losses.

Which Comes First: $3,491 or $4,793?

As of this writing, ETH trades at $4,295. If sell-side pressure strengthens, the altcoin could retest the support floor at $4,063. Should this key price mark give way, ETH could plunge to $3,491.

ETH Price Analysis. Source: TradingView

Conversely, ETH could see a rebound and rally to $4,793 if new demand enters the market.

The post Ethereum’s Early August Surge Meets Reality Check as Bears Eye Dip Below $4,000 appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Stellar

Stellar  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Hedera

Hedera  Avalanche

Avalanche  Litecoin

Litecoin  Monero

Monero  Zcash

Zcash  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Dai

Dai  Cronos

Cronos  USDT0

USDT0  Polkadot

Polkadot  MemeCore

MemeCore  Mantle

Mantle  sUSDS

sUSDS  Bittensor

Bittensor  World Liberty Financial

World Liberty Financial  Uniswap

Uniswap  Aave

Aave  USD1

USD1  Internet Computer

Internet Computer  Bitget Token

Bitget Token  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  OKB

OKB  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Falcon USD

Falcon USD  Binance-Peg WETH

Binance-Peg WETH  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Tether Gold

Tether Gold  Solana

Solana  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  USDtb

USDtb  Aster

Aster  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Worldcoin

Worldcoin  Dash

Dash  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Algorand

Algorand  Gate

Gate  syrupUSDT

syrupUSDT  Pump.fun

Pump.fun  Kinetiq Staked HYPE

Kinetiq Staked HYPE  BFUSD

BFUSD  PAX Gold

PAX Gold  StakeWise Staked ETH

StakeWise Staked ETH  syrupUSDC

syrupUSDC  Liquid Staked ETH

Liquid Staked ETH  Lombard Staked BTC

Lombard Staked BTC  VeChain

VeChain  Wrapped BNB

Wrapped BNB  Function FBTC

Function FBTC  Cosmos Hub

Cosmos Hub  Sky

Sky  Story

Story  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH  NEXO

NEXO  Solv Protocol BTC

Solv Protocol BTC  Ripple USD

Ripple USD  Global Dollar

Global Dollar  Filecoin

Filecoin  Render

Render  Sei

Sei  Virtuals Protocol

Virtuals Protocol  Pudgy Penguins

Pudgy Penguins  Bonk

Bonk  Mantle Staked Ether

Mantle Staked Ether  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Immutable

Immutable  Circle USYC

Circle USYC  clBTC

clBTC  OUSG

OUSG  Jupiter Staked SOL

Jupiter Staked SOL  PancakeSwap

PancakeSwap  Aerodrome Finance

Aerodrome Finance  Ondo US Dollar Yield

Ondo US Dollar Yield  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Stables Labs USDX

Stables Labs USDX  Decred

Decred  Optimism

Optimism  Celestia

Celestia  Lido DAO

Lido DAO  Stacks

Stacks  Injective

Injective  Marinade Staked SOL

Marinade Staked SOL  tBTC

tBTC  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Beldex

Beldex  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Curve DAO

Curve DAO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  The Graph

The Graph  USDai

USDai  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  SPX6900

SPX6900  FLOKI

FLOKI  Tezos

Tezos  Usual USD

Usual USD  DoubleZero

DoubleZero  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Stader ETHx

Stader ETHx  GTETH

GTETH  Pyth Network

Pyth Network  IOTA

IOTA  Kaia

Kaia  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  TrueUSD

TrueUSD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Trust Wallet

Trust Wallet  Cognify

Cognify  Ether.fi

Ether.fi  Starknet

Starknet  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Plasma

Plasma  AB

AB  Swell Ethereum

Swell Ethereum  Conflux

Conflux  sBTC

sBTC  Pendle

Pendle  Humanity

Humanity  Sonic

Sonic  BitTorrent

BitTorrent  The Sandbox

The Sandbox  Bitcoin SV

Bitcoin SV  GHO

GHO  ether.fi Staked ETH

ether.fi Staked ETH  Helium

Helium  USDD

USDD  Ethereum Name Service

Ethereum Name Service  ARK

ARK  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Sun Token

Sun Token  Maple Finance

Maple Finance  JasmyCoin

JasmyCoin  Theta Network

Theta Network  GALA

GALA  Satoshi Stablecoin

Satoshi Stablecoin  dogwifhat

dogwifhat  Wrapped HYPE

Wrapped HYPE  AINFT

AINFT  Arbitrum Bridged Wrapped eETH (Arbitrum)

Arbitrum Bridged Wrapped eETH (Arbitrum)  Flow

Flow  Decentraland

Decentraland  ZKsync

ZKsync  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)