Bitcoin on Edge: Whale Moves and Short-Term Losses Signal Potential Shake-Up

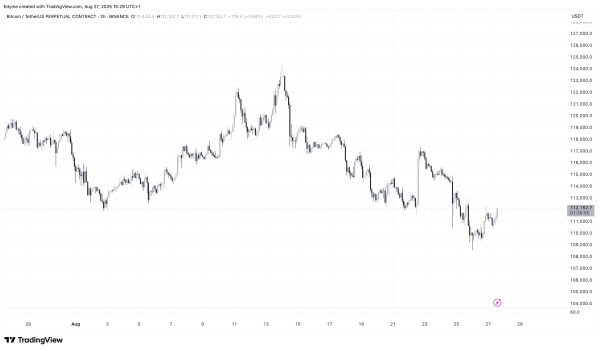

Bitcoin continues to face challenges sustaining its momentum after retreating from its recent all-time high above $124,000. At the time of writing, the asset trades around $111,090, reflecting a 10.5% decline from its peak and a 4.2% drop over the past week.

The pullback highlights growing uncertainty among traders as buying pressure weakens, even while some on-chain indicators suggest potential accumulation.

One such signal comes from Binance, the world’s largest cryptocurrency exchange by trading volume. Analyst Crazzyblockk, a contributor to CryptoQuant’s QuickTake platform, examined a metric called the Binance Buying Power Ratio.

According to the analyst, this ratio, measuring the inflow of stablecoins relative to Bitcoin outflows from Binance, has recently climbed sharply, moving into positive territory. The implication is that traders are sending stablecoins into the exchange (potential buying power) while withdrawing Bitcoin, likely for long-term storage.

Binance Buying Power Ratio Signals Accumulation

Crazzyblockk explained that this pattern points to a buildup of liquidity while simultaneously reducing the Bitcoin supply available for sale on Binance. In his words:

Stablecoins in, BTC out. This combination of accumulating ‘dry powder’ and securing assets off-exchange is a classic sign of a market preparing for a bullish move.

The surge in buying power ratio coincides with Bitcoin’s current consolidation phase, suggesting that some traders may be preparing for a rebound.

Historically, an increase in stablecoin inflows has often preceded heightened trading activity, with many market participants using these reserves to enter positions once favorable conditions emerge.

At the same time, large Bitcoin outflows from exchanges can reflect a broader trend of long-term holding behavior. Investors who transfer coins to private or institutional-grade wallets often intend to store them securely, limiting immediate selling pressure.

If sustained, this dual trend of stablecoin accumulation and Bitcoin withdrawals could support the market by reducing available supply and preparing liquidity for upward moves.

Bitcoin Short-Term Holders Show Signs of Weakness

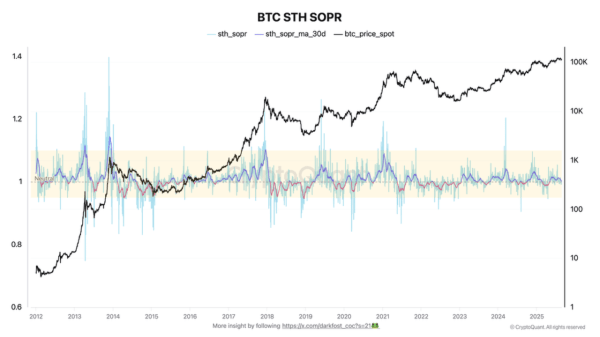

While Binance metrics suggest optimism, another CryptoQuant analyst, Darkfost, highlighted a more cautious indicator: the Spent Output Profit Ratio (SOPR) for short-term holders (STHs). This metric measures whether coins moved on-chain are being sold at a profit or loss.

Darkfost noted that the STH SOPR has now fallen below 1, with its monthly average sitting at the neutral point. In practical terms, this means that many recent buyers are no longer selling at a profit, and some are even taking losses. He wrote:

Historically, when STH SOPR reaches this level, two scenarios are common. Either the market rebounds quickly, or short-term holders panic, leading to further losses. During this cycle, the second scenario has often played out—though these periods have consistently created opportunities for medium- to long-term investors.

The comparison to late 2021, when Bitcoin last peaked at $69,000 before entering a prolonged correction, shows the weight of this signal. A persistent decline in SOPR could indicate rising pressure from traders seeking to exit, even as long-term holders demonstrate greater conviction.

Featured image created with DALL-E, Chart from TradingView

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Stellar

Stellar  LEO Token

LEO Token  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Zcash

Zcash  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Dai

Dai  USDT0

USDT0  Cronos

Cronos  Polkadot

Polkadot  Mantle

Mantle  Bittensor

Bittensor  MemeCore

MemeCore  sUSDS

sUSDS  Uniswap

Uniswap  Aave

Aave  World Liberty Financial

World Liberty Financial  USD1

USD1  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  Bitget Token

Bitget Token  OKB

OKB  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Binance-Peg WETH

Binance-Peg WETH  Falcon USD

Falcon USD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Tether Gold

Tether Gold  Wrapped SOL

Wrapped SOL  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  Aster

Aster  USDtb

USDtb  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Worldcoin

Worldcoin  Dash

Dash  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Official Trump

Official Trump  Gate

Gate  Algorand

Algorand  Pump.fun

Pump.fun  syrupUSDT

syrupUSDT  PAX Gold

PAX Gold  StakeWise Staked ETH

StakeWise Staked ETH  BFUSD

BFUSD  Kinetiq Staked HYPE

Kinetiq Staked HYPE  syrupUSDC

syrupUSDC  Lombard Staked BTC

Lombard Staked BTC  Function FBTC

Function FBTC  Liquid Staked ETH

Liquid Staked ETH  Wrapped BNB

Wrapped BNB  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Story

Story  Sky

Sky  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH