Q1 2025 reveals crypto media’s visibility reset in Western Europe

In Q1 2025, crypto media in Western Europe entered a phase of noticeable realignment. As the soft enforcement of MiCA began reshaping content boundaries—particularly around what qualifies as promotional—publishers also faced algorithmic turbulence from Google’s March core update and evolving discovery standards across platforms. Many crypto-focused outlets—lacking the compliance readiness, structural rigor, and content governance now expected in regulated discovery ecosystems—appeared unprepared for these shifts and saw their reach decline. Yet a small segment not only held ground—they grew.

Building on Outset PR’s earlier report on Latin America’s crypto media landscape, we analyzed the Q1 2025 performance of 133 publications across Western Europe, including 87 crypto-native and 46 generalist outlets. We break down what the data shows—and how a few standout platforms have found new ways to win the visibility game in crypto media.

Visibility can no longer be assumed

Drawing on SimilarWeb data, we found that between January and March 2025, 82% of crypto-native publications tracked by Outset PR experienced a decline in web traffic. Total traffic fell from 26.57 million visits in January to 22.85 million in February, and then to 22.22 million in March—a cumulative drop of 16.3%.

This was not a one-time anomaly. It marked a turning point shaped by overlapping forces: the soft rollout of MiCA enforcement, evolving definitions of promotional content, Google’s March core algorithm update, new platform content standards, and search behavior shaped by macroeconomic uncertainty.

Traffic concentration follows a power-law pattern

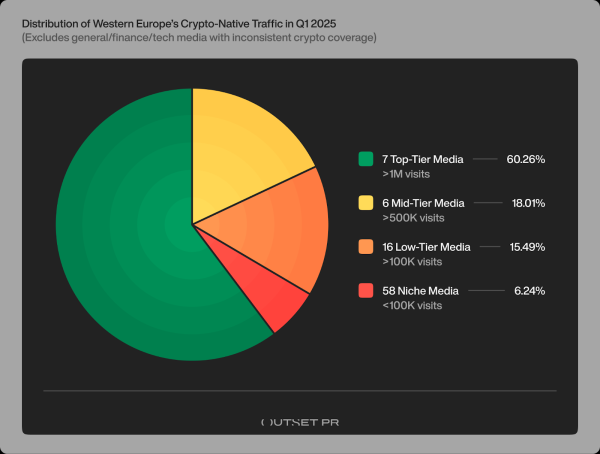

Among the 87 crypto-native publications analyzed, traffic distribution followed a sharp power-law curve—revealing how a small number of high-performing platforms dominate visibility:

- Only seven outlets exceeded 1 million monthly visits, yet they accounted for 60.26% of all crypto-native traffic. Their edge came from strong regional presence, solid SEO, and the ability to meet compliance standards.

- The next six outlets, with between 500,000 to 900,000 visits, accounted for 18.01% of total traffic.

- Sixteen mid-tier outlets (100,000–500,000) contributed just 15.49%, typically showing niche authority without scalable infrastructure.

- The remaining 58 outlets attracted fewer than 100,000 monthly visits each—collectively representing only 6.24% of total traffic. Notably, this segment includes 13 of Q1’s 16 growing outlets—underscoring that while some platforms are gaining momentum, their absolute reach remains modest. Growth alone does not guarantee influence in a fragmented visibility landscape.

Distribution of Western Europe’s Crypto-Native Traffic, Q1 2025. Source: Outset PR analysis, based on SimilarWeb data

This stark concentration highlights a growing visibility gap: access to trusted narratives is increasingly filtered through a few structurally resilient channels.

Country-level hubs of visibility

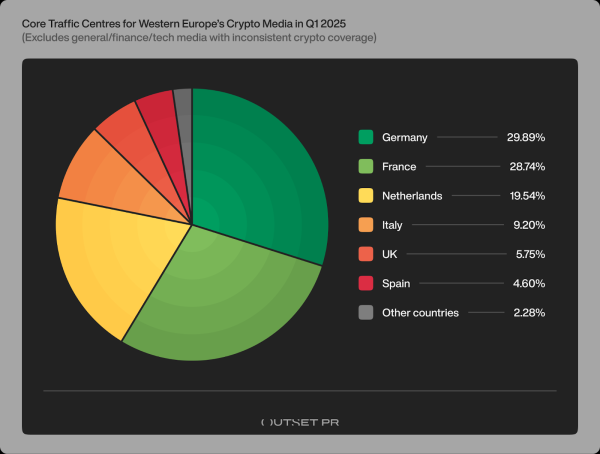

While MiCA applies regionally, traffic and media influence remain concentrated in specific geographic areas:

- Germany (29.89%) and France (28.74%) emerged as the two largest crypto media hubs, hosting several high-traffic platforms with consistent reach and compliance structures.

- The Netherlands (19.54%) followed with notable performance, though skewed toward a few leading outlets.

- Italy (9.20%), the United Kingdom (5.75%) showed more limited reach, with no crypto-native outlet exceeding 500K monthly visits.

- Spain (4.60%), though lower in total share, stood out as an exception—hosting at least one crypto-native platform with over 1 million monthly visits.

Core Traffic Centres for Western Europe’s Crypto Media, Q1 2025. Source: Outset PR analysis, based on SimilarWeb data

Markets with mature compliance cultures and robust editorial ecosystems were better positioned to maintain visibility in the post-MiCA environment, while others lacked scalable platforms capable of withstanding regulatory and algorithmic shifts.

Why generalist outlets stayed on top

Generalist outlets held a clear upper hand over crypto-native platforms in Q1 2025. Among the 46 non-crypto-dedicated publications studied, total traffic reached 106.25 million visits—more than four times the combined reach of crypto-native sites. Notably, 19 finance-focused outlets consistently exceeded 1 million monthly visits, accounting for 95.29% of total generalist traffic.

Their edge likely comes from greater editorial depth, topic diversity, and technical infrastructure, allowing them to adapt more easily to shifting market and compliance demands.

A key factor driving this dominance was Google Discover visibility. According to data from SimilarWeb, Ahrefs, and Outset PR’s internal testing, only 29.89% of crypto-native sites were eligible for Discover listings, and just 22.99% had consistent visibility. In contrast, 32.61% of generalist platforms maintained steady Discover presence—giving them a structural advantage in traffic acquisition.

With Discover increasingly favoring structured, compliant, and authoritative content, generalist outlets were better positioned to capture algorithmic preference and sustain long-term reach in a post-MiCA ecosystem.

Lessons from the resilient few

- Multilingual expansion: Several growing outlets expanded across multiple Western European languages. Regionally adapted domains, clearer disclaimers, and SEO-tuned editorial structures may have helped align with MiCA expectations while preserving visibility.

- Group infrastructure & compliance support: Top performers often belonged to larger media groups. Shared SEO systems, internal compliance, and performance-focused editorial workflows provided the agility needed to adapt.

- Niche positioning & local authority: Outlets focused on specific jurisdictions or verticals with structured content and localized credibility showed consistent performance, indicating that specialization offers resilience.

- Editorial flexibility: For several Q1 gainers, growth followed visible shifts in editorial strategy: away from repetitive or AI-generated content, and toward informative, transparent, and regulation-aware reporting.

Final thought

Media is how crypto tells its story. And as expectations rise—from platforms, regulators, and users—visibility may increasingly depend on structure, clarity, and responsiveness.

Crypto has always evolved under pressure—and so has the information ecosystem around it. Q1 2025 may mark the start of a new phase: one where presence is filtered not just by reach, but by resilience and readiness.

No longer shaped by volume alone, this environment rewards trust, transparency, and the ability to stay relevant as standards continue to shift. If that trend holds, the outlets adapting today could become tomorrow’s benchmarks in crypto storytelling.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Stellar

Stellar  LEO Token

LEO Token  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Zcash

Zcash  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Dai

Dai  USDT0

USDT0  Cronos

Cronos  Polkadot

Polkadot  Mantle

Mantle  Bittensor

Bittensor  MemeCore

MemeCore  sUSDS

sUSDS  Uniswap

Uniswap  Aave

Aave  World Liberty Financial

World Liberty Financial  USD1

USD1  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  Bitget Token

Bitget Token  OKB

OKB  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Binance-Peg WETH

Binance-Peg WETH  Falcon USD

Falcon USD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Tether Gold

Tether Gold  Wrapped SOL

Wrapped SOL  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  Aster

Aster  USDtb

USDtb  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Worldcoin

Worldcoin  Dash

Dash  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Official Trump

Official Trump  Gate

Gate  Algorand

Algorand  Pump.fun

Pump.fun  syrupUSDT

syrupUSDT  PAX Gold

PAX Gold  StakeWise Staked ETH

StakeWise Staked ETH  BFUSD

BFUSD  Kinetiq Staked HYPE

Kinetiq Staked HYPE  syrupUSDC

syrupUSDC  Lombard Staked BTC

Lombard Staked BTC  Function FBTC

Function FBTC  Liquid Staked ETH

Liquid Staked ETH  Wrapped BNB

Wrapped BNB  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Story

Story  Sky

Sky  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH