Ethereum (ETH) Price Prediction For September 19

Ethereum price today is trading near $4,605, consolidating just below the $4,638–$4,665 resistance zone. Buyers have defended the $4,520–$4,547 area, where short-term EMAs are stacked, keeping price action constructive. The key question is whether ETH can extend higher toward $4,700, or if sellers cap the move and force another retest of the $4,476–$4,370 support band.

Ethereum Price Holds Rising Trendline

ETH Key Technical Levels (Source: TradingView)

The 4-hour chart shows ETH respecting its ascending trendline, with higher lows building since early September. The Supertrend indicator has flipped bullish, now resting around $4,639, aligning with immediate resistance. A breakout above this level would expose $4,700 and potentially $4,820, while failure to clear it risks a pullback toward the $4,476 and $4,370 zones.

Momentum remains balanced. The RSI sits near mid-50s, avoiding overbought extremes while maintaining upward bias. The 100-EMA and 200-EMA provide deeper trendline cushions near $4,493 and $4,370, reinforcing ETH’s broader bullish structure as long as these levels hold.

Exchange Flows Highlight Accumulation

ETH On-Chain Accumulation (Source: Coinglass)

On-chain data supports the bullish undertone. Spot netflows show consistent outflows, with $77.6 million withdrawn from exchanges on September 18. This trend reduces available supply and often signals investor preference for holding ETH off-exchange, a pattern that has historically preceded bullish price extensions.

Despite occasional spikes of inflows, the dominant flow structure since August has been negative, providing a steady supply-side constraint. Analysts argue that sustained outflows of this magnitude can create the foundation for a push beyond resistance levels.

Stablecoin Growth Strengthens Ethereum’s Role

Stablecoins on Ethereum L1 + L2s have now crossed $171B in circulation ATH

– Ethereum mainnet alone holds $152.8B (+78% YoY). It remains the undisputed hub of stablecoin liquidity.

– L2s combined account for $18B+, with Arbitrum ($8.8B) and Base ($3.9B) leading the charge.

-… pic.twitter.com/5KrzQa5A3F— Francesco Andreoli ᵍᵐ (@francescoswiss) September 17, 2025

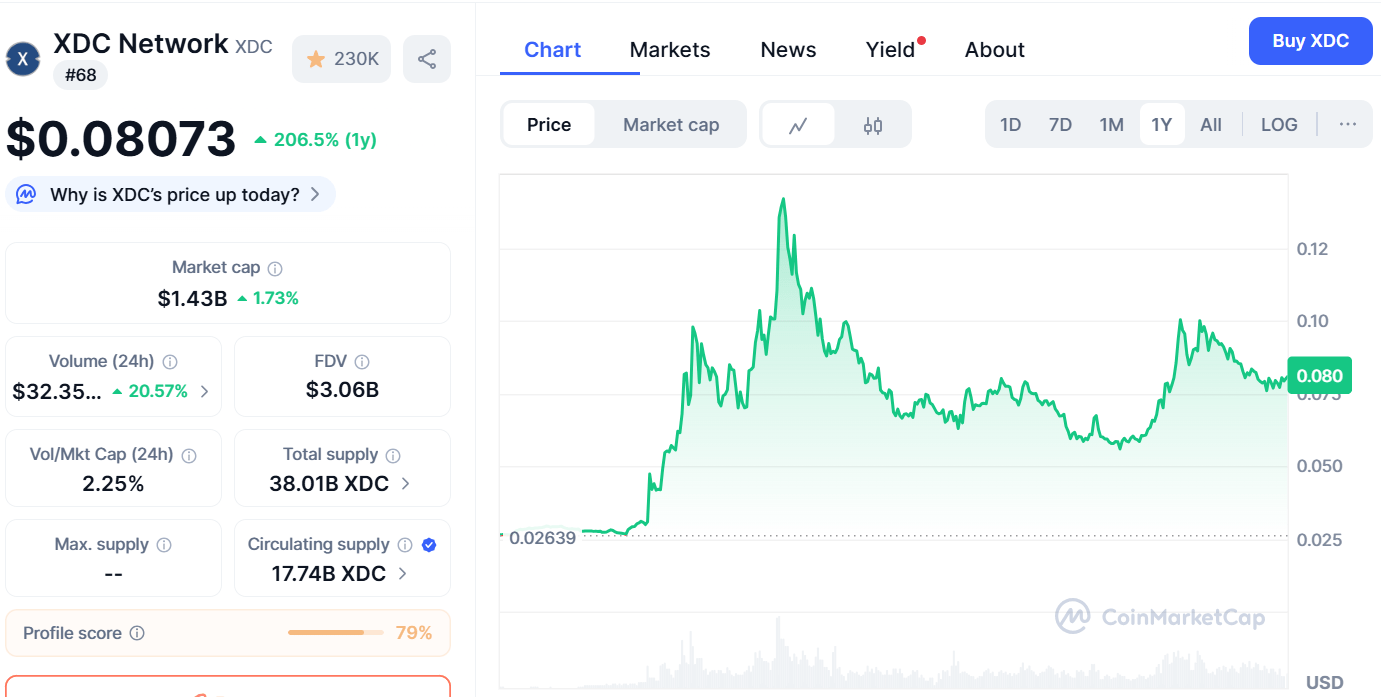

Fundamentals add further weight to Ethereum’s bullish case. Data shows stablecoins on Ethereum mainnet and Layer 2s have surpassed $171 billion in circulation, with the mainnet alone holding $152.8 billion. This represents a 78% year-on-year increase, underscoring Ethereum’s status as the dominant hub for stablecoin liquidity.

Growth is accelerating across scaling networks. Arbitrum accounts for $8.8 billion, while Base holds $3.9 billion. Emerging L2s like Mantle and Linea have also posted triple-digit growth. The scale of liquidity concentrated on Ethereum not only strengthens its ecosystem but also bolsters confidence in ETH as collateral and settlement asset across DeFi markets.

Technical Outlook For Ethereum Price

Key levels for Ethereum in the short term:

- Upside targets: $4,638, $4,700, and $4,820 if bullish momentum continues.

- Downside supports: $4,547, $4,476, and $4,370 as near-term defense zones.

- Trend support: $4,200 as the broader structural floor if selling pressure accelerates.

Outlook: Will Ethereum Go Up?

Ethereum’s immediate direction rests on whether buyers can pierce the $4,638–$4,665 ceiling. On-chain outflows, combined with record stablecoin liquidity anchored to Ethereum, suggest a strong fundamental backdrop.

Analysts remain cautiously optimistic as long as ETH holds above $4,500. While a drop below $4,476 would delay the bullish thesis and allow for deeper consolidation near $4,370, a breakout above $4,665 could accelerate the rally toward $4,820 and potentially $5,000. For now, Ethereum price continues to lean bullish within its broader ascending cycle.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Stellar

Stellar  LEO Token

LEO Token  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Litecoin

Litecoin  Zcash

Zcash  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Dai

Dai  Cronos

Cronos  USDT0

USDT0  Polkadot

Polkadot  Mantle

Mantle  Bittensor

Bittensor  MemeCore

MemeCore  sUSDS

sUSDS  Uniswap

Uniswap  USD1

USD1  Aave

Aave  World Liberty Financial

World Liberty Financial  Internet Computer

Internet Computer  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  Bitget Token

Bitget Token  OKB

OKB  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic  Binance-Peg WETH

Binance-Peg WETH  Falcon USD

Falcon USD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Solana

Solana  Tether Gold

Tether Gold  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  Aster

Aster  USDtb

USDtb  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Worldcoin

Worldcoin  Dash

Dash  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Official Trump

Official Trump  Gate

Gate  Algorand

Algorand  Pump.fun

Pump.fun  syrupUSDT

syrupUSDT  PAX Gold

PAX Gold  StakeWise Staked ETH

StakeWise Staked ETH  BFUSD

BFUSD  Kinetiq Staked HYPE

Kinetiq Staked HYPE  syrupUSDC

syrupUSDC  Lombard Staked BTC

Lombard Staked BTC  Liquid Staked ETH

Liquid Staked ETH  Function FBTC

Function FBTC  Wrapped BNB

Wrapped BNB  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Story

Story  Sky

Sky  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH  NEXO

NEXO  Solv Protocol BTC

Solv Protocol BTC  Filecoin

Filecoin  Ripple USD

Ripple USD  Global Dollar

Global Dollar  Render

Render  Sei

Sei  Pudgy Penguins

Pudgy Penguins  Bonk

Bonk  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Immutable

Immutable  Circle USYC

Circle USYC  clBTC

clBTC  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  OUSG

OUSG  Jupiter Staked SOL

Jupiter Staked SOL  PancakeSwap

PancakeSwap  Aerodrome Finance

Aerodrome Finance  Ondo US Dollar Yield

Ondo US Dollar Yield  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Stables Labs USDX

Stables Labs USDX  Optimism

Optimism  Celestia

Celestia  Decred

Decred  Lido DAO

Lido DAO  Stacks

Stacks  Marinade Staked SOL

Marinade Staked SOL  Injective

Injective  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  tBTC

tBTC  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Beldex

Beldex  The Graph

The Graph  Curve DAO

Curve DAO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  USDai

USDai  FLOKI

FLOKI  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  SPX6900

SPX6900  Tezos

Tezos  Usual USD

Usual USD  Stader ETHx

Stader ETHx  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  GTETH

GTETH  Pyth Network

Pyth Network  DoubleZero

DoubleZero  Kaia

Kaia  IOTA

IOTA  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  TrueUSD

TrueUSD  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Plasma

Plasma  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Cognify

Cognify  Trust Wallet

Trust Wallet  Starknet

Starknet  Ether.fi

Ether.fi  Swell Ethereum

Swell Ethereum  AB

AB  sBTC

sBTC  Conflux

Conflux  Sonic

Sonic  Pendle

Pendle  The Sandbox

The Sandbox  Bitcoin SV

Bitcoin SV  BitTorrent

BitTorrent  ether.fi Staked ETH

ether.fi Staked ETH  Humanity

Humanity  Ethereum Name Service

Ethereum Name Service  Maple Finance

Maple Finance  GHO

GHO  ARK

ARK  Binance-Peg Dogecoin

Binance-Peg Dogecoin  USDD

USDD  Helium

Helium  Theta Network

Theta Network  dogwifhat

dogwifhat  Sun Token

Sun Token  GALA

GALA  JasmyCoin

JasmyCoin  Satoshi Stablecoin

Satoshi Stablecoin  Arbitrum Bridged Wrapped eETH (Arbitrum)

Arbitrum Bridged Wrapped eETH (Arbitrum)  Wrapped HYPE

Wrapped HYPE  AINFT

AINFT  Decentraland

Decentraland  ZKsync

ZKsync  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Flow

Flow  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund