ETH Transaction Volume Climbs on Price Rally, Cheaper DeFi Costs

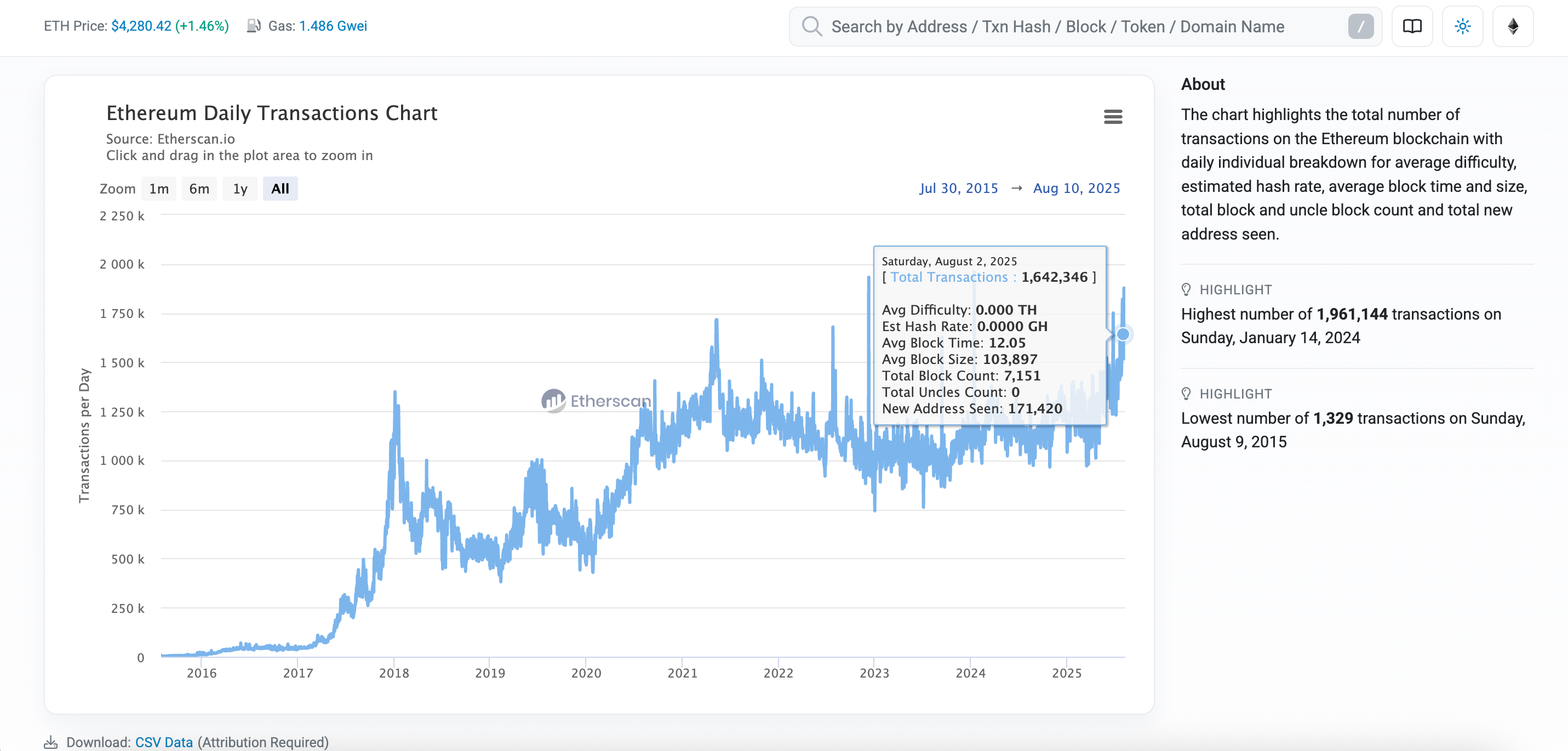

Ethereum’s transaction volume has been overall on an upward trajectory, closing in its all time high of 1.9 million transactions in a single day in January 2024.

The latest surge is drawing attention from both retail traders and institutional observers, as it reflects a confluence of technical improvements, favorable market sentiment, and a renewed appetite for on-chain activity.

According to data from Etherscan, daily transaction counts have been consistently trending higher over the past several weeks. Other data shows seven-day averages of daily transactions have already surpassed their previous records.

Analysts suggest that this momentum is being fueled by a combination of factors: a recent increase in network capacity, rising ether prices, and a reduction in transaction costs, particularly for decentralized finance (DeFi) protocols and stablecoin transfers.

(Etherscan daily transaction chart/ Etherscan)

One of the biggest enablers of the current spike has been a substantial capacity boost on Ethereum’s mainnet. The Fidelity Digital Assets Research Team told CoinDesk that “Ethereum’s Layer 1 is seeing a surge in transactions largely due to a 50% increase in the gas limit since March, which allows more transactions to fit into each block.” This upgrade has significantly increased throughput, enabling more efficient settlement and reducing congestion. As a result, stablecoin transfer costs have fallen consistently below a dollar, making DeFi activity and peer-to-peer payments far more affordable. Fidelity notes that DeFi currently tops the charts for ETH burns, underlining its central role in driving network activity.

Another major driver is ether’s recent price rally, which has rekindled speculative interest across the crypto market. “The surge in Ethereum transactions is largely the result of a sharp price increase over a relatively short period of time,” said Ray Youssef, CEO of crypto app NoOnes. He compared the mood to the early stages of “alt-season,” a period when traders flock to alternative cryptocurrencies, often creating a feedback loop of rising activity and prices. The mid-year gains, which saw ETH cross $4,200 over the weekend, have sparked a surge in speculative trades, liquidity provision, and strategic token movements across decentralized platforms.

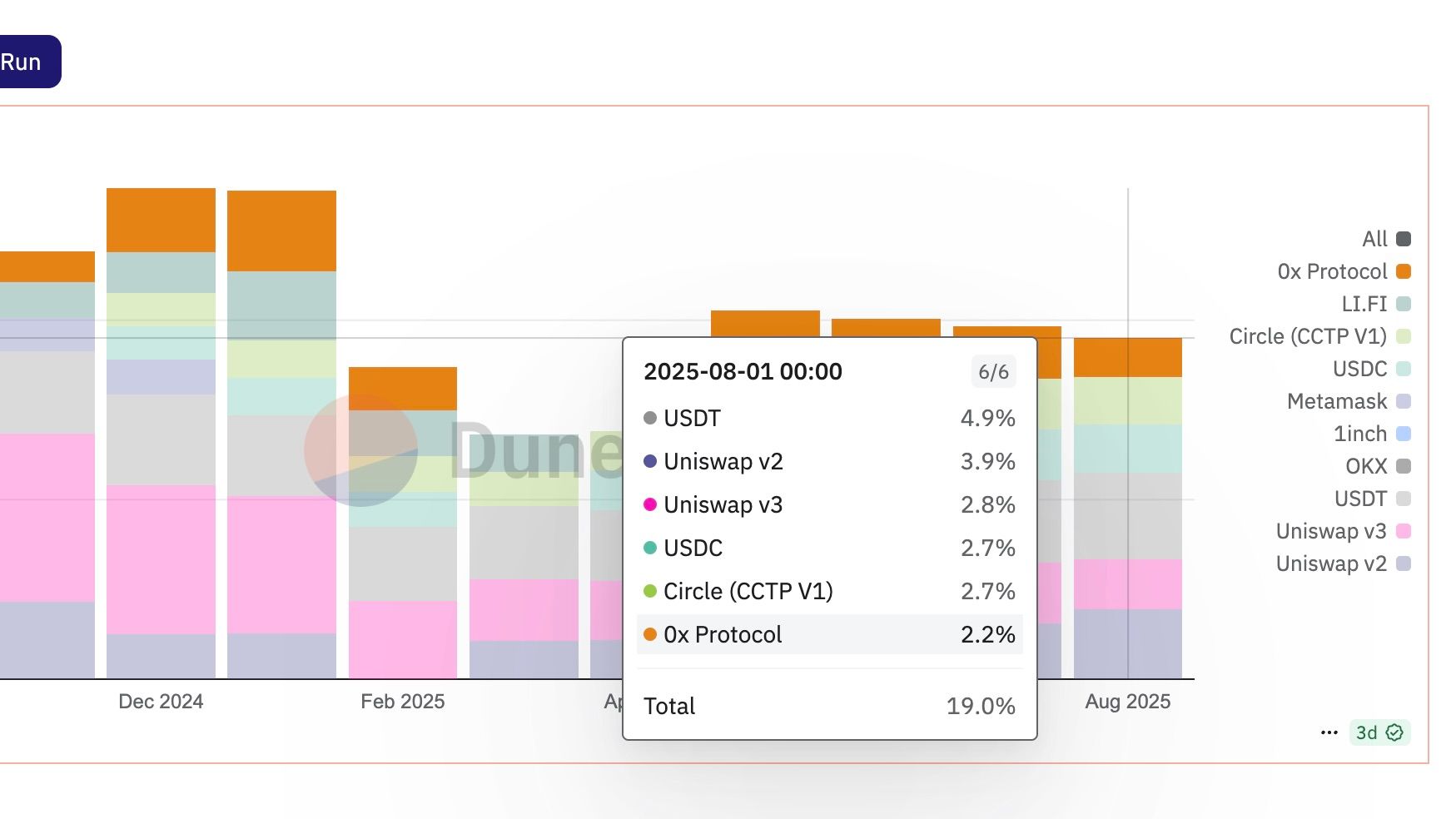

Messari’s Jake Koch-Gallup pointed out that Uniswap swaps, as well as USDT and USDC transfers, remain consistently among the top five gas consumers on the network. This underscores that decentralized exchanges (DEXs) and stablecoin usage continue to be the main engines of demand. “Rising prices tend to pull more participants on-chain, driven by speculative trading, renewed incentive programs, increased L2 usage, and deeper liquidity. These dynamics all contribute to higher Layer 1 transaction volume, both directly and through settlement,” Koch-Gallup told CoinDesk.

(Top gas guzzlers on Ethereum from Jake @ Messari Dashboard/Dune)

Beyond traders and DeFi users, corporate participation is also helping shape the current landscape. “Seeing a green light from regulators, companies are eager to jump on what they see as the ‘last car of the crypto train,’” Youssef said. He suggested that this corporate inflow is providing a more stable foundation for Ethereum’s financial and transactional ecosystem, even if the alt-season effect fades over time. While corporate ETH accumulation adds to long-term demand, Koch-Gallup cautioned that it has little direct impact on immediate transaction counts.

The network’s present momentum suggests Ethereum could be on track to continue to set new all-time highs in daily transactions in the coming weeks. Fidelity observed that the rise in activity demonstrates that demand for block space is keeping pace with the increased supply, an encouraging sign for the ecosystem’s health. However, sustaining this trend will likely require more than just favorable market sentiment.

Koch-Gallup also offered a note of caution. “With blob fees near zero and lower demand for Layer 1 execution, ETH burn has slowed and net supply has periodically turned inflationary,” he said. “Sustaining this trend likely depends on either a resurgence in fee-generating mainnet activity or better mechanisms for L2s to feed value back to Ethereum.” This issue, how the protocol can capture more of the value generated by the activity it secures, is central to ongoing discussions about Ethereum’s evolution.

As the network continues to mature, stakeholders from DeFi innovators to institutional investors are watching closely to see whether this surge will mark the beginning of a sustained growth phase, or a temporary peak driven by speculative heat.

Looking ahead, Ethereum’s roadmap includes further scaling proposals such as PeerDAS and improved Layer 2 integration, which could help alleviate bottlenecks and create a more sustainable environment for high transaction volumes.

For now, the data is telling: transaction counts are climbing, fees for everyday DeFi use are down, and participation across both retail and corporate segments is strong. Whether Ethereum can translate this momentum into lasting adoption and ecosystem resilience may well define its trajectory for the coming months.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Stellar

Stellar  WETH

WETH  Zcash

Zcash  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Hedera

Hedera  Avalanche

Avalanche  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  USDT0

USDT0  Dai

Dai  Cronos

Cronos  Bittensor

Bittensor  Polkadot

Polkadot  MemeCore

MemeCore  Mantle

Mantle  sUSDS

sUSDS  Uniswap

Uniswap  USD1

USD1  World Liberty Financial

World Liberty Financial  Aave

Aave  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bitget Token

Bitget Token  PayPal USD

PayPal USD  OKB

OKB  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Falcon USD

Falcon USD  Binance-Peg WETH

Binance-Peg WETH  Tether Gold

Tether Gold  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  USDtb

USDtb  POL (ex-MATIC)

POL (ex-MATIC)  Aster

Aster  HTX DAO

HTX DAO  Dash

Dash  Worldcoin

Worldcoin  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  syrupUSDT

syrupUSDT  Gate

Gate  Algorand

Algorand  PAX Gold

PAX Gold  BFUSD

BFUSD  syrupUSDC

syrupUSDC  Kinetiq Staked HYPE

Kinetiq Staked HYPE  StakeWise Staked ETH

StakeWise Staked ETH  Pump.fun

Pump.fun  Lombard Staked BTC

Lombard Staked BTC  Liquid Staked ETH

Liquid Staked ETH  Wrapped BNB

Wrapped BNB  VeChain

VeChain  Story

Story  Sky

Sky  Cosmos Hub

Cosmos Hub  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH  Solv Protocol BTC

Solv Protocol BTC  NEXO

NEXO  Filecoin

Filecoin  Ripple USD

Ripple USD  Global Dollar

Global Dollar  Render

Render  Sei

Sei  Pudgy Penguins

Pudgy Penguins  Decred

Decred  Bonk

Bonk  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Immutable

Immutable  Circle USYC

Circle USYC  clBTC

clBTC  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  OUSG

OUSG  Jupiter Staked SOL

Jupiter Staked SOL  Aerodrome Finance

Aerodrome Finance  PancakeSwap

PancakeSwap  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Stables Labs USDX

Stables Labs USDX  Ondo US Dollar Yield

Ondo US Dollar Yield  Optimism

Optimism  Celestia

Celestia  Stacks

Stacks  Lido DAO

Lido DAO  Marinade Staked SOL

Marinade Staked SOL  Injective

Injective  tBTC

tBTC  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  SPX6900

SPX6900  Beldex

Beldex  Curve DAO

Curve DAO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  The Graph

The Graph  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  USDai

USDai  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  FLOKI

FLOKI  Tezos

Tezos  Usual USD

Usual USD  GTETH

GTETH  Stader ETHx

Stader ETHx  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Kaia

Kaia  DoubleZero

DoubleZero  Pyth Network

Pyth Network  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  IOTA

IOTA  TrueUSD

TrueUSD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Cognify

Cognify  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Plasma

Plasma  Trust Wallet

Trust Wallet  AB

AB  Starknet

Starknet  Swell Ethereum

Swell Ethereum  Ether.fi

Ether.fi  sBTC

sBTC  Conflux

Conflux  Pendle

Pendle  Humanity

Humanity  Sonic

Sonic  BitTorrent

BitTorrent  ether.fi Staked ETH

ether.fi Staked ETH  The Sandbox

The Sandbox  Bitcoin SV

Bitcoin SV  GHO

GHO  Maple Finance

Maple Finance  Ethereum Name Service

Ethereum Name Service  USDD

USDD  ARK

ARK  dogwifhat

dogwifhat  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Wrapped HYPE

Wrapped HYPE  Sun Token

Sun Token  Theta Network

Theta Network  JasmyCoin

JasmyCoin  Satoshi Stablecoin

Satoshi Stablecoin  GALA

GALA  AINFT

AINFT  Arbitrum Bridged Wrapped eETH (Arbitrum)

Arbitrum Bridged Wrapped eETH (Arbitrum)  Helium

Helium  ZKsync

ZKsync  Decentraland

Decentraland  Flow

Flow  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  DeXe

DeXe