DeFi Development Corp. boosts its Solana holdings by 29% with a $77 million purchase

DeFi Development Corp. has doubled down on its bet on Solana, scooping up 407,247 SOL, worth about $77 million at current prices. The latest acquisition takes the company’s total holdings to more than 1.83 million SOL, roughly $371 million, and strengthens its claim as one of the largest institutional Solana treasuries in the market.

The buy was fueled by fresh capital from a recent equity raise, and DeFi Development still has over $40 million from the same raise set aside for future purchases.

DeFi Development’s treasury rose by 29% as a result of this purchase, which has put it in touching distance of the top spot among corporate SOL holders.

DeFi Development opens purse for Solana buys

Before this acquisition, DeFi Development held 1.42 million SOL. The new haul brings its exposure up by nearly a third, pushing its Solana-per-share (SPS) ratio to 0.0864, which equates to $17.52 worth of SOL per share outstanding.

The company currently has around 21 million shares in circulation, though it acknowledged that once warrants from its equity raise are factored in, the figure could rise to roughly 31 million.

Even so, the company mentioned that the SPS ratio should remain comfortably above the previously flagged 0.0675 threshold, meaning shareholders can expect their proportional Solana exposure to hold steady despite future dilution.

The Solana treasury race heats up

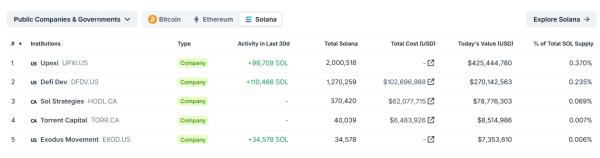

DeFi Development’s aggressive move comes as the corporate race to build Solana treasuries gains momentum. Publicly listed firms now hold more than $800 million worth of SOL combined, with names such as Upexi, SOL Strategies, and Torrent Capital, among others, leading the way. Sharps Technology has also signaled plans to join the fray, outlining a $400 million Solana treasury initiative.

Solana treasury rankings as of August 28, with DeFi Development’s yet to be updated. Source: Coingecko

Meanwhile, heavyweight funds like Pantera Capital and Galaxy Digital are circling billion-dollar commitments into Solana infrastructure and ecosystem projects. Together, these moves are contributing massively to cementing Solana’s reputation as the next major battleground for institutional crypto capital, following a wave of corporate adoption that first centered around Bitcoin and later extended to Ethereum.

DeFi Development hitches wagon to Solana

For DeFi Development shareholders, the strategy delivers something simple and direct, and that’s exposure to SOL’s upside. In addition to price appreciation, the company earns staking rewards and validator income by running its own Solana infrastructure, recycling those yields back into the treasury to compound growth.

That said, the approach isn’t without risk. By tying much of its balance sheet to a single digital asset, DeFi Development’s fortunes will rise and fall with Solana’s price swings. The company’s valuation could become just as volatile as the token it holds.

Still, some analysts argue that the timing is in DeFi Development’s favor. Solana has been one of the fastest-growing ecosystems in crypto, with expanding activity in DeFi, NFTs, payments, and enterprise adoption.

Demand for blockspace and validator services continues to climb, giving treasury-heavy firms like DeFi Development a chance to earn both capital gains and recurring income streams if the network sustains its momentum.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Stellar

Stellar  LEO Token

LEO Token  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Zcash

Zcash  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Dai

Dai  USDT0

USDT0  Cronos

Cronos  Polkadot

Polkadot  Mantle

Mantle  Bittensor

Bittensor  MemeCore

MemeCore  sUSDS

sUSDS  Uniswap

Uniswap  Aave

Aave  World Liberty Financial

World Liberty Financial  USD1

USD1  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  Bitget Token

Bitget Token  OKB

OKB  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Binance-Peg WETH

Binance-Peg WETH  Falcon USD

Falcon USD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Tether Gold

Tether Gold  Wrapped SOL

Wrapped SOL  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  Aster

Aster  USDtb

USDtb  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Worldcoin

Worldcoin  Dash

Dash  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Official Trump

Official Trump  Gate

Gate  Algorand

Algorand  Pump.fun

Pump.fun  syrupUSDT

syrupUSDT  PAX Gold

PAX Gold  StakeWise Staked ETH

StakeWise Staked ETH  BFUSD

BFUSD  Kinetiq Staked HYPE

Kinetiq Staked HYPE  syrupUSDC

syrupUSDC  Lombard Staked BTC

Lombard Staked BTC  Function FBTC

Function FBTC  Liquid Staked ETH

Liquid Staked ETH  Wrapped BNB

Wrapped BNB  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Story

Story  Sky

Sky  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH