Analysis: DATs Keep Buying Bitcoin, Outperforming ETFs Is the Hard Part

“Just buy an ETF.” That blunt advice from Strive Asset Management CEO Matt Cole during a panel at Hong Kong’s Bitcoin Asia in August summed up the growing frustration with Digital Asset Treasuries (DAT), the corporate vehicles that promise to outperform bitcoin BTC$112,720.84 through clever financing and balance-sheet engineering but, so far, struggle to make good on that pledge.

(BitcoinQuant.co)

Bitcoin itself is up about 23% this year. Yet, most Digital Asset Treasuries, including MicroStrategy, Semler Scientific, GameStop, and Trump Media, have badly trailed both BTC and the ETFs tracking it. Only a few outliers, like Twenty One Capital and Japan’s Metaplanet, which has been prone to volatility, have managed to beat the benchmark.

That gap exposes the core weakness of the DAT trade. These companies were built to outperform BTC through leverage, financing, or operational alpha, but most are lagging the simplest possible exposure.

The pitch of levered beta with balance-sheet discipline only works when equity premiums, convertibles, and debt markets stay friendly. Think about how toxic Strategy’s $8 billion in debt would look if there were a rate hike. With an average coupon of just 0.42% and maturities stretching over four years, those bonds look manageable today, but that comfort vanishes in a higher-rate world.

Even though the headlines come through daily about crypto entrepreneurs taking over a shell company and pumping its balance sheet full of BTC, the warnings are growing louder and louder.

Galaxy Digital has warned that the entire structure depends on a persistent premium to net asset value, a reflexive setup reminiscent of the 1920s investment-trust boom. NYDIG has been just as critical, arguing that the industry’s favored “mNAV” metric masks liabilities and inflates per-share exposure by assuming debt conversions that never happen.

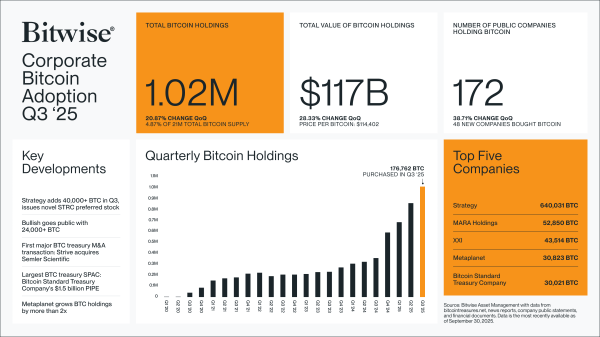

None of this means corporate bitcoin adoption is a mirage; it’s growing faster than ever. There are almost 40% more public companies holding bitcoin today than there were three months ago, according to data compiled by Bitwise.

(Bitwise)

Some of these companies are real firms that have BTC on the balance sheet because of the nature of their industry, like Coinbase, Bullish (Bullish is the parent company of CoinDesk), or BTC miners like MARA. Others have it as a hedge against fiat instability.

But, so many companies on Bitwise’s list are BTC DATs, and it’s important to differentiate these from other DATs that list proof-of-stake altcoins like ETH or Solana. This is a different offering.

By staking native assets and operating validators, these DATs earn yield not from leverage but from network activity itself. For instance, owning an ETH or TRX DAT would get exposure to Ethereum or Tron – the networks that the stablecoin revolution live on. In theory, this exposure turns treasuries into miniature ecosystems, compounding value as the network scales.

Tron’s listco, SRM, now Tron Inc after a rocky start, is showing how this is done. Nearly half of USDT activity lives on Tron, so if investors want a ‘Visa moment’ for USDT – especially in the most exciting markets for stablecoins like Latin America – Tron Inc is a DAT that fits this bill.

Still, that kind of on-chain exposure remains the exception, not the rule. Most DATs haven’t figured out how to translate balance-sheet size into operational yield or network participation. They were supposed to be smarter than ETFs, capital-efficient, yield-bearing, and tied to the real economic flow of blockchains, but many remain little more than leveraged proxies for bitcoin beta.

Until more treasury firms can prove they can compound capital faster than a passive ETF, the simplest takeaway from the Hong Kong stage might remain the best one: just buy the ETF.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Stellar

Stellar  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Hedera

Hedera  Avalanche

Avalanche  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  USDT0

USDT0  Dai

Dai  Cronos

Cronos  Bittensor

Bittensor  Polkadot

Polkadot  MemeCore

MemeCore  Mantle

Mantle  sUSDS

sUSDS  Uniswap

Uniswap  Aave

Aave  USD1

USD1  World Liberty Financial

World Liberty Financial  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  Bitget Token

Bitget Token  Internet Computer

Internet Computer  OKB

OKB  NEAR Protocol

NEAR Protocol  Ethena

Ethena  Pepe

Pepe  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Binance-Peg WETH

Binance-Peg WETH  Falcon USD

Falcon USD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Tether Gold

Tether Gold  Wrapped SOL

Wrapped SOL  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  USDtb

USDtb  POL (ex-MATIC)

POL (ex-MATIC)  Aster

Aster  HTX DAO

HTX DAO  Worldcoin

Worldcoin  Dash

Dash  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  syrupUSDT

syrupUSDT  Gate

Gate  Algorand

Algorand  PAX Gold

PAX Gold  Pump.fun

Pump.fun  BFUSD

BFUSD  syrupUSDC

syrupUSDC  StakeWise Staked ETH

StakeWise Staked ETH  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Liquid Staked ETH

Liquid Staked ETH  Lombard Staked BTC

Lombard Staked BTC  VeChain

VeChain  Wrapped BNB

Wrapped BNB  Story

Story  Cosmos Hub

Cosmos Hub  Sky

Sky  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH  NEXO

NEXO  Solv Protocol BTC

Solv Protocol BTC  Filecoin

Filecoin  Ripple USD

Ripple USD  Global Dollar

Global Dollar  Render

Render  Sei

Sei  Pudgy Penguins

Pudgy Penguins  Bonk

Bonk  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  Immutable

Immutable  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Decred

Decred  Circle USYC

Circle USYC  clBTC

clBTC  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  OUSG

OUSG  Jupiter Staked SOL

Jupiter Staked SOL  Aerodrome Finance

Aerodrome Finance  PancakeSwap

PancakeSwap  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Stables Labs USDX

Stables Labs USDX  Ondo US Dollar Yield

Ondo US Dollar Yield  Optimism

Optimism  Celestia

Celestia  Stacks

Stacks  Lido DAO

Lido DAO  Marinade Staked SOL

Marinade Staked SOL  Injective

Injective  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  tBTC

tBTC  SPX6900

SPX6900  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Beldex

Beldex  Curve DAO

Curve DAO  The Graph

The Graph  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  USDai

USDai  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  FLOKI

FLOKI  Tezos

Tezos  Usual USD

Usual USD  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Stader ETHx

Stader ETHx  GTETH

GTETH  Kaia

Kaia  DoubleZero

DoubleZero  Pyth Network

Pyth Network  IOTA

IOTA  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  TrueUSD

TrueUSD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Starknet

Starknet  Cognify

Cognify  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Plasma

Plasma  AB

AB  Ether.fi

Ether.fi  Trust Wallet

Trust Wallet  Swell Ethereum

Swell Ethereum  sBTC

sBTC  Conflux

Conflux  Pendle

Pendle  Sonic

Sonic  BitTorrent

BitTorrent  The Sandbox

The Sandbox  Humanity

Humanity  ether.fi Staked ETH

ether.fi Staked ETH  Ethereum Name Service

Ethereum Name Service  Maple Finance

Maple Finance  Bitcoin SV

Bitcoin SV  GHO

GHO  USDD

USDD  Binance-Peg Dogecoin

Binance-Peg Dogecoin  dogwifhat

dogwifhat  Theta Network

Theta Network  JasmyCoin

JasmyCoin  ARK

ARK  Wrapped HYPE

Wrapped HYPE  Sun Token

Sun Token  GALA

GALA  Satoshi Stablecoin

Satoshi Stablecoin  AINFT

AINFT  ZKsync

ZKsync  Arbitrum Bridged Wrapped eETH (Arbitrum)

Arbitrum Bridged Wrapped eETH (Arbitrum)  Helium

Helium  Decentraland

Decentraland  Flow

Flow  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Mantle Restaked ETH

Mantle Restaked ETH