AB (AB) Price Prediction: AB Price Stabilizes After 40% Rally WLFI Deploys USD1 on AB Chain

AB continued to draw attention this week after a strong seven-day rebound lifted the token nearly 40% from last week’s lows. The asset as of press time trades near $0.00747, showing a mild daily decline but still holding a sharply improved structure compared with earlier levels.

The recent rally followed a recovery from $0.00527, where buyers stepped in and shifted momentum. Consequently, the market is now evaluating whether AB can maintain support after a rapid climb into major Fibonacci zones. Besides short-term volatility, the project’s ecosystem expansion added new interest, especially after a new stablecoin integration.

Market Structure Holds Near 0.618 Fibonacci Support

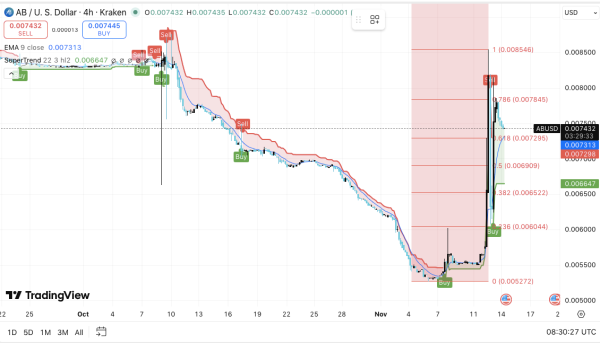

AB’s recent move began with a decisive rebound from the 0% Fibonacci level, which triggered a vertical push toward the upper retracement bands. The surge extended into the 0.786 and 1.0 retracement regions, where stronger selling pressure emerged. Moreover, the rejection near $0.008546 created an expected cooldown as traders locked in gains.

AB Price Dynamics (Source: TradingView)

Price now trades around the 0.618 Fibonacci level near $0.007295. This area forms the key line for the current trend. Holding this zone keeps the broader bullish structure intact.

However, losing it may open a deeper correction toward $0.00690 or even $0.00652. Additionally, the SuperTrend indicator remains supportive on the four-hour chart, showing that the main trend still leans upward.

AB Price Action (Source: TradingView)

RSI has cooled from recent peaks and now sits near 63, which suggests a steady but calm momentum profile. MACD readings also remain above zero, highlighting sustained strength despite a slower pace.

AB Chain Expands Utility Through USD1 Deployment

Sentiment around AB also benefited from new developments within its ecosystem. World Liberty Financial introduced USD1 on AB Chain this week, marking a significant step for the network’s stablecoin infrastructure. The addition aims to deliver faster and more convenient settlement for traders and users seeking stable payment options.

Moreover, the AB Wallet continues to position itself as the preferred platform for USD1 activity across supported chains. It offers zero-fee transfers and near-instant settlement, which may increase user engagement. The wallet team is also exploring yield options and additional utilities that enhance value for stablecoin users.

Technical Outlook for AB Price

Key levels remain clearly defined following last week’s sharp rally.

- Upside levels: $0.007845 and $0.008546 remain immediate hurdles. A breakout above these areas could extend toward $0.00892 and $0.00930 as the next resistance zones.

- Downside levels: $0.00729 (0.618 Fib) serves as the primary support, followed by $0.00690 and $0.00652 as deeper retracement levels if selling pressure increases.

- Resistance ceiling: $0.008546, the recent swing high, is the level AB must reclaim for sustained bullish continuation. A close above this zone opens the door for a trend extension.

The technical picture suggests AB is consolidating after an overextended surge, forming a short-term compression structure between the 0.618 and 0.786 Fibonacci zones. A decisive break from this range could trigger a volatility expansion in either direction.

Will AB Continue Its Uptrend?

AB’s short-term outlook depends on whether buyers can defend the $0.00729 support, which currently acts as the backbone of the recent recovery. Holding this level may allow a renewed challenge of the $0.007845–$0.008546 cluster, where the next breakout attempt is likely to occur.

Momentum remains favorable on higher timeframes, and the recent pullback improves the probability of a continuation move. If inflows strengthen and price reclaims the upper Fib zone, AB could attempt a move toward $0.00892 and possibly $0.00930.

Failure to hold $0.00729, however, risks a deeper retracement into $0.00690 or $0.00652. Such a drop would reset momentum and return price to a healthier accumulation zone.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Cardano

Cardano  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Chainlink

Chainlink  LEO Token

LEO Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hyperliquid

Hyperliquid  Stellar

Stellar  Monero

Monero  WETH

WETH  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Hedera

Hedera  Avalanche

Avalanche  Sui

Sui  Shiba Inu

Shiba Inu  Dai

Dai  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Cronos

Cronos  Toncoin

Toncoin  Ethena Staked USDe

Ethena Staked USDe  Uniswap

Uniswap  PayPal USD

PayPal USD  USDT0

USDT0  Polkadot

Polkadot  Mantle

Mantle  Canton

Canton  Bittensor

Bittensor  Aave

Aave  USD1

USD1  Bitget Token

Bitget Token  MemeCore

MemeCore  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  OKB

OKB  Tether Gold

Tether Gold  Falcon USD

Falcon USD  Aster

Aster  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Pi Network

Pi Network  Ethena

Ethena  Pepe

Pepe  Jito Staked SOL

Jito Staked SOL  Binance-Peg WETH

Binance-Peg WETH  Rain

Rain  Pump.fun

Pump.fun  Wrapped SOL

Wrapped SOL  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  HTX DAO

HTX DAO  Ondo

Ondo  Worldcoin

Worldcoin  Aptos

Aptos  POL (ex-MATIC)

POL (ex-MATIC)  PAX Gold

PAX Gold  syrupUSDC

syrupUSDC  USDtb

USDtb  BFUSD

BFUSD  KuCoin

KuCoin  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Rocket Pool ETH

Rocket Pool ETH  Sky

Sky  Ripple USD

Ripple USD  Gate

Gate  Wrapped BNB

Wrapped BNB  Global Dollar

Global Dollar  Algorand

Algorand  Circle USYC

Circle USYC  Official Trump

Official Trump  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Cosmos Hub

Cosmos Hub  Filecoin

Filecoin  VeChain

VeChain  Function FBTC

Function FBTC  Lombard Staked BTC

Lombard Staked BTC  Liquid Staked ETH

Liquid Staked ETH  Solv Protocol BTC

Solv Protocol BTC  syrupUSDT

syrupUSDT  NEXO

NEXO  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Render

Render  Sei

Sei  Story

Story  PancakeSwap

PancakeSwap  Bonk

Bonk  Jupiter

Jupiter  OUSG

OUSG  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Mantle Staked Ether

Mantle Staked Ether  Renzo Restaked ETH

Renzo Restaked ETH  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  clBTC

clBTC  Pudgy Penguins

Pudgy Penguins  Ondo US Dollar Yield

Ondo US Dollar Yield  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Dash

Dash  Jupiter Staked SOL

Jupiter Staked SOL  SPX6900

SPX6900  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  USDai

USDai  Optimism

Optimism  StakeWise Staked ETH

StakeWise Staked ETH  Beldex

Beldex  Aerodrome Finance

Aerodrome Finance  Virtuals Protocol

Virtuals Protocol  Curve DAO

Curve DAO  Injective

Injective  Lido DAO

Lido DAO  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Starknet

Starknet  tBTC

tBTC  Stacks

Stacks  MYX Finance

MYX Finance  Marinade Staked SOL

Marinade Staked SOL  Usual USD

Usual USD  Celestia

Celestia  Telcoin

Telcoin  AB

AB  The Graph

The Graph  Tezos

Tezos  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Ether.fi

Ether.fi  USDD

USDD  TrueUSD

TrueUSD  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  Ultima

Ultima  FLOKI

FLOKI  GTETH

GTETH  Kaia

Kaia  IOTA

IOTA  Stader ETHx

Stader ETHx  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Pendle

Pendle  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Ethereum Name Service

Ethereum Name Service  Pyth Network

Pyth Network  Trust Wallet

Trust Wallet  Lorenzo Wrapped Bitcoin

Lorenzo Wrapped Bitcoin  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  JUST

JUST  GHO

GHO  Bitcoin SV

Bitcoin SV  Basic Attention

Basic Attention  Plasma

Plasma  BitTorrent

BitTorrent  Conflux

Conflux  Sonic

Sonic  Helium

Helium  Swell Ethereum

Swell Ethereum  The Sandbox

The Sandbox  DoubleZero

DoubleZero  sBTC

sBTC  Sun Token

Sun Token  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Decred

Decred  AINFT

AINFT  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Flow

Flow  dogwifhat

dogwifhat  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  ether.fi Staked ETH

ether.fi Staked ETH  Olympus

Olympus  Merlin Chain

Merlin Chain  JasmyCoin

JasmyCoin  GALA

GALA  Ape and Pepe

Ape and Pepe  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Gnosis

Gnosis  Wrapped HYPE

Wrapped HYPE  Theta Network

Theta Network