MEV driving institutions away from DeFi, costing users dearly: Crypto exec

Maximal extractable value (MEV), the process of miners or validators reordering transactions in a block to extract profits, is preventing financial institutions from adopting decentralized finance (DeFi), which hurts retail users, according to Aditya Palepu, CEO of DEX Labs, the lead contributor to decentralized crypto derivatives exchange DerivaDEX.

All electronically-traded markets suffer from maximal extractable value or similar issues inherent in the information asymmetry in ordering trading transaction data, Palepu told Cointelegraph.

The solution is to prevent order flow data from being visible before execution through processing transactions in trusted execution environments, which handle transactions privately through a funded vault or some other mechanism, Palepu said. He added:

“What makes them really powerful is that they can process orders privately. So your trading intentions aren’t broadcast to the world before execution. They’re encrypted client-side, and they’re only decrypted inside the secure enclave after they’re sequenced.”

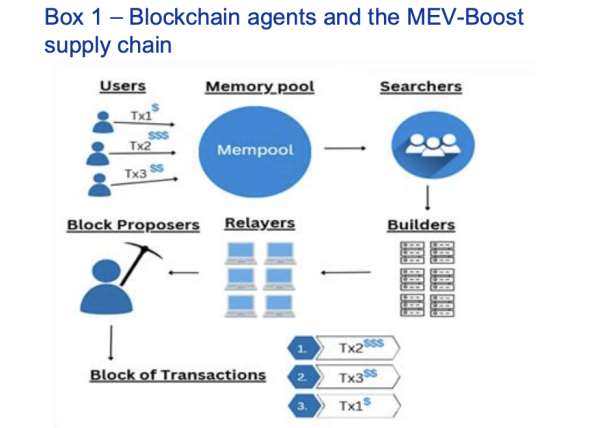

A simplified graphic illustrating the MEV supply chain. Source: European Securities and Markets Authority (ESMA)

This makes front-running transactions “impossible,” he said, protecting users from things like “sandwich attacks,” a form of market manipulation where validators or miners place transactions before and after a user’s order to manipulate price and extract profits.

The presence of MEV as core infrastructure in crypto and DeFi has sparked intense debate among industry executives and protocol founders, as they attempt to address MEV’s potential to increase centralization, drive up costs, and stifle mass adoption.

Related: How Batched Threshold Encryption could end extractive MEV and make DeFi fair again

Institutions staying out of the DeFi game hurts retail users

The lack of transaction privacy prevents financial institutions from adopting DeFi because it exposes them to market manipulation and front-running risks from broadcasting transactions before they are executed, Palepu told Cointelegraph.

“When institutions can’t participate effectively, everyone suffers, including retail,” Palepu told Cointelegraph, adding that institutions create the “highways and roads” or the necessary trading infrastructure for financial markets to function smoothly.

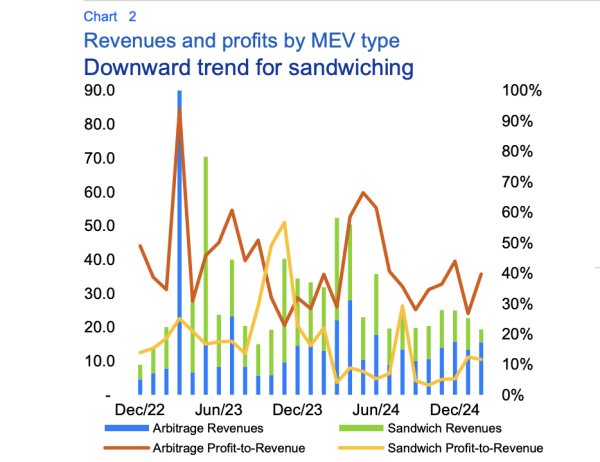

Revenues and profits of different MEV methods. Source: European Securities and Markets Authority (ESMA)

These include non-extractive arbitrage trading opportunities that dampen price volatility and keep asset prices at or near parity across exchanges, he added.

“Exchanges, like any marketplace, need vibrancy and diversity of participation,” Palepu said, adding that the lack of institutional involvement can cause liquidity to dry up, volatility to spike, market manipulation to increase, and transaction costs to surge.

Magazine How crypto bots are ruining crypto — including auto memecoin rug pulls

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Stellar

Stellar  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Hedera

Hedera  Avalanche

Avalanche  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  USDT0

USDT0  Dai

Dai  Cronos

Cronos  Bittensor

Bittensor  Polkadot

Polkadot  MemeCore

MemeCore  Mantle

Mantle  sUSDS

sUSDS  Uniswap

Uniswap  Aave

Aave  USD1

USD1  World Liberty Financial

World Liberty Financial  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  Bitget Token

Bitget Token  Internet Computer

Internet Computer  OKB

OKB  NEAR Protocol

NEAR Protocol  Ethena

Ethena  Pepe

Pepe  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Binance-Peg WETH

Binance-Peg WETH  Falcon USD

Falcon USD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Tether Gold

Tether Gold  Wrapped SOL

Wrapped SOL  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  USDtb

USDtb  POL (ex-MATIC)

POL (ex-MATIC)  Aster

Aster  HTX DAO

HTX DAO  Worldcoin

Worldcoin  Dash

Dash  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  syrupUSDT

syrupUSDT  Gate

Gate  Algorand

Algorand  PAX Gold

PAX Gold  Pump.fun

Pump.fun  BFUSD

BFUSD  syrupUSDC

syrupUSDC  StakeWise Staked ETH

StakeWise Staked ETH  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Liquid Staked ETH

Liquid Staked ETH  Lombard Staked BTC

Lombard Staked BTC  VeChain

VeChain  Wrapped BNB

Wrapped BNB  Story

Story  Cosmos Hub

Cosmos Hub  Sky

Sky  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH  NEXO

NEXO  Solv Protocol BTC

Solv Protocol BTC  Filecoin

Filecoin  Ripple USD

Ripple USD  Global Dollar

Global Dollar  Render

Render  Sei

Sei  Pudgy Penguins

Pudgy Penguins  Bonk

Bonk  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  Immutable

Immutable  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Decred

Decred  Circle USYC

Circle USYC  clBTC

clBTC  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  OUSG

OUSG  Jupiter Staked SOL

Jupiter Staked SOL  Aerodrome Finance

Aerodrome Finance  PancakeSwap

PancakeSwap  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Stables Labs USDX

Stables Labs USDX  Ondo US Dollar Yield

Ondo US Dollar Yield  Optimism

Optimism  Celestia

Celestia  Stacks

Stacks  Lido DAO

Lido DAO  Marinade Staked SOL

Marinade Staked SOL  Injective

Injective  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  tBTC

tBTC  SPX6900

SPX6900  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Beldex

Beldex  Curve DAO

Curve DAO  The Graph

The Graph  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  USDai

USDai  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  FLOKI

FLOKI  Tezos

Tezos  Usual USD

Usual USD  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Stader ETHx

Stader ETHx  GTETH

GTETH  Kaia

Kaia  DoubleZero

DoubleZero  Pyth Network

Pyth Network  IOTA

IOTA  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  TrueUSD

TrueUSD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Starknet

Starknet  Cognify

Cognify  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Plasma

Plasma  AB

AB  Ether.fi

Ether.fi  Trust Wallet

Trust Wallet  Swell Ethereum

Swell Ethereum  sBTC

sBTC  Conflux

Conflux  Pendle

Pendle  Sonic

Sonic  BitTorrent

BitTorrent  The Sandbox

The Sandbox  Humanity

Humanity  ether.fi Staked ETH

ether.fi Staked ETH  Ethereum Name Service

Ethereum Name Service  Maple Finance

Maple Finance  Bitcoin SV

Bitcoin SV  GHO

GHO  USDD

USDD  Binance-Peg Dogecoin

Binance-Peg Dogecoin  dogwifhat

dogwifhat  Theta Network

Theta Network  JasmyCoin

JasmyCoin  ARK

ARK  Wrapped HYPE

Wrapped HYPE  Sun Token

Sun Token  GALA

GALA  Satoshi Stablecoin

Satoshi Stablecoin  AINFT

AINFT  ZKsync

ZKsync  Arbitrum Bridged Wrapped eETH (Arbitrum)

Arbitrum Bridged Wrapped eETH (Arbitrum)  Helium

Helium  Decentraland

Decentraland  Flow

Flow  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Mantle Restaked ETH

Mantle Restaked ETH