Altcoin winter may be coming, as most assets have been sliding against BTC and in dollar terms

Despite the expectations for an altcoin season in 2025, the rallies for most assets were short-lived. On-chain metrics also suggest that even the leading altcoins are back to crypto winter conditions, as activity is winding down.

On-chain metrics point to an ‘altcoin winter’, where most assets will only slide to a lower range. In 2025, prices shifted to altcoin season on several occasions, but the rallies only lasted for a few days.

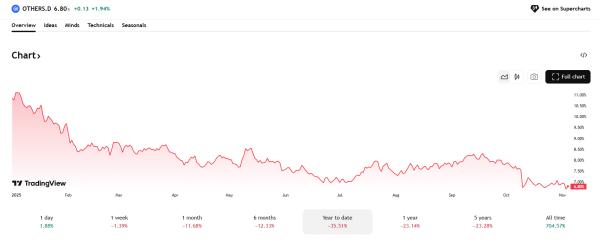

For the year to date, altcoins excluding the top 10 assets are down by 35.5%, extending their long-term slide. Even blue-chip assets saw a downturn in the past month, despite expectations for a market-wide recovery in October.

Despite the occasional altcoin pumps and the recovery of ETH, smaller altcoins dropped by over 35.5% in the year-to-date. | Source: TradingView

For most of 2025, on-chain activity remained high, boosted by DeFi, meme tokens, and DEX trading, as well as lending. Stablecoin transfers also kept some of the major chains active.

Some altcoins may outperform BTC in the short term, but overall, the markets rarely see a full rotation of liquidity into the riskier assets. The rise in perpetual DEX trading also means fewer buyers for altcoins, and fewer holders, but more directional bets through leveraged trading.

Altcoin prices lost 50% on average

In the past three months, those metrics took a downturn, with a lower number of active wallets, new users, and transaction counts. Most altcoins are down 50% on average over the past three months, while they also never revisited all–time highs from previous cycles.

Based on the altcoin season index of 41 points, it is neither a BTC season nor an altcoin season. As BTC crashed closer to $100,000, altcoins took even deeper cuts. ETH led the drop, dipping to $3299.88. BNB returned to $955, while SOL dipped further to $155.

Smaller altcoins remained inactive and range-bound, with small exceptions from pumping tokens and legacy private coins. Despite the occasional recoveries, overall slowdowns in altcoin metrics have continued for six months and are starting to resemble previous crypto winter periods.

Traders also hold the widespread belief that there will not be a market where all assets are rising, regardless of fundamentals or trading profiles. Millions of new tokens were created, and only a small handful have access to liquidity. The slowdown in South Korean markets is also cutting into the growth potential of altcoins.

Despite the favorable altcoin buy signal, there is diminishing demand for potentially illiquid coins and tokens. Even top meme assets like PEPE have lost their on-chain activity, while Solana’s community is now focusing on the ZCash (ZEC) integration.

Altcoins lose appeal as crypto matures

Altcoins extended their series of losses as there are doubts about the return of a regular four-year cycle. In 2025, some altcoins got a boost from treasury companies, but most assets were too risky to be added to reserves.

Altcoin treasuries also used existing reserves from ICOs, team allocations, and whale wallets, and rarely led to open market buying.

The overall expectation is that altcoins will keep losing in BTC terms, and more will be forgotten with no chance of returning.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Wrapped SOL

Wrapped SOL  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Figure Heloc

Figure Heloc  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Stellar

Stellar  Wrapped eETH

Wrapped eETH  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Zcash

Zcash  Hedera

Hedera  WETH

WETH  Avalanche

Avalanche  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Dai

Dai  Cronos

Cronos  USDT0

USDT0  Mantle

Mantle  MemeCore

MemeCore  Polkadot

Polkadot  Bittensor

Bittensor  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Uniswap

Uniswap  USD1

USD1  Aave

Aave  Bitget Token

Bitget Token  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Internet Computer

Internet Computer  PayPal USD

PayPal USD  OKB

OKB  Pepe

Pepe  NEAR Protocol

NEAR Protocol  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Falcon USD

Falcon USD  Tether Gold

Tether Gold  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Binance-Peg WETH

Binance-Peg WETH  Aster

Aster  Ondo

Ondo  Aptos

Aptos  USDtb

USDtb  Pi Network

Pi Network  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Worldcoin

Worldcoin  KuCoin

KuCoin  Dash

Dash  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Gate

Gate  Algorand

Algorand  syrupUSDT

syrupUSDT  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Pump.fun

Pump.fun  BFUSD

BFUSD  PAX Gold

PAX Gold  StakeWise Staked ETH

StakeWise Staked ETH  syrupUSDC

syrupUSDC  Lombard Staked BTC

Lombard Staked BTC  Wrapped BNB

Wrapped BNB  Function FBTC

Function FBTC  Sky

Sky  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Story

Story  Liquid Staked ETH

Liquid Staked ETH  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  NEXO

NEXO  Renzo Restaked ETH

Renzo Restaked ETH  Ripple USD

Ripple USD  Solv Protocol BTC

Solv Protocol BTC  Global Dollar

Global Dollar  Sei

Sei  Render

Render  Filecoin

Filecoin  Pudgy Penguins

Pudgy Penguins  Virtuals Protocol

Virtuals Protocol  Bonk

Bonk  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Mantle Staked Ether

Mantle Staked Ether  Immutable

Immutable  Circle USYC

Circle USYC  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  clBTC

clBTC  OUSG

OUSG  Jupiter Staked SOL

Jupiter Staked SOL  PancakeSwap

PancakeSwap  Aerodrome Finance

Aerodrome Finance  Ondo US Dollar Yield

Ondo US Dollar Yield  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Stables Labs USDX

Stables Labs USDX  Optimism

Optimism  Celestia

Celestia  Lido DAO

Lido DAO  Stacks

Stacks  Injective

Injective  tBTC

tBTC  Beldex

Beldex  Marinade Staked SOL

Marinade Staked SOL  Curve DAO

Curve DAO  SPX6900

SPX6900  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  USDai

USDai  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  The Graph

The Graph  Decred

Decred  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  FLOKI

FLOKI  DoubleZero

DoubleZero  Tezos

Tezos  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Usual USD

Usual USD  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Pyth Network

Pyth Network  IOTA

IOTA  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  Stader ETHx

Stader ETHx  GTETH

GTETH  Kaia

Kaia  TrueUSD

TrueUSD  Cognify

Cognify  Trust Wallet

Trust Wallet  Sonic

Sonic  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Starknet

Starknet  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Ether.fi

Ether.fi  Plasma

Plasma  Humanity

Humanity  AB

AB  ZKsync

ZKsync  Conflux

Conflux  sBTC

sBTC  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Pendle

Pendle  Swell Ethereum

Swell Ethereum  GHO

GHO  The Sandbox

The Sandbox  Bitcoin SV

Bitcoin SV  BitTorrent

BitTorrent  ARK

ARK  Ethereum Name Service

Ethereum Name Service  USDD

USDD  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Maple Finance

Maple Finance  ether.fi Staked ETH

ether.fi Staked ETH  Sun Token

Sun Token  Theta Network

Theta Network  JasmyCoin

JasmyCoin  Helium

Helium  dogwifhat

dogwifhat  Satoshi Stablecoin

Satoshi Stablecoin  GALA

GALA  Wrapped HYPE

Wrapped HYPE  AINFT

AINFT  Decentraland

Decentraland  MYX Finance

MYX Finance  Flow

Flow  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Savings Dai

Savings Dai