Bitcoin Mining Is Tougher Than Ever — So Why Are Miners Smiling?

Bitcoin’s mining difficulty surged to an all-time high of 127.6 trillion in August 2025. The move reflects a continued expansion of global computational power, securing the network.

However, despite the increased technical challenge, miner profitability is quietly climbing, a rare dynamic analysts say could signal a new phase in the Bitcoin (BTC) market cycle.

Bitcoin Mining Difficulty Hits Record High

The next mining difficulty adjustment, expected on August 9, is projected to lower the metric slightly to around 124.71 trillion.

Bitcoin Mining Difficulty. Source: Coinwarz

This adjustment aims to bring the average block time back to the 10-minute target, down from the current 10 minutes and 23 seconds.

These periodic recalibrations are fundamental to Bitcoin’s design. They maintain consistent issuance and network stability despite fluctuations in hash rate.

The anomaly, however, is that higher Bitcoin mining difficulty has not translated into squeezed margins for miners.

Quite the opposite, network data showing miner revenues have reached a post-halving peak of $52.63 million per exahash daily.

Bitcoin Miner Revenue. Source: ycharts.com

“Bitcoin Miners Revenue Per Day is at a current level of 52.63M, down from 56.35M yesterday and up from 25.64M one year ago. This is a change of -6.61% from yesterday and 105.3% from one year ago,” analysts at ychart.com indicated.

This is a strong signal, considering rising energy costs and an increasingly competitive mining playing field.

In a recent post, Blockware Intelligence, a Bitcoin mining analytics firm, highlighted this divergence.

“The bull case for Bitcoin mining? BTC/USD increasing faster than mining difficulty. Over the past 12 months: > BTC/USD +75% > Mining Difficulty: +53%. Profit margins for Bitcoin miners are increasing,” the firm stated in a recent post.

Rising Profit Margins Signal Bullish Shift

Historically, such a dynamic, where the Bitcoin price rises faster than mining difficulty, has occurred during the early stages of bullish market cycles. Similar patterns were observed in 2016 and again in mid-2020, which preceded major price rallies.

The growing profitability also reflects deeper demand dynamics, with data showing the current Kimchi premium in South Korea stands at +0.6%. Notably, this indicates a strong regional appetite for BTC.

Korean Kimchi Premium. Source: CryptoQuant

Kimchi premium represents the price difference between local exchanges and global spot markets.

That, paired with the deployment of more efficient ASIC machines and rising institutional mining investments, suggests the mining sector is both healthy and optimistic about Bitcoin’s medium-term trajectory.

Beyond miner margins, Bitcoin’s scarcity narrative remains intact. With over 94% of the total 21 million BTC already mined, the pioneer crypto’s stock-to-flow ratio now stands at approximately 120, double that of gold.

This long-term scarcity positions Bitcoin as a hedge against inflation and monetary debasement, even as short-term price action remains subdued.

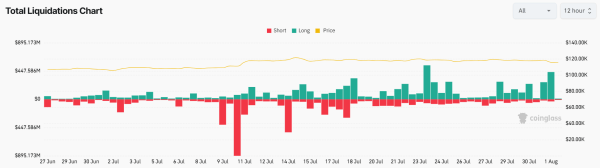

Still, the broader market has yet to price in the network’s improving fundamentals. After the July highs, Bitcoin retraced to levels below $115,000, signaling a temporary decoupling between on-chain technical health and investor sentiment.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Analysts attribute this disconnect to macroeconomic headwinds, trade policies, and shifting capital flows. Meanwhile, miners appear to be front-running the rest of the market.

The combination of rising difficulty, increasing margins, and strong regional demand could mark a turning point in mining economics and Bitcoin’s broader cycle. If history rhymes, the network’s growing strength may soon echo in price.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Stellar

Stellar  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Zcash

Zcash  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  USDT0

USDT0  Dai

Dai  Cronos

Cronos  Polkadot

Polkadot  Bittensor

Bittensor  MemeCore

MemeCore  Mantle

Mantle  sUSDS

sUSDS  Uniswap

Uniswap  World Liberty Financial

World Liberty Financial  USD1

USD1  Aave

Aave  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  Bitget Token

Bitget Token  Internet Computer

Internet Computer  OKB

OKB  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Falcon USD

Falcon USD  Binance-Peg WETH

Binance-Peg WETH  Tether Gold

Tether Gold  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Wrapped SOL

Wrapped SOL  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  USDtb

USDtb  Aster

Aster  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Dash

Dash  Worldcoin

Worldcoin  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  syrupUSDT

syrupUSDT  Gate

Gate  Algorand

Algorand  Pump.fun

Pump.fun  PAX Gold

PAX Gold  BFUSD

BFUSD  syrupUSDC

syrupUSDC  StakeWise Staked ETH

StakeWise Staked ETH  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Lombard Staked BTC

Lombard Staked BTC  Liquid Staked ETH

Liquid Staked ETH  Wrapped BNB

Wrapped BNB  VeChain

VeChain  Story

Story  Cosmos Hub

Cosmos Hub  Sky

Sky  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH  NEXO

NEXO  Solv Protocol BTC

Solv Protocol BTC  Quant

Quant  Filecoin

Filecoin  Ripple USD

Ripple USD  Global Dollar

Global Dollar  Render

Render  Sei

Sei  Pudgy Penguins

Pudgy Penguins  Decred

Decred  Bonk

Bonk  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Immutable

Immutable  Circle USYC

Circle USYC  clBTC

clBTC  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  OUSG

OUSG  Jupiter Staked SOL

Jupiter Staked SOL  PancakeSwap

PancakeSwap  Aerodrome Finance

Aerodrome Finance  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Stables Labs USDX

Stables Labs USDX  Ondo US Dollar Yield

Ondo US Dollar Yield  Optimism

Optimism  Celestia

Celestia  Stacks

Stacks  Lido DAO

Lido DAO  Marinade Staked SOL

Marinade Staked SOL  Injective

Injective  tBTC

tBTC  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  SPX6900

SPX6900  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Beldex

Beldex  Curve DAO

Curve DAO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  The Graph

The Graph  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  USDai

USDai  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  FLOKI

FLOKI  Tezos

Tezos  Usual USD

Usual USD  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  DoubleZero

DoubleZero  Stader ETHx

Stader ETHx  GTETH

GTETH  Kaia

Kaia  Pyth Network

Pyth Network  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  IOTA

IOTA  TrueUSD

TrueUSD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Plasma

Plasma  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Cognify

Cognify  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Starknet

Starknet  Trust Wallet

Trust Wallet  AB

AB  Ether.fi

Ether.fi  Swell Ethereum

Swell Ethereum  sBTC

sBTC  Conflux

Conflux  Humanity

Humanity  Pendle

Pendle  Sonic

Sonic  BitTorrent

BitTorrent  ether.fi Staked ETH

ether.fi Staked ETH  The Sandbox

The Sandbox  Ethereum Name Service

Ethereum Name Service  Bitcoin SV

Bitcoin SV  Maple Finance

Maple Finance  GHO

GHO  USDD

USDD  dogwifhat

dogwifhat  Binance-Peg Dogecoin

Binance-Peg Dogecoin  ARK

ARK  JasmyCoin

JasmyCoin  Theta Network

Theta Network  Sun Token

Sun Token  ZKsync

ZKsync  Wrapped HYPE

Wrapped HYPE  GALA

GALA  Satoshi Stablecoin

Satoshi Stablecoin  Helium

Helium  AINFT

AINFT  Arbitrum Bridged Wrapped eETH (Arbitrum)

Arbitrum Bridged Wrapped eETH (Arbitrum)  Decentraland

Decentraland  Flow

Flow  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Mantle Restaked ETH

Mantle Restaked ETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund