China Stimulus Could Spark Altcoin Rally as Economic Data Weakens

The cryptocurrency market faces a critical juncture as the People’s Bank of China (PBOC) considers stimulus measures in response to slowing economic activity.

Analysts suggest that if Beijing injects liquidity into the system, altcoins could experience a significant rally, potentially surpassing previous all-time highs.

China Stimulus Possible in Next Month

While headlines often focus on the US Federal Reserve, China’s monetary policy exerts an equally crucial influence on global risk assets, including cryptocurrencies. A March 2025 21Shares report highlighted a 94% correlation between Bitcoin’s price and global liquidity, surpassing the S&P 500 and gold. This correlation underscores the significance of central bank policies in shaping investor sentiment toward crypto markets.

According to Porkopolis Economics, the U.S. M0 monetary base currently stands at $5.8 trillion, followed by $5.4 trillion in the eurozone, $5.2 trillion in China, and $4.4 trillion in Japan. Given that China accounts for nearly 19.5% of global GDP, the PBOC’s policy decisions carry weighty implications for international capital flows, even when the Fed dominates market attention.

Top monetary assets, USD. Source: Porkopolis Economics

China’s economic data in July 2025 highlighted several areas of weakness. Retail sales fell 0.1% month-on-month, while fixed-asset investment declined 5.3% year-on-year, the steepest contraction since March 2020, according to estimates from Goldman Sachs. Industrial production, meanwhile, inched up 0.4%, indicating limited growth momentum.

Unemployment also showed signs of stress, with the survey-based urban jobless rate climbing to 5.2% in July, up from 5.0% in June. Bloomberg noted that the PBOC could introduce stimulus measures “as soon as September,” while economists at Nomura and Commerzbank echoed the expectation of imminent support policies.

Central banks typically deploy stimulus through interest rate cuts or special financing conditions, effectively expanding the money supply. Such interventions historically boost risk assets, including stocks and cryptocurrencies, by making liquidity more accessible and reducing financing costs. In the crypto context, this could translate into renewed demand for altcoins, which have historically been sensitive to shifts in global liquidity.

US Market Signals Provide Context

Despite growing fears of a recession in the United States, markets have remained remarkably resilient. The University of Michigan’s consumer survey, released in early August, revealed that 60% of Americans expect unemployment to worsen over the next year, a sentiment last recorded during the 2008–09 financial crisis.

Yet, investors continue to display optimism. The S&P 500 closed above 6,400 for the first time ever, while 5-year U.S. Treasury yields rebounded from 3.74% on August 4 to 3.83% on Friday, signaling reduced risk aversion. Higher Treasury yields often indicate a willingness among investors to embrace riskier assets, as demand for government-backed instruments diminishes when confidence improves.

US 5-year Treasury yields. Source: TradingView

For the cryptocurrency market, this combination of factors—resilient equities, rebounding yields, and potential Chinese stimulus—creates a fertile environment for altcoin recovery. Should the PBOC follow through with expansionary measures, the influx of liquidity may catalyze a broad rotation into cryptocurrencies, driving prices higher across a range of tokens.

Altcoins: Navigating the Uncertainties

Before the 2017 crackdown, China was one of the world’s largest markets for crypto and altcoins, with significant grassroots and institutional interest. Altcoins like NEO and VeChain, which have strong Chinese roots, were especially popular among local investors.

Although China’s crypto ownership rate has dropped to about 5.2%, reflecting declining retail participation due to government restrictions, Chinese blockchain projects and altcoins continue to have strong enterprise and technical support, and many Chinese citizens reportedly engage in crypto markets via offshore platforms or proxies despite restrictions.

Despite favorable liquidity conditions, several uncertainties remain. Global recession fears, geopolitical tensions, and evolving regulatory frameworks could temper investor enthusiasm. Moreover, while China’s stimulus may inject liquidity, the effectiveness of such measures will depend on market perception and execution. If stimulus policies are insufficient or temporary, the altcoin market may respond only modestly.

Analysts also emphasize the importance of US economic conditions. Rising Treasury yields indicate that investors are increasingly pricing inflation and growth expectations. These signals interact with Chinese liquidity policies, creating a complex backdrop in which altcoins may flourish or experience headwinds. Investors should also monitor the Trump administration’s China tariffs, which have been delayed for another 90 days.

The post China Stimulus Could Spark Altcoin Rally as Economic Data Weakens appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Stellar

Stellar  LEO Token

LEO Token  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Zcash

Zcash  Litecoin

Litecoin  Monero

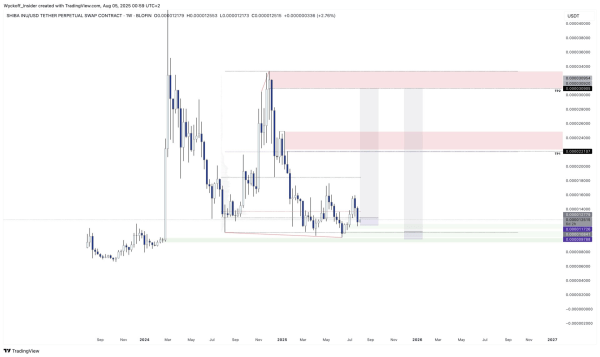

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Dai

Dai  USDT0

USDT0  Cronos

Cronos  Polkadot

Polkadot  Mantle

Mantle  Bittensor

Bittensor  MemeCore

MemeCore  sUSDS

sUSDS  Uniswap

Uniswap  Aave

Aave  World Liberty Financial

World Liberty Financial  USD1

USD1  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  Bitget Token

Bitget Token  OKB

OKB  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Binance-Peg WETH

Binance-Peg WETH  Falcon USD

Falcon USD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Tether Gold

Tether Gold  Wrapped SOL

Wrapped SOL  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  Aster

Aster  USDtb

USDtb  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Worldcoin

Worldcoin  Dash

Dash  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Official Trump

Official Trump  Gate

Gate  Algorand

Algorand  Pump.fun

Pump.fun  syrupUSDT

syrupUSDT  PAX Gold

PAX Gold  StakeWise Staked ETH

StakeWise Staked ETH  BFUSD

BFUSD  Kinetiq Staked HYPE

Kinetiq Staked HYPE  syrupUSDC

syrupUSDC  Lombard Staked BTC

Lombard Staked BTC  Function FBTC

Function FBTC  Liquid Staked ETH

Liquid Staked ETH  Wrapped BNB

Wrapped BNB  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Story

Story  Sky

Sky  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH