Bitcoin tops $108,000 as crypto traders shrug off Mid-east tensions

Bitcoin climbed above $108,000 on Wednesday, reaching its highest level in weeks, as traders ignored renewed unrest in the Middle East and a US stock market that stayed just below all-time highs.

The world’s OG crypto hit the intraday peak without hesitation, even while altcoins like Ether and Solana dipped slightly in the afternoon.

Meanwhile, lawmakers and regulators in Washington, D.C. made noise that could fuel even more momentum. Jerome Powell, the Federal Reserve Chair, appeared before the Senate Banking Committee earlier in the day and said that stablecoins have “come a long way” and now sit firmly inside the “traditional financial framework.”

Powell’s acknowledgment that crypto isn’t just a side show anymore came on the same day that the head of the Federal Housing Finance Agency, Billy Pulte, directed Fannie Mae and Freddie Mac to begin reviewing how crypto assets, like Bitcoin, could be used to qualify for mortgages.

Billy’s family founded Pulte Group, one of the country’s largest homebuilders, and his influence over the housing sector is substantial. That directive may be seen as a green light for digital assets in US real estate financing.

Trump’s NYSE crypto ETF faces decision window

Inside the New York Stock Exchange, officials are pushing forward a proposal tied to President Donald Trump’s Truth Social platform. The exchange submitted a rule change request that would allow the listing of a Bitcoin and Ethereum ETF linked directly to Trump’s company.

If the Securities and Exchange Commission gives it the go-ahead, it could launch within 90 days and expand the administration’s push to bring crypto closer to Wall Street. Trump, now back in the White House, has been vocal about making crypto a larger piece of the American financial system, and this ETF would mark one of the most significant steps yet.

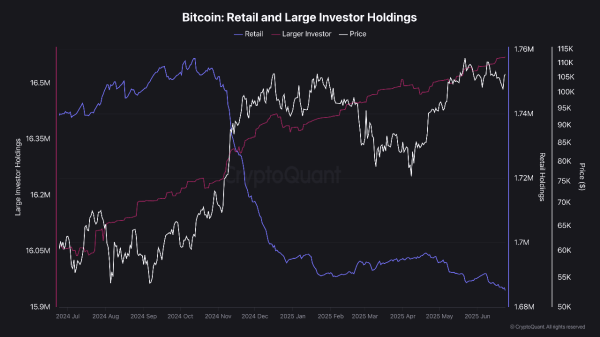

On-chain analytics show a dramatic split in market behavior. Retail holders, wallets holding less than 1 BTC, have been selling consistently. These addresses dropped to 1.69 million BTC, a 54,500 BTC year-over-year decline, with daily outflows averaging 220 BTC.

Over the past 12 months, these wallet movements had a –0.89 correlation to price, meaning the more they sold, the higher the price climbed. At the same time, large wallets, those holding at least 1,000 BTC now control 16.57 million BTC, after adding over 507,000 BTC in a year. These wallets are absorbing around 1,460 BTC per day and show a +0.86 correlation to price, which means their activity tracks upward movement.

That imbalance is sharp. Institutions are taking in nearly seven times the amount retail holders are letting go. Combine that with the fact that only 450 BTC are mined daily after the halving, and the pressure on supply becomes obvious. But what’s different this time is that small traders haven’t jumped back in.

There’s no retail FOMO yet, no frenzy like previous bull runs. Instead, individual holders are still exiting, hinting that the current rally might not even be close to peaking.

Binance, stablecoins, and key support levels show what comes next

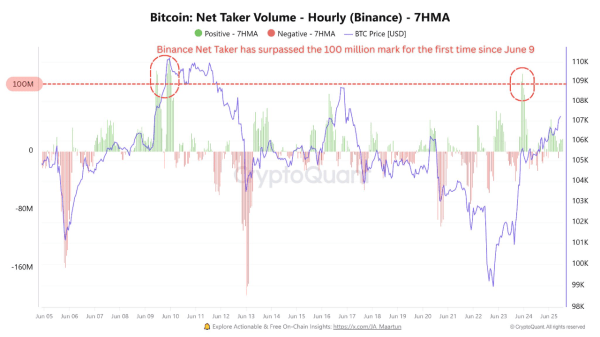

Over on Binance, a big move happened on June 24. Net Taker Volume topped $100 million, something that hadn’t happened since June 9. It’s usually seen when overleveraged shorts get wiped or when retail traders pile in all at once. These bursts can fuel short-term buying, but they don’t guarantee lasting demand, and plus the activity also happened alongside $1.25 billion in stablecoin outflows from derivatives exchanges, the largest since mid-May.

Another number traders are watching closely is the Realized Price, also called the cost basis, of short-term holders (STH). These wallets, which hold for fewer than six months, represent over 40% of Bitcoin’s total market cap. That makes their entry points critical.

Right now, wallets in the 1 week to 1 month group are holding at $106,200, while those in the 1 to 3 month range sit at $95,000, and wallets from 3 to 6 months ago are at $93,300. When those values are weighted, the average cost basis lands at about $97,700.

That’s where things get fragile. Bitcoin’s current price is hovering near $100,000, a level that matters both emotionally and technically. If the price dips below $97k, a chain reaction of panic selling could hit the market, especially from STHs who are already nervous. It’s a narrow range, and a dangerous one.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Stellar

Stellar  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Hedera

Hedera  Avalanche

Avalanche  Litecoin

Litecoin  Monero

Monero  Zcash

Zcash  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Dai

Dai  Cronos

Cronos  USDT0

USDT0  Polkadot

Polkadot  MemeCore

MemeCore  Mantle

Mantle  sUSDS

sUSDS  Bittensor

Bittensor  World Liberty Financial

World Liberty Financial  Uniswap

Uniswap  Aave

Aave  USD1

USD1  Internet Computer

Internet Computer  Bitget Token

Bitget Token  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  OKB

OKB  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Falcon USD

Falcon USD  Binance-Peg WETH

Binance-Peg WETH  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Tether Gold

Tether Gold  Solana

Solana  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  USDtb

USDtb  Aster

Aster  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Worldcoin

Worldcoin  Dash

Dash  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Algorand

Algorand  Gate

Gate  syrupUSDT

syrupUSDT  Pump.fun

Pump.fun  Kinetiq Staked HYPE

Kinetiq Staked HYPE  BFUSD

BFUSD  PAX Gold

PAX Gold  StakeWise Staked ETH

StakeWise Staked ETH  syrupUSDC

syrupUSDC  Liquid Staked ETH

Liquid Staked ETH  Lombard Staked BTC

Lombard Staked BTC  VeChain

VeChain  Wrapped BNB

Wrapped BNB  Function FBTC

Function FBTC  Cosmos Hub

Cosmos Hub  Sky

Sky  Story

Story  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH  NEXO

NEXO  Solv Protocol BTC

Solv Protocol BTC  Ripple USD

Ripple USD  Global Dollar

Global Dollar  Filecoin

Filecoin  Render

Render  Sei

Sei  Virtuals Protocol

Virtuals Protocol  Pudgy Penguins

Pudgy Penguins  Bonk

Bonk  Mantle Staked Ether

Mantle Staked Ether  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Immutable

Immutable  Circle USYC

Circle USYC  clBTC

clBTC  OUSG

OUSG  Jupiter Staked SOL

Jupiter Staked SOL  PancakeSwap

PancakeSwap  Aerodrome Finance

Aerodrome Finance  Ondo US Dollar Yield

Ondo US Dollar Yield  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Stables Labs USDX

Stables Labs USDX  Decred

Decred  Optimism

Optimism  Celestia

Celestia  Lido DAO

Lido DAO  Stacks

Stacks  Injective

Injective  Marinade Staked SOL

Marinade Staked SOL  tBTC

tBTC  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Beldex

Beldex  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Curve DAO

Curve DAO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  The Graph

The Graph  USDai

USDai  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  SPX6900

SPX6900  FLOKI

FLOKI  Tezos

Tezos  Usual USD

Usual USD  DoubleZero

DoubleZero  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Stader ETHx

Stader ETHx  GTETH

GTETH  Pyth Network

Pyth Network  IOTA

IOTA  Kaia

Kaia  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  TrueUSD

TrueUSD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Trust Wallet

Trust Wallet  Cognify

Cognify  Ether.fi

Ether.fi  Starknet

Starknet  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Plasma

Plasma  AB

AB  Swell Ethereum

Swell Ethereum  Conflux

Conflux  sBTC

sBTC  Pendle

Pendle  Humanity

Humanity  Sonic

Sonic  BitTorrent

BitTorrent  The Sandbox

The Sandbox  Bitcoin SV

Bitcoin SV  GHO

GHO  ether.fi Staked ETH

ether.fi Staked ETH  Helium

Helium  USDD

USDD  Ethereum Name Service

Ethereum Name Service  ARK

ARK  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Sun Token

Sun Token  Maple Finance

Maple Finance  JasmyCoin

JasmyCoin  Theta Network

Theta Network  GALA

GALA  Satoshi Stablecoin

Satoshi Stablecoin  dogwifhat

dogwifhat  Wrapped HYPE

Wrapped HYPE  AINFT

AINFT  Arbitrum Bridged Wrapped eETH (Arbitrum)

Arbitrum Bridged Wrapped eETH (Arbitrum)  Flow

Flow  Decentraland

Decentraland  ZKsync

ZKsync  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)