SOL: Nasdaq-Listed Firm Secures $200M in Financing, with Over $150M Tied to Solana Treasury Strategy

At the time of writing, solana

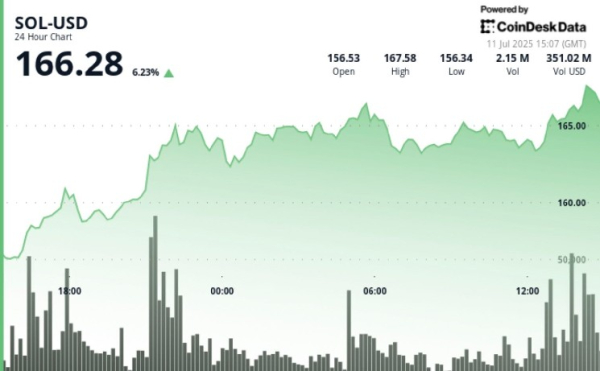

SOL$162.80 is trading at around $166.28, up 6.23% in the past 24-hour period, according to CoinDesk Research’s technical analysis model.

Upexi (UPXI), a Tampa-based consumer brands company listed on Nasdaq, announced Friday it has secured approximately $200 million in new financing through a combination of equity and convertible note offerings. A portion of the proceeds will support Upexi’s existing operations, while the rest will be used to grow its cryptocurrency treasury, with a specific focus on Solana

SOL$162.80.

As part of the equity component, Upexi raised $50 million from accredited and institutional investors, including its CEO Allan Marshall. Shares were sold at $4.00 each, with management purchasing at a premium of $4.94. The company said the equity deal is expected to close around July 14.

Separately, Upexi entered into agreements to issue $150 million in convertible notes to institutional investors. The notes are backed by SOL as collateral and carry a 2% annual interest rate. They are convertible into Upexi stock at a fixed price of $4.25 per share and mature in 24 months. The notes are expected to close around July 16, at which point the associated SOL will be added to the company’s holdings.

In a June 26 press release, Upexi disclosed that it held 735,692 SOL as of June 24, an 8% increase from the 679,677 SOL reported on May 28. Upon closing of the new financing, Upexi expects to more than double its current SOL position.

The offerings were conducted privately and are not registered with the SEC.

Technical Analysis

- SOL demonstrated exceptional resilience throughout the preceding 24-hour period from 10 July 15:00 to 11 July 14:00, progressing from $156.45 to $166.65, constituting a substantial 6.52% appreciation with an aggregate trading range of $10.99 extending from $155.78 to $166.76.

- The price dynamics unveiled distinctive accumulation sequences with considerable volume-backed support materialising at $160.31 during the 21:00 hour advancement, where extraordinary volume of 3.23 million substantially surpassed the 24-hour mean of 1.34 million, corroborating institutional capital deployment.

- Pivotal resistance emerged proximate to $165.30, subjected to multiple examinations between 22:00 and 03:00, whilst the conclusive breakthrough above $166.00 transpired with amplified volume of 2.26 million, intimating persistent bullish conviction.

- The technical architecture suggests SOL has consolidated a superior trading corridor with robust volume validation, establishing foundations for prospective advancement towards the $170.00 psychological threshold.

- Throughout the concluding 60-minute interval from 11 July 13:05 to 14:04, SOL encountered considerable volatility whilst preserving its overarching bullish disposition, oscillating within a $2.90 bandwidth from $164.24 to $166.76 and settling at $165.87, representing a marginal 0.44% contraction from the hour’s commencement at $165.92.

- The period manifested quintessential consolidation attributes encompassing two discrete phases: an initial retreat to $164.28 circa 13:33 accompanied by intensified distribution pressure of 45,017 volume, succeeded by a vigorous recovery commencing at 13:48 where volume escalated to 81,740 during the ascent towards $166.76, validating renewed accumulation interest.

- Fundamental support crystallised near $164.30 with multiple successful examinations, whilst resistance materialised around $166.50-$166.75, establishing a well-delineated trading corridor that suggests constructive price discovery following the antecedent 24-hour advance, positioning SOL for potential continuation of its broader upward trajectory upon completion of this consolidation phase.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Stellar

Stellar  LEO Token

LEO Token  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Zcash

Zcash  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Dai

Dai  USDT0

USDT0  Cronos

Cronos  Polkadot

Polkadot  Mantle

Mantle  Bittensor

Bittensor  MemeCore

MemeCore  sUSDS

sUSDS  Uniswap

Uniswap  Aave

Aave  World Liberty Financial

World Liberty Financial  USD1

USD1  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  Bitget Token

Bitget Token  OKB

OKB  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Binance-Peg WETH

Binance-Peg WETH  Falcon USD

Falcon USD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Tether Gold

Tether Gold  Wrapped SOL

Wrapped SOL  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  Aster

Aster  USDtb

USDtb  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Worldcoin

Worldcoin  Dash

Dash  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Official Trump

Official Trump  Gate

Gate  Algorand

Algorand  Pump.fun

Pump.fun  syrupUSDT

syrupUSDT  PAX Gold

PAX Gold  StakeWise Staked ETH

StakeWise Staked ETH  BFUSD

BFUSD  Kinetiq Staked HYPE

Kinetiq Staked HYPE  syrupUSDC

syrupUSDC  Lombard Staked BTC

Lombard Staked BTC  Function FBTC

Function FBTC  Liquid Staked ETH

Liquid Staked ETH  Wrapped BNB

Wrapped BNB  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Story

Story  Sky

Sky  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH