Bitcoin’s $100K Question: Here’s Why BTC, XRP, SOL May Surge This Week

Bitcoin BTC$103,508.20 has faced a challenging few weeks, retreating sharply from its record highs and weighing on the broader market, including ether ETH$3,526.49, XRP$2.3078, solana SOL$162.78 and others.

However, there’s a compelling reason to expect the cryptocurrency to stay above the pivotal $100,000 level and rally this week, and it’s tied to a positive shift in the U.S. financial system that signals potential for renewed investor risk-taking.

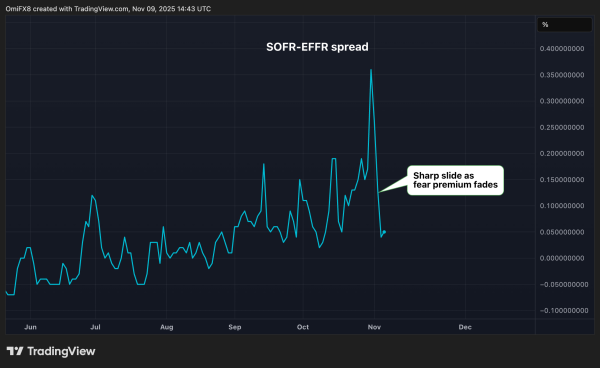

At the heart of the story is the spread between the SOFR and EFFR, which gauges dollar liquidity conditions in the U.S. banking sector. SOFR, the Secured Overnight Financing Rate, is the overnight interest rate that banks pay to borrow cash using Treasuries as collateral. The Effective Federal Funds Rate (EFFR) is the rate at which banks led reserves to each other overnight without collateral.

Usually, this spread hovers in a narrow range, but late last month it surged to the highest since 2019, signaling stress and liquidity tightening in the financial system. The result? the dollar index, which tracks the greenback’s value against major fiat currencies, rose and bitcoin fell sharply, breaching the $100,000 level at one point.

But over the last couple of days, the SOFR-EFFR spread has sharply tanked to 0.05 from 0.35, erasing that spike. This reversal hints at easing financial conditions—the fear premium has faded, and liquidity is normalizing.

SOFR-EFFR spread. (TradingView)

All else being equal, tightening of this spread signals looser financial conditions, favorable for risk assets like bitcoin. And guess what, BTC is on the rise as of writing, trading above $103,000, representing a 1.6% gain on a 24-hour basis, according to CoinDesk data. ETH, XRP, SOL, BNB have gained 1.5% to 2.5% following BTC’s lead.

SRF borrowing slides, DXY rally stalls

Other key indicators also point to easing liquidity stress. For instance, banks’ borrowing from the Federal Reserve’s standing repo facility (SRF), a key liquidity management tool, has dropped back to zero after peaking at a record $50 billion earlier this month, according to data from ING. Banks had borrowed billions through the SRF as a response to temporary funding pressures.

Concurrently, the dollar index’s rally has softened at resistance from the August high of 100.25, causing the upward momentum to stall. A renewed sell-off in the DXY could bode well for BTC, which is seen as a hedge against dollar debasement and a proxy for inflation protection.

Dollar Index’s daily chart in candlestick format. (TradingView)

All these factors combine to create a compelling case for bitcoin and the wider crypto market to rally in the coming week.

Key risks

Keep an eye on flows into the U.S.-listed spot ETFs, as they will need to show strength following nearly $2.8 billion in outflows over the past four weeks.

A breakout in the DXY above 100.25 could dent BTC’s bullish prospects.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Wrapped SOL

Wrapped SOL  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  WhiteBIT Coin

WhiteBIT Coin  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Zcash

Zcash  Bitcoin Cash

Bitcoin Cash  Wrapped eETH

Wrapped eETH  USDS

USDS  Stellar

Stellar  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Litecoin

Litecoin  Ethena USDe

Ethena USDe  LEO Token

LEO Token  Monero

Monero  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WETH

WETH  Avalanche

Avalanche  Hedera

Hedera  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Cronos

Cronos  Dai

Dai  Mantle

Mantle  Uniswap

Uniswap  Internet Computer

Internet Computer  MemeCore

MemeCore  sUSDS

sUSDS  NEAR Protocol

NEAR Protocol  Bittensor

Bittensor  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Aave

Aave  USD1

USD1  Bitget Token

Bitget Token  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  OKB

OKB  Pepe

Pepe  Currency One USD

Currency One USD  Ethereum Classic

Ethereum Classic  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  Aptos

Aptos  Aster

Aster  Binance-Peg WETH

Binance-Peg WETH  Ondo

Ondo  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Falcon USD

Falcon USD  Tether Gold

Tether Gold  Filecoin

Filecoin  POL (ex-MATIC)

POL (ex-MATIC)  Pi Network

Pi Network  Worldcoin

Worldcoin  USDtb

USDtb  KuCoin

KuCoin  HTX DAO

HTX DAO  Arbitrum

Arbitrum  Algorand

Algorand  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Binance Staked SOL

Binance Staked SOL  VeChain

VeChain  Pump.fun

Pump.fun  Gate

Gate  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Cosmos Hub

Cosmos Hub  StakeWise Staked ETH

StakeWise Staked ETH  PAX Gold

PAX Gold  BFUSD

BFUSD  Wrapped BNB

Wrapped BNB  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  syrupUSDT

syrupUSDT  Sky

Sky  Function FBTC

Function FBTC  Lombard Staked BTC

Lombard Staked BTC  Render

Render  Story

Story  Liquid Staked ETH

Liquid Staked ETH  Quant

Quant  syrupUSDC

syrupUSDC  Sei

Sei  Jupiter

Jupiter  NEXO

NEXO  Renzo Restaked ETH

Renzo Restaked ETH  Dash

Dash  Bonk

Bonk  Global Dollar

Global Dollar  Solv Protocol BTC

Solv Protocol BTC  Ripple USD

Ripple USD  Circle USYC

Circle USYC  Aerodrome Finance

Aerodrome Finance  Pudgy Penguins

Pudgy Penguins  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  PancakeSwap

PancakeSwap  Immutable

Immutable  Celestia

Celestia  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Optimism

Optimism  clBTC

clBTC  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Jupiter Staked SOL

Jupiter Staked SOL  OUSG

OUSG  Stacks

Stacks  Lido DAO

Lido DAO  Injective

Injective  The Graph

The Graph  DoubleZero

DoubleZero  Curve DAO

Curve DAO  Ondo US Dollar Yield

Ondo US Dollar Yield  Starknet

Starknet  Tezos

Tezos  SPX6900

SPX6900  cgETH Hashkey Cloud

cgETH Hashkey Cloud  DeAgentAI

DeAgentAI  tBTC

tBTC  Beldex

Beldex  Marinade Staked SOL

Marinade Staked SOL  Decred

Decred  FLOKI

FLOKI  Pyth Network

Pyth Network  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Kaia

Kaia  Sonic

Sonic  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  IOTA

IOTA  USDai

USDai  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  SOON

SOON  Plasma

Plasma  Ether.fi

Ether.fi  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  GTETH

GTETH  Stader ETHx

Stader ETHx  Maple Finance

Maple Finance  Usual USD

Usual USD  Ethereum Name Service

Ethereum Name Service  Trust Wallet

Trust Wallet  Conflux

Conflux  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  The Sandbox

The Sandbox  Bitcoin SV

Bitcoin SV  TrueUSD

TrueUSD  JasmyCoin

JasmyCoin  Theta Network

Theta Network  ether.fi Staked ETH

ether.fi Staked ETH  dogwifhat

dogwifhat  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  AB

AB  GALA

GALA  Swell Ethereum

Swell Ethereum  BitTorrent

BitTorrent  Pendle

Pendle  Binance-Peg Dogecoin

Binance-Peg Dogecoin  sBTC

sBTC  Helium

Helium  Flow

Flow  Decentraland

Decentraland  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  MYX Finance

MYX Finance  GHO

GHO  ARK

ARK  Sun Token

Sun Token  Concordium

Concordium  ZKsync

ZKsync  USDD

USDD  Wrapped HYPE

Wrapped HYPE  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Raydium

Raydium