Top Research Firm Predicts XRP Run to $50, Here’s Why

XRP has continued to maintain support within an important multi-year channel months after Sistine Research predicted a massive rally.

For context, Sistine Research first shared its long-term analysis in April, using a weekly chart to compare XRP’s current setup with its 2017 pattern. According to the analysis, XRP could rally to a peak of $50 if the right conditions align.

XRP Breaches Symmetrical Triangle

Data from the chart shows that after XRP dropped from the $0.06144 high in December 2013, it moved inside a tight symmetrical triangle that lasted 1,169 days between 2014 and 2017.

The Parallel Channel

However, the chart from Sistine Research identifies another parallel channel that took shape from April 2021. Notably, the upper red trendline of this channel emerged from the $3.31 peak in January 2018, representing the resistance of the channel. Meanwhile, the lower red trendline emerged from the $1.96 peak in April 2021, representing the support of the channel.

After XRP broke out of the symmetrical triangle, it entered this parallel channel, with support around $2 (the April 2021 peak) and resistance around $3.4 (the January 2018 peak). The Sistine Research chart indicates that it would need to breach the upper trendline to continue its uptrend.

XRP 1W Chart | Sistine Research

Importantly, this huge base mirrored the 2017 setup, only on a much larger scale. Measuring the triangle, the research firm set a conservative target between $33 and $50. It added that if the same structure is read as a cup and handle, the projection expands to $77–$100.

To frame the timeline, Sistine marked 675 days beyond the breakout zone for these targets to materialize. Specifically, this points to 2026 or early 2027 as the period when the targets could play out.

XRP Maintains Support at the Parallel Channel

Interestingly, XRP price action since April has remained within the channel. In mid-May, XRP climbed to $2.65 but failed to reach the upper red trendline. From here, it dipped to $1.96 in June, touching the lower red trendline and confirming support.

XRP Maintains Channel Support

However, bulls quickly stepped in, driving the price to a new peak of $3.66 by mid-July for a direct retest of the upper red trendline. Nonetheless, XRP faced a massive rejection. Despite this, XRP has not dropped to retest the lower trendline support. Instead, it continues to consolidate above $3, preparing for another attempt at the ceiling.

Analysts Remain Bullish

Notably, other analysts remain bullish that another leg up could push prices above the channel. For one, Dark Defender recently pointed out that XRP has begun to break through initial weekly resistance.

“The Power of the Waves”

Initial weekly resistance is being broken right now.#XRP targets, $4.39 and the $5.85 Fibonacci levels

Supports: $3.01, $2.85.

As clear as it gets. pic.twitter.com/MjaAqczjSU

— Dark Defender (@DefendDark) September 12, 2025

He presented near-term targets at $4.39 and $5.85 based on Fibonacci levels and highlighted support at $3.01 and $2.85, almost exactly where the lower red trendline from the Sistine Research channel sits.

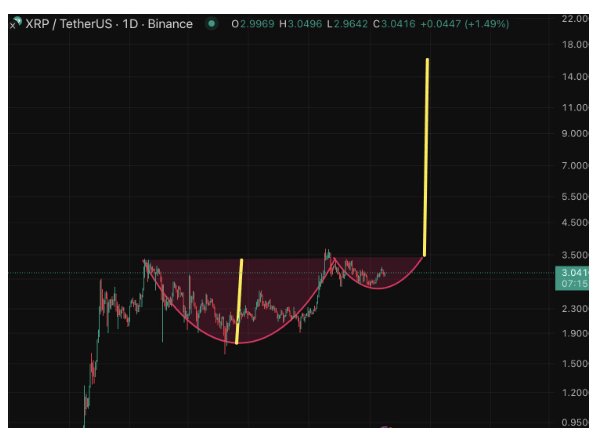

Meanwhile, Baron Dominus highlighted a cup-and-handle formation on the daily chart. The cup formed when XRP dropped from the January peak to $1.61 in April and then recovered to $3.66 in July. XRP is now forming the handle, with potential to reach $15 before year-end if momentum holds.

XRP Cup and Handle Structure | Baron Dominus

Source

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Stellar

Stellar  LEO Token

LEO Token  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Zcash

Zcash  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Dai

Dai  USDT0

USDT0  Cronos

Cronos  Polkadot

Polkadot  Mantle

Mantle  Bittensor

Bittensor  MemeCore

MemeCore  sUSDS

sUSDS  Uniswap

Uniswap  Aave

Aave  World Liberty Financial

World Liberty Financial  USD1

USD1  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  Bitget Token

Bitget Token  OKB

OKB  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Binance-Peg WETH

Binance-Peg WETH  Falcon USD

Falcon USD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Tether Gold

Tether Gold  Wrapped SOL

Wrapped SOL  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  Aster

Aster  USDtb

USDtb  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Worldcoin

Worldcoin  Dash

Dash  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Official Trump

Official Trump  Gate

Gate  Algorand

Algorand  Pump.fun

Pump.fun  syrupUSDT

syrupUSDT  PAX Gold

PAX Gold  StakeWise Staked ETH

StakeWise Staked ETH  BFUSD

BFUSD  Kinetiq Staked HYPE

Kinetiq Staked HYPE  syrupUSDC

syrupUSDC  Lombard Staked BTC

Lombard Staked BTC  Function FBTC

Function FBTC  Liquid Staked ETH

Liquid Staked ETH  Wrapped BNB

Wrapped BNB  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Story

Story  Sky

Sky  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH