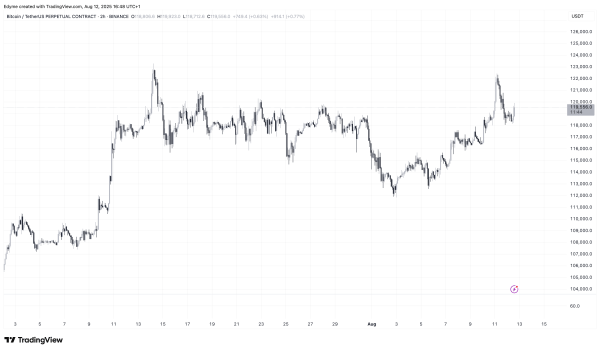

Bitcoin Pulls Back From $122K, Is the Rally Losing Steam or Just Pausing?

Bitcoin’s recent rally pushed the cryptocurrency to retest the $122,000 level before facing a pullback. At the time of writing, BTC is trading at approximately $119,053, marking a short-term correction after reclaiming significant highs earlier in the week.

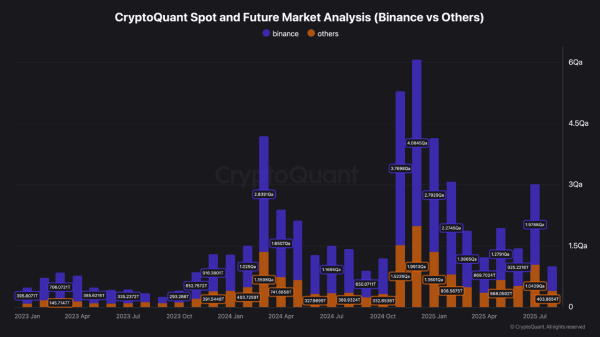

The move comes as traders and analysts watch closely for signs of market strength or weakness at current price levels. One metric drawing attention is Binance’s share of global trading volume.

According to CryptoQuant analyst BorisVest, the exchange’s dominance in trading activity provides valuable context for interpreting Bitcoin’s performance at all-time highs (ATHs).

By comparing volume distribution across exchanges during previous ATH periods, the analysis seeks to determine whether the broader market is participating in the rally or if activity is concentrated on a single platform.

Bitcoin Exchange Volume Concentration and Market Signals

BorisVest’s review found that during the first ATH in 2024, global market volumes were elevated, and Binance’s trading activity was more than double that of all other exchanges combined.

When Bitcoin retested its ATH later that year, overall market volumes increased across multiple platforms, yet Binance maintained its lead in total trading share.

In contrast, when Bitcoin set a new record in mid-2025, total market volume did not show a significant increase compared to previous rallies. While Binance still recorded nearly twice the trading volume of other exchanges combined, the absence of a wider market volume expansion raised concerns.

The analyst noted that historically, ATHs supported by broad volume growth tend to indicate stronger market conviction. A lack of participation from other exchanges could signal potential challenges in sustaining higher prices over the coming months.

On-Chain Patterns Suggest Gradual Market Progress

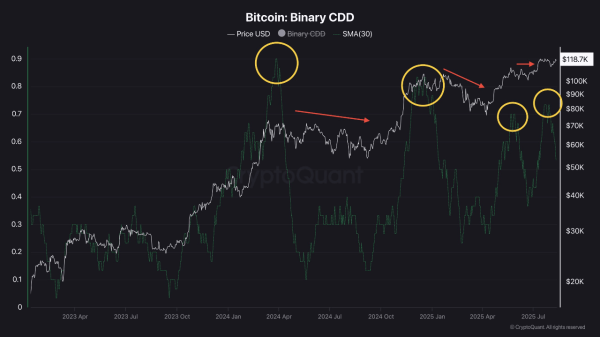

In a separate assessment, CryptoQuant analyst Avocado onchain examined Binary Coin Days Destroyed (CDD), a metric tracking the movement of long-dormant coins. The indicator recently turned lower after a brief rise, with Bitcoin’s price trading within a sideways range.

Historically, increases in Binary CDD have been linked to selling pressure from long-term holders, often leading to corrections. However, current market conditions, shaped by changes in custody solutions, over-the-counter trading activity, and institutional investment strategies, make interpreting CDD spikes more complex.

Avocado onchain highlighted that in recent cycles, Binary CDD rises have been followed by either prolonged sideways trading or moderate corrections.

The current data supports what the analyst describes as a “stair-step” rally, where the market advances gradually while cooling short-term speculative activity. This pattern, if sustained, could prevent rapid depletion of buying momentum and allow for more stable long-term growth.

Other on-chain data suggests that selling from long-term holders remains subdued, indicating limited pressure to exit positions at current price levels.

This aligns with the view that while near-term movements may be range-bound, the broader trend still holds the potential for future upside, contingent on broader participation and sustained investor demand.

Featured image created with DALL-E, Chart from TradingView

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Stellar

Stellar  WETH

WETH  Zcash

Zcash  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Hedera

Hedera  Avalanche

Avalanche  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  USDT0

USDT0  Dai

Dai  Cronos

Cronos  Bittensor

Bittensor  Polkadot

Polkadot  MemeCore

MemeCore  Mantle

Mantle  sUSDS

sUSDS  Uniswap

Uniswap  USD1

USD1  World Liberty Financial

World Liberty Financial  Aave

Aave  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bitget Token

Bitget Token  PayPal USD

PayPal USD  OKB

OKB  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Falcon USD

Falcon USD  Binance-Peg WETH

Binance-Peg WETH  Tether Gold

Tether Gold  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  USDtb

USDtb  POL (ex-MATIC)

POL (ex-MATIC)  Aster

Aster  HTX DAO

HTX DAO  Dash

Dash  Worldcoin

Worldcoin  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  syrupUSDT

syrupUSDT  Gate

Gate  Algorand

Algorand  PAX Gold

PAX Gold  BFUSD

BFUSD  syrupUSDC

syrupUSDC  Kinetiq Staked HYPE

Kinetiq Staked HYPE  StakeWise Staked ETH

StakeWise Staked ETH  Pump.fun

Pump.fun  Lombard Staked BTC

Lombard Staked BTC  Liquid Staked ETH

Liquid Staked ETH  Wrapped BNB

Wrapped BNB  VeChain

VeChain  Story

Story  Sky

Sky  Cosmos Hub

Cosmos Hub  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH  Solv Protocol BTC

Solv Protocol BTC  NEXO

NEXO  Filecoin

Filecoin  Ripple USD

Ripple USD  Global Dollar

Global Dollar  Render

Render  Sei

Sei  Pudgy Penguins

Pudgy Penguins  Decred

Decred  Bonk

Bonk  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Immutable

Immutable  Circle USYC

Circle USYC  clBTC

clBTC  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  OUSG

OUSG  Jupiter Staked SOL

Jupiter Staked SOL  Aerodrome Finance

Aerodrome Finance  PancakeSwap

PancakeSwap  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Stables Labs USDX

Stables Labs USDX  Ondo US Dollar Yield

Ondo US Dollar Yield  Optimism

Optimism  Celestia

Celestia  Stacks

Stacks  Lido DAO

Lido DAO  Marinade Staked SOL

Marinade Staked SOL  Injective

Injective  tBTC

tBTC  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  SPX6900

SPX6900  Beldex

Beldex  Curve DAO

Curve DAO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  The Graph

The Graph  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  USDai

USDai  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  FLOKI

FLOKI  Tezos

Tezos  Usual USD

Usual USD  GTETH

GTETH  Stader ETHx

Stader ETHx  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Kaia

Kaia  DoubleZero

DoubleZero  Pyth Network

Pyth Network  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  IOTA

IOTA  TrueUSD

TrueUSD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Cognify

Cognify  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Plasma

Plasma  Trust Wallet

Trust Wallet  AB

AB  Starknet

Starknet  Swell Ethereum

Swell Ethereum  Ether.fi

Ether.fi  sBTC

sBTC  Conflux

Conflux  Pendle

Pendle  Humanity

Humanity  Sonic

Sonic  BitTorrent

BitTorrent  ether.fi Staked ETH

ether.fi Staked ETH  The Sandbox

The Sandbox  Bitcoin SV

Bitcoin SV  GHO

GHO  Maple Finance

Maple Finance  Ethereum Name Service

Ethereum Name Service  USDD

USDD  ARK

ARK  dogwifhat

dogwifhat  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Wrapped HYPE

Wrapped HYPE  Sun Token

Sun Token  Theta Network

Theta Network  JasmyCoin

JasmyCoin  Satoshi Stablecoin

Satoshi Stablecoin  GALA

GALA  AINFT

AINFT  Arbitrum Bridged Wrapped eETH (Arbitrum)

Arbitrum Bridged Wrapped eETH (Arbitrum)  Helium

Helium  ZKsync

ZKsync  Decentraland

Decentraland  Flow

Flow  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  DeXe

DeXe