Parabolic Bitcoin Rally Is Coming—Here’s What to Watch

One of the dominant narratives this cycle has been that “this time is different.” With institutional adoption reshaping Bitcoin’s supply and demand dynamics, many argue that we won’t see the kind of euphoric blowoff top that defined past cycles. Instead, the idea is that smart money and ETFs will smooth out volatility, replacing mania with maturity. But is that really the case?

Sentiment Drives Markets, Even for Institutions

Skeptics often dismiss tools like the Fear and Greed Index as too simplistic, arguing that they can’t capture the nuance of institutional flows. But writing off sentiment ignores a fundamental truth that institutions are still run by people, and people remain prone to the same cognitive and emotional biases that drive market cycles, regardless of how deep their pockets are!

Figure 1: The Fear and Greed Index still shows sentiment extremes are the best areas to act as a contrarian. View Live Chart

Even though volatility has dampened compared to earlier cycles, the move from $15,000 to over $120,000 is far from underwhelming. And crucially, Bitcoin has achieved this without the kind of deep, extended drawdowns that marked past bull markets. The ETF boom and corporate treasury accumulation have shifted supply dynamics, but the basic feedback loop of greed, fear, and speculation remains intact.

Market Bubbles Are a Timeless Reality

It’s not just Bitcoin that’s susceptible to parabolic runs, bubbles have been part of markets for centuries. Asset prices have repeatedly surged beyond fundamentals, fueled by human behavior. Studies consistently show that stability itself often breeds instability, and that quiet periods encourage leverage, speculation, and eventually runaway price action. Bitcoin has followed this same rhythm. Periods of low volatility see Open Interest climb, leverage build, and speculative bets increase.

Figure 2: Open Interest has historically spiked during low-volatility periods, a setup that often precedes sharp parabolic moves. View Live Chart

Contrary to the belief that “sophisticated” investors are immune, research from the London School of Economics suggests the opposite. Professional capital can accelerate bubbles by piling in late, chasing momentum, and amplifying moves. The 2008 housing crisis and the dot-com bust were not retail-driven, but led by institutions.

ETF flows this cycle provide another powerful example. Periods of net outflows from spot ETFs have actually coincided with local market bottoms. Rather than perfectly timing the cycle, these flows reveal that “smart money” is just as prone to herd behavior and trend following investing as retail traders.

Figure 3: ETF outflows (red) have consistently coincided with local market bottoms, a contrarian signal. View Live Chart

Capital Flows Could Ignite Bitcoin’s Next Leap

Meanwhile, looking at global markets shows how capital rotation could ignite another parabolic leg. Since January 2024, Gold’s market cap has surged by over $10 trillion, from $14T to $24T. For Bitcoin, with a current market cap around $2T, even a fraction of that kind of inflow could have an outsized effect thanks to the money multiplier. With roughly 77% of BTC held by long-term holders, only about 20–25% of supply is readily liquid, resulting in a conservative money multiplier of 4x. That means new inflows of $500 billion, just 5% of gold’s recent expansion, could translate into a $2 trillion increase in Bitcoin’s market cap, implying prices well over $220,000.

Figure 4: Long-term holder supply remains elevated, consistent with mid-cycle dynamics rather than late-stage distribution. View Live Chart

Perhaps the strongest case for a blowoff top is that we’ve already seen parabolic rallies within this very cycle. Since the 2022 bottom, Bitcoin has staged multiple 60–100%+ runs in under 100 days. Overlaying those fractals onto current price action provides realistic outlines of how price could reach $180,000–$220,000 before year-end.

Figure 5: Historical fractals from earlier in this cycle project possible paths to $200K+ Bitcoin.

Bitcoin’s Parabolic Potential Remains Unshaken

The narrative that institutional adoption has eliminated parabolic blowoff tops underestimates both Bitcoin’s structure and human psychology. Bubbles aren’t an accident of retail speculation; they are a recurring feature of markets across history, often accelerated by sophisticated capital.

This doesn’t mean certainty, markets never work that way. But dismissing the possibility of a parabolic top ignores centuries of market behavior and the unique supply-demand mechanics that make Bitcoin one of the most reflexive assets in history. If anything, “this time is different” may only mean that the rally could be bigger, faster, and more dramatic than most expect.

For deeper data, charts, and professional insights into bitcoin price trends, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post Parabolic Bitcoin Rally Is Coming—Here’s What to Watch first appeared on Bitcoin Magazine and is written by Matt Crosby.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Stellar

Stellar  WETH

WETH  Zcash

Zcash  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Hedera

Hedera  Avalanche

Avalanche  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  USDT0

USDT0  Dai

Dai  Cronos

Cronos  Bittensor

Bittensor  Polkadot

Polkadot  MemeCore

MemeCore  Mantle

Mantle  sUSDS

sUSDS  Uniswap

Uniswap  USD1

USD1  World Liberty Financial

World Liberty Financial  Aave

Aave  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bitget Token

Bitget Token  PayPal USD

PayPal USD  OKB

OKB  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Falcon USD

Falcon USD  Binance-Peg WETH

Binance-Peg WETH  Tether Gold

Tether Gold  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Aptos

Aptos  Ondo

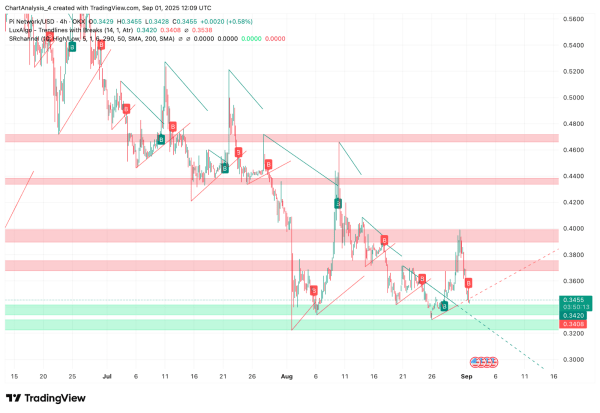

Ondo  Pi Network

Pi Network  USDtb

USDtb  POL (ex-MATIC)

POL (ex-MATIC)  Aster

Aster  HTX DAO

HTX DAO  Dash

Dash  Worldcoin

Worldcoin  KuCoin

KuCoin  Rocket Pool ETH

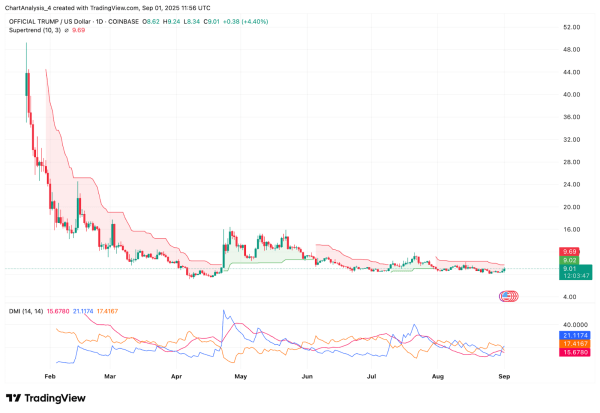

Rocket Pool ETH  Official Trump

Official Trump  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  syrupUSDT

syrupUSDT  Gate

Gate  Algorand

Algorand  PAX Gold

PAX Gold  BFUSD

BFUSD  syrupUSDC

syrupUSDC  Kinetiq Staked HYPE

Kinetiq Staked HYPE  StakeWise Staked ETH

StakeWise Staked ETH  Pump.fun

Pump.fun  Lombard Staked BTC

Lombard Staked BTC  Liquid Staked ETH

Liquid Staked ETH  Wrapped BNB

Wrapped BNB  VeChain

VeChain  Story

Story  Sky

Sky  Cosmos Hub

Cosmos Hub  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH  Solv Protocol BTC

Solv Protocol BTC  NEXO

NEXO  Filecoin

Filecoin  Ripple USD

Ripple USD  Global Dollar

Global Dollar  Render

Render  Sei

Sei  Pudgy Penguins

Pudgy Penguins  Decred

Decred  Bonk

Bonk  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Immutable

Immutable  Circle USYC

Circle USYC  clBTC

clBTC  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  OUSG

OUSG  Jupiter Staked SOL

Jupiter Staked SOL  Aerodrome Finance

Aerodrome Finance  PancakeSwap

PancakeSwap  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Stables Labs USDX

Stables Labs USDX  Ondo US Dollar Yield

Ondo US Dollar Yield  Optimism

Optimism  Celestia

Celestia  Stacks

Stacks  Lido DAO

Lido DAO  Marinade Staked SOL

Marinade Staked SOL  Injective

Injective  tBTC

tBTC  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  SPX6900

SPX6900  Beldex

Beldex  Curve DAO

Curve DAO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  The Graph

The Graph  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  USDai

USDai  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  FLOKI

FLOKI  Tezos

Tezos  Usual USD

Usual USD  GTETH

GTETH  Stader ETHx

Stader ETHx  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Kaia

Kaia  DoubleZero

DoubleZero  Pyth Network

Pyth Network  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  IOTA

IOTA  TrueUSD

TrueUSD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Cognify

Cognify  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Plasma

Plasma  Trust Wallet

Trust Wallet  AB

AB  Starknet

Starknet  Swell Ethereum

Swell Ethereum  Ether.fi

Ether.fi  sBTC

sBTC  Conflux

Conflux  Pendle

Pendle  Humanity

Humanity  Sonic

Sonic  BitTorrent

BitTorrent  ether.fi Staked ETH

ether.fi Staked ETH  The Sandbox

The Sandbox  Bitcoin SV

Bitcoin SV  GHO

GHO  Maple Finance

Maple Finance  Ethereum Name Service

Ethereum Name Service  USDD

USDD  ARK

ARK  dogwifhat

dogwifhat  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Wrapped HYPE

Wrapped HYPE  Sun Token

Sun Token  Theta Network

Theta Network  JasmyCoin

JasmyCoin  Satoshi Stablecoin

Satoshi Stablecoin  GALA

GALA  AINFT

AINFT  Arbitrum Bridged Wrapped eETH (Arbitrum)

Arbitrum Bridged Wrapped eETH (Arbitrum)  Helium

Helium  ZKsync

ZKsync  Decentraland

Decentraland  Flow

Flow  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  DeXe

DeXe