Cardano vs Polkadot: Which Layer-1 Is the Best to Buy for 2025?

Cardano (ADA) and Polkadot (DOT) are two of the most popular Layer-1 blockchain platforms, and both are promising candidates for investments in 2025. Each has its own strengths: Cardano’s strength lies in its protocol’s research-oriented approach and eco-friendly proof-of-stake technology, while Polkadot’s lies in its interoperability through its parachain model. The momentum was further propelled when $60 billion asset manager Grayscale recently filed for ETFs for both ADA and DOT, indicating increasing institutional confidence in these altcoins.

Analysts also highlight prospects outside of Layer-1 projects. MAGACOIN FINANCE, an Ethereum Layer-2, has begun to gain traction as a speculative play with high-risk, high-reward potential combined with the stability of the larger players.

Cardano: Research Backed and Eco Friendly

Cardano has established its reputation on a two-layered architecture that separates settlement from computation. This stack ultimately makes possible secure smart contracts, decentralized applications, and efficient scalability solutions like Hydra. Its native cryptocurrency protocol, known as Ouroboros, is considered to be a secure and energy-efficient proof-of-stake consensus mechanism, making it an appealing investment option for sustainability-conscious investors.

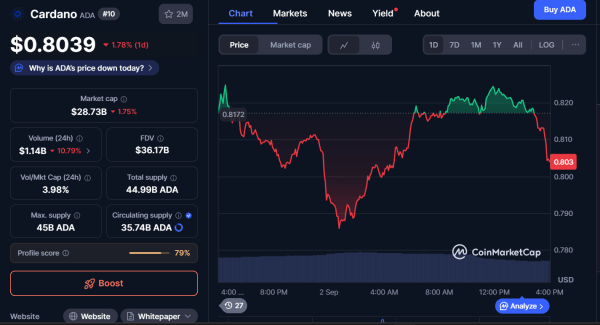

ADA currently trades around $0.80 and bounced up from a volatile August which plummeted to $0.78. The token continues to trade on a bearish wedge pattern finding support around $0.80 and resistance around $0.85-$0.86. A breakout above resistance would be confirmed, potentially targeting $0.90 or $0.95, while a failure to support $0.80 would result in downside towards $0.756 or lower.

In the long run, it is predicted the coin will trade between $0.50 and $1.50 for the year 2025 based on the adoption of its smart contract environment. With Grayscale’s ETF filing in progress, an additional catalyst of institutional inflows may propel Cardano’s investment case even further.

Polkadot: Designed for Interoperability

In contrast to these approaches, Polkadot is a Layer-0 network that connects several Layer 1 blockchains through its Relay Chain and parachains. Transactions can be performed in parallel, which promotes scalability and enables cross-chain applications. Developers prefer this configuration as it makes the dApps interoperable and interoperability is likely to be crucial to Web3 adoption.

The network currently supports around 166 transactions per second, but as the number of parachains increases, the network is expected to support significantly higher levels of throughput. As the development activity and parachains auctions each continue to grow, Polkadot’s role as a multichain hub becomes more apparent.

DOT price predictions for the year 2025 span a spectrum of expectations, ranging from $4.85 to $18, underscoring the potential upside and inherent volatility of this cryptocurrency. Grayscale’s decision to pursue a Polkadot ETF is a testament to its belief in the long-term growth potential of the project.

Cardano vs Polkadot: Differences

When compared side-by-side, both projects play clear strengths:

Architecture: Cardano is a secure two-layer chain, and Polkadot uses its Relay Chain to bridge multiple parachains.

Performance: Cardano has an average transaction rate of approximately 257 transactions per second, and Hydra is expected to have improved performance. Polkadot has the idea of parallel parachains for quicker finality and greater theoretical throughput.

Ecosystem: Cardano is committed to academic rigor, sustainability, and peer-reviewed dApps. Polkadot is an interoperability and cross-chain application-centric blockchain.

Investment Outlook: ADA is considered to be a stable research backed investment with an average of $1 in 2025. DOT has more volatility than DOE but also a higher upside target of $13-$15.

Both assets are backed by Grayscale’s ETF filings, which can attract a large amount of institutional capital once approved.

The Wildcard: MAGACOIN FINANCE as an Ethereum L2

In addition to the Layer-1 competition, MAGACOIN FINANCE is also emerging as a Layer-2 Ethereum project. Unlike other L2s, MAGA marries meme-driven hype with audited tokenomics and verified security, a combo that has led to mounting retail interest.

Due to its nature as a speculative play, it is considered a high risk, high reward alternative to established coins such as Cardano and Polkadot. As a result, portfolios that combine stability and upside are increasingly pointing to MAGA as a wildcard to watch in 2025.

Conclusion

Cardano and Polkadot continue to be two of the most credible Layer 1 investments for 2025. Polkadot brings innovation and interoperability, whereas Cardano promises sustainability and steady ecosystem growth. Both have gained a strong vote of confidence in the form of Grayscale’s ETF filings, something that could attract institutional flows and solidify their long-term value.

At the same time, smaller opportunities are being watched by investors seeking larger upside. MAGACOIN FINANCE, an Ethereum Layer-2, offers the speculative momentum that is the counterpart to the stability of the Layer-1 giants. Together, ADA, DOT, and MAGA present a combination of stability, innovation, and speculative potential, defining the next wave of crypto investments.

To learn more about MAGACOIN FINANCE, visit:

Website:https://magacoinfinance.com

Access:https://magacoinfinance.com/access

Twitter/X:https://x.com/magacoinfinance

Telegram:https://t.me/magacoinfinance

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Figure Heloc

Figure Heloc  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Stellar

Stellar  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Zcash

Zcash  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Litecoin

Litecoin  Monero

Monero  Shiba Inu

Shiba Inu  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  USDT0

USDT0  Dai

Dai  Cronos

Cronos  Polkadot

Polkadot  Bittensor

Bittensor  MemeCore

MemeCore  Mantle

Mantle  sUSDS

sUSDS  Uniswap

Uniswap  World Liberty Financial

World Liberty Financial  USD1

USD1  Aave

Aave  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  PayPal USD

PayPal USD  Bitget Token

Bitget Token  Internet Computer

Internet Computer  OKB

OKB  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethena

Ethena  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Falcon USD

Falcon USD  Binance-Peg WETH

Binance-Peg WETH  Tether Gold

Tether Gold  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Wrapped SOL

Wrapped SOL  Aptos

Aptos  Ondo

Ondo  Pi Network

Pi Network  USDtb

USDtb  Aster

Aster  POL (ex-MATIC)

POL (ex-MATIC)  HTX DAO

HTX DAO  Dash

Dash  Worldcoin

Worldcoin  KuCoin

KuCoin  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  syrupUSDT

syrupUSDT  Gate

Gate  Algorand

Algorand  Pump.fun

Pump.fun  PAX Gold

PAX Gold  BFUSD

BFUSD  syrupUSDC

syrupUSDC  StakeWise Staked ETH

StakeWise Staked ETH  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Lombard Staked BTC

Lombard Staked BTC  Liquid Staked ETH

Liquid Staked ETH  Wrapped BNB

Wrapped BNB  VeChain

VeChain  Story

Story  Cosmos Hub

Cosmos Hub  Sky

Sky  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH  NEXO

NEXO  Solv Protocol BTC

Solv Protocol BTC  Quant

Quant  Filecoin

Filecoin  Ripple USD

Ripple USD  Global Dollar

Global Dollar  Render

Render  Sei

Sei  Pudgy Penguins

Pudgy Penguins  Decred

Decred  Bonk

Bonk  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Immutable

Immutable  Circle USYC

Circle USYC  clBTC

clBTC  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  OUSG

OUSG  Jupiter Staked SOL

Jupiter Staked SOL  PancakeSwap

PancakeSwap  Aerodrome Finance

Aerodrome Finance  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Stables Labs USDX

Stables Labs USDX  Ondo US Dollar Yield

Ondo US Dollar Yield  Optimism

Optimism  Celestia

Celestia  Stacks

Stacks  Lido DAO

Lido DAO  Marinade Staked SOL

Marinade Staked SOL  Injective

Injective  tBTC

tBTC  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  SPX6900

SPX6900  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Beldex

Beldex  Curve DAO

Curve DAO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  The Graph

The Graph  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  USDai

USDai  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  FLOKI

FLOKI  Tezos

Tezos  Usual USD

Usual USD  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  DoubleZero

DoubleZero  Stader ETHx

Stader ETHx  GTETH

GTETH  Kaia

Kaia  Pyth Network

Pyth Network  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  IOTA

IOTA  TrueUSD

TrueUSD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Plasma

Plasma  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Cognify

Cognify  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Starknet

Starknet  Trust Wallet

Trust Wallet  AB

AB  Ether.fi

Ether.fi  Swell Ethereum

Swell Ethereum  sBTC

sBTC  Conflux

Conflux  Humanity

Humanity  Pendle

Pendle  Sonic

Sonic  BitTorrent

BitTorrent  ether.fi Staked ETH

ether.fi Staked ETH  The Sandbox

The Sandbox  Ethereum Name Service

Ethereum Name Service  Bitcoin SV

Bitcoin SV  Maple Finance

Maple Finance  GHO

GHO  USDD

USDD  dogwifhat

dogwifhat  Binance-Peg Dogecoin

Binance-Peg Dogecoin  ARK

ARK  JasmyCoin

JasmyCoin  Theta Network

Theta Network  Sun Token

Sun Token  ZKsync

ZKsync  Wrapped HYPE

Wrapped HYPE  GALA

GALA  Satoshi Stablecoin

Satoshi Stablecoin  Helium

Helium  AINFT

AINFT  Arbitrum Bridged Wrapped eETH (Arbitrum)

Arbitrum Bridged Wrapped eETH (Arbitrum)  Decentraland

Decentraland  Flow

Flow  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Mantle Restaked ETH

Mantle Restaked ETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund