Bitcoin Price Watch: Can Bulls Push Past $110K or Will Bears Regroup?

Bitcoin is trading at $107,338 with a market valuation of $2.13 trillion, while its 24-hour volume reached $18.47 billion as the price fluctuated between an intraday range of $106,556 to $107,572. This consolidation signals a market pause, with technical indicators suggesting potential continuation if key resistance levels are surpassed.

Bitcoin

The daily chart highlights a resilient uptrend following bitcoin’s bounce from the $98,240 support level, which now acts as a pivotal demand zone. The presence of large bullish candles accompanied by rising volume reinforces the strength of the current rally. Immediate resistance stands at $108,500, followed by a stronger ceiling at $110,700, where traders may consider exiting long positions if momentum wanes. A favorable re-entry zone appears between $103,000 and $104,000, where traders should look for reversal confirmations before committing.

BTC/USD 1-day chart via Bitstamp on June 28, 2025.

On the 4-hour chart, bitcoin maintains an upward trajectory but is currently navigating a sideways consolidation phase near recent highs. The price range between $106,000 and $108,500 is crucial, acting as both a short-term accumulation zone and a resistance band. A pullback to the $106,000–$106,500 area—aligned with key exponential moving averages (EMAs)—offers a favorable long entry, especially if supported by bullish patterns. Should the price break through $108,500 with volume, a continuation toward previous highs is plausible. Until then, traders may opt to reduce exposure if momentum diminishes and candles contract near resistance.

BTC/USD 4-hour chart via Bitstamp on June 28, 2025.

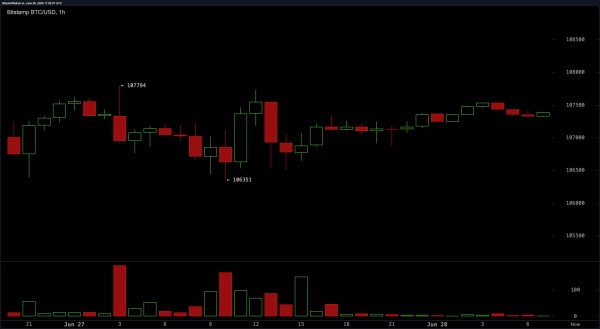

The 1-hour chart presents a compressed price action zone between $106,350 and $107,794, typical of low-volatility environments before breakout events. Volume has tapered off, indicating indecision, but this often precedes sharp movements. Traders may explore scalping opportunities near $106,500 if a bullish divergence emerges on the relative strength index (RSI). A clear break above $107,800, coupled with a volume spike, may confirm a short-term breakout setup. Conversely, rejection near the upper boundary with long wicks suggests caution and potential mean reversion. While consolidation seems like it’s been an eternity, something will happen soon enough.

BTC/USD 1-hour chart via Bitstamp on June 28, 2025.

Across major oscillators, the broader technical sentiment is neutral with a slight lean toward bullishness. The relative strength index (RSI), stochastic oscillator, commodity channel index (CCI), average directional index (ADX), and awesome oscillator each register neutral readings, offering no extremes in sentiment. Momentum stands out as the sole bearish indicator, issuing a negative signal, while the moving average convergence divergence (MACD) remains bullish. This divergence implies a market in equilibrium, awaiting a directional trigger.

The alignment of moving averages (MAs) across all key durations from 10 to 200 periods is unequivocally bullish. Every simple moving average (SMA) and exponential moving average (EMA) signals a buy, with current prices comfortably above all benchmarks. Notably, the 10-period EMA and SMA are positioned at $106,062 and $105,168, respectively, reinforcing immediate support. As the price hovers near highs, these technical supports provide a solid base for upward movement if bulls regain control. The interplay of price compression, volume behavior, and trend alignment suggests the market is preparing for its next decisive move.

Bull Verdict:

If bitcoin maintains support above $106,000 and breaks through the $108,500 resistance with rising volume, the market is poised for a bullish continuation toward the $110,700 level. Strong alignment across all moving averages, coupled with a stabilizing macro trend and low volatility conditions, supports the potential for renewed upward momentum.

Bear Verdict:

Should bitcoin fail to sustain the $106,000 support zone and momentum continues to deteriorate—especially with neutral-to-weak oscillator readings—price could retrace toward the $103,000–$104,000 range or lower. A lack of breakout volume and visible rejection near $107,800–$108,000 would signal buyer fatigue, opening the door for short-term downside pressure.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Stellar

Stellar  LEO Token

LEO Token  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Zcash

Zcash  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Dai

Dai  USDT0

USDT0  Cronos

Cronos  Polkadot

Polkadot  Mantle

Mantle  Bittensor

Bittensor  MemeCore

MemeCore  sUSDS

sUSDS  Uniswap

Uniswap  Aave

Aave  World Liberty Financial

World Liberty Financial  USD1

USD1  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  Bitget Token

Bitget Token  OKB

OKB  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Binance-Peg WETH

Binance-Peg WETH  Falcon USD

Falcon USD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Tether Gold

Tether Gold  Wrapped SOL

Wrapped SOL  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  Aster

Aster  USDtb

USDtb  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Worldcoin

Worldcoin  Dash

Dash  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Official Trump

Official Trump  Gate

Gate  Algorand

Algorand  Pump.fun

Pump.fun  syrupUSDT

syrupUSDT  PAX Gold

PAX Gold  StakeWise Staked ETH

StakeWise Staked ETH  BFUSD

BFUSD  Kinetiq Staked HYPE

Kinetiq Staked HYPE  syrupUSDC

syrupUSDC  Lombard Staked BTC

Lombard Staked BTC  Function FBTC

Function FBTC  Liquid Staked ETH

Liquid Staked ETH  Wrapped BNB

Wrapped BNB  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Story

Story  Sky

Sky  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH