Aave Outperforms DeFi Sector with 52% TVL Surge in Q2

Top lending protocol Aave has outpaced broader decentralized finance (DeFi) growth over the past three months, gaining market share as capital continues to flow into major protocols.

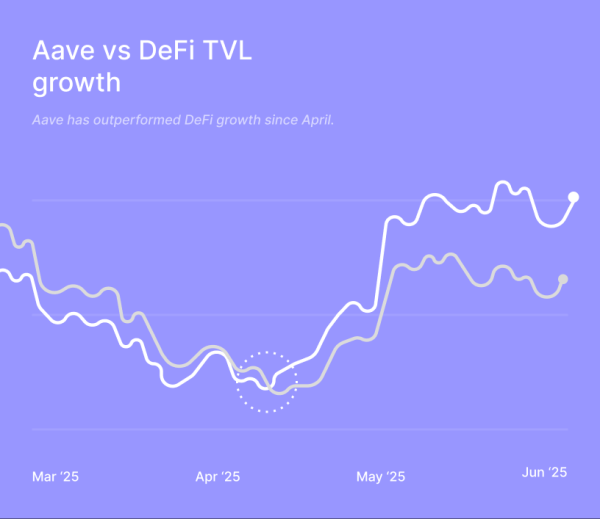

The decentralized lending protocol’s total value locked (TVL) rose to over $25.4 billion by the end of Q2, up over 52% from $16.7 billion in April, according to data from DeFiLlama. In comparison, total DeFi TVL grew 26%, from $92 billion to $116 billion, in the same period.

Aave’s share of the DeFi lending market also has grown to 48%, leading the sector, which has surpassed $58 billion in TVL. Moreover, with $28 billion in TVL, Aave accounts for nearly 23% of TVL across all of DeFi, the largest of any protocol.

Aave vs DeFi TVL: Source: Avara’s head of marketing on X

Meanwhile, a recent report from DWF Labs found that Aave’s share of total deposits and borrows has grown from about 40% to around 60% ($16.5 billion) in 2025.

Earlier this week, Aave also reported in a post on X that its total cumulative borrows hit $775 billion. In response, Stani Kulechov, the founder and CEO of Aave, said the “next stop is $1 trillion.”

“As one of the more established names in the lending space, Aave has solidified its position as the market leader,” the DWF Labs report reads. “Compared to the DeFi Summers of 2021 and 2022, Aave has actually increased its market share and dominance, despite a significant rise in competition.”

These milestones highlight Aave’s rapid growth and reflect a broader shift in DeFi, where users are increasingly moving to Layer 2 (L2) networks for lower fees and faster transactions.

Mike Cahill, CEO of Douro Labs, a leading contributor to the Pyth Network, told The Defiant that Aave’s steady growth points to a broader trend across web3: rising investor demand for more established and reliable DeFi protocols.

“In a market still recovering from the risk-off sentiment of 2022–23, protocols like Aave are benefiting from a ‘flight to quality’ dynamic where users prioritize liquidity depth, cross-chain coverage, and institutional integrations,” Cahill explained, adding:

“The launch of GHO has also helped to reignite interest, offering a native stablecoin utility layer on top of Aave’s lending engine.”

Launched in 2023, GHO is Aave’s native stablecoin that’s pegged 1:1 to the U.S. dollar. It currently boasts a market capitalization of nearly $312 million, per CoinGecko.

Evolving Tech

The DWF Labs report further points to Aave’s evolving tech as a key reason for its continued growth. Its upcoming V4 upgrade, for example, will use a new “Hub and Spoke” design to bring together liquidity and make it easier for developers to build.

The upgrade is expected to significantly boost capital efficiency and modularity. It also builds on Aave’s Horizon initiative, which aims to bring institutional-grade real-world assets (RWAs) on-chain and make them usable as collateral in DeFi lending markets.

A few months ago, Aave revealed on X that apart from new initiatives such as Aave V4 and Horizon by Aave Labs, there’s “much more to come.”

The price of Aave’s native governance token, AAVE, is also performing well, alongside the protocol’s growth, up over 240% over the past year.

In a recent DeFi Daily newsletter, The Defiant noted that though Aave is clearly dominating in DeFi, challenger protocols like Spark, Morpho, Venus, Sonne Finance, Maple and Seamless are starting to carve out market share.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Stellar

Stellar  LEO Token

LEO Token  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Zcash

Zcash  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Dai

Dai  USDT0

USDT0  Cronos

Cronos  Polkadot

Polkadot  Mantle

Mantle  Bittensor

Bittensor  MemeCore

MemeCore  sUSDS

sUSDS  Uniswap

Uniswap  Aave

Aave  World Liberty Financial

World Liberty Financial  USD1

USD1  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  Bitget Token

Bitget Token  OKB

OKB  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Binance-Peg WETH

Binance-Peg WETH  Falcon USD

Falcon USD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Tether Gold

Tether Gold  Wrapped SOL

Wrapped SOL  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  Aster

Aster  USDtb

USDtb  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Worldcoin

Worldcoin  Dash

Dash  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Official Trump

Official Trump  Gate

Gate  Algorand

Algorand  Pump.fun

Pump.fun  syrupUSDT

syrupUSDT  PAX Gold

PAX Gold  StakeWise Staked ETH

StakeWise Staked ETH  BFUSD

BFUSD  Kinetiq Staked HYPE

Kinetiq Staked HYPE  syrupUSDC

syrupUSDC  Lombard Staked BTC

Lombard Staked BTC  Function FBTC

Function FBTC  Liquid Staked ETH

Liquid Staked ETH  Wrapped BNB

Wrapped BNB  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Story

Story  Sky

Sky  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH